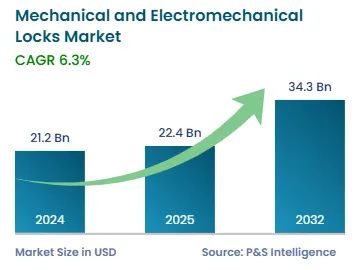

The mechanical and electromechanical locks market size stands at USD 21.2 billion in 2024.

What will be the growth rate of the mechanical and electromechanical locks market during the forecast period?+

During 2025–2032, the growth rate of the mechanical and electromechanical locks market will be 6.3%.

Which is the largest end user in the mechanical and electromechanical locks market?+

Hospitality is the largest end user in the mechanical and electromechanical locks market.

What are the major drivers for the mechanical and electromechanical locks market?+

The major drivers of the mechanical and electromechanical locks market include the rising demand for digital locks from coworking spaces, the surging need for electronic access control from the hospitality sector, and the increasing focus on safety and convenience.

Mechanical and electromechanical locks market is fragmented in nature.