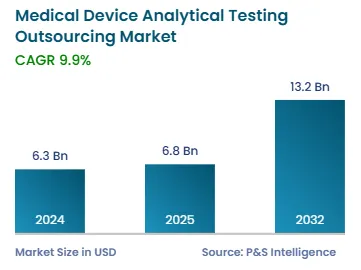

The market for medical device analytical testing outsourcing services generated USD 6.3 billion in 2024.

What is the medical device analytical testing outsourcing industry growth potential?+

The medical device analytical testing outsourcing industry will witness growth of 9.9% over this decade.

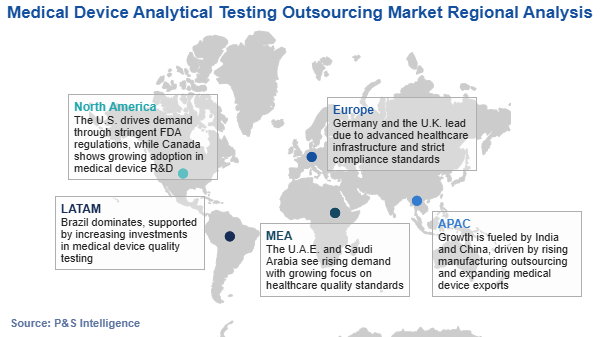

What is the regional scenario of the medical device analytical testing outsourcing market?+

APAC is the largest market for medical device analytical testing outsourcing services.

Which are the significant therapeutic areas in the medical device analytical testing outsourcing industry?+

The cardiology, diabetes, and general and plastic surgery therapeutic areas are the most significant in the medical device analytical testing outsourcing industry.

What is the key medical device analytical testing outsourcing market strategic developments?+

Facility expansion is the strongest strategic measure in the market for medical device analytical testing outsourcing services.