MEA Chiller Market Analysis

Explore In-Depth MEA Chiller Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 11675

Explore In-Depth MEA Chiller Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

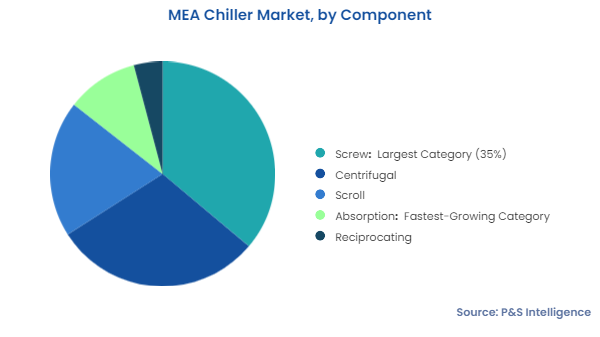

The screw category accounts for the highest revenue, of USD 500.5 million.

This dominance is owing to the excellent efficiency, especially with part-load conditions, versatility, longevity, and low maintenance cost of screw chillers. These advantages lead to the expanding use of screw chillers in diverse applications, from large commercial and hotel air conditioning to industrial process cooling. Compared to other types, screw chillers have fewer moving parts, which lessens the probability of mechanical failures and other maintenance needs.

The absorption category is the fastest-growing during the forecast period. Absorption chillers are highly energy-efficient and cost-effective when optimally exploiting waste heat or renewable sources, such as solar–thermal power. Further, they use refrigerants with a much lower Global Warming Potential, making them a more-conscious choice for the environment. Their high efficiency in harnessing heat from renewable energy sources is contributing to the growing demand for them as the region transitions toward a greener cooling solution.

The components analyzed here are:

The commercial category has been recording the largest MEA chiller market share over the historical period (2019–2024).

This is primarily credited to the surge in population, significant economic development, rapid urbanization, and their corresponding influence on cooling needs, especially in the U.A.E., Saudi Arabia, Qatar, Egypt, and South Africa. The developments in the tourism & and hospitality and healthcare sectors, changing nature of commercial real estate, and strict regulations on energy efficiency also propel this category.

The industrial category will advance at the highest CAGR, of 5.8%, in the next six years. Due to the important role of chillers in maintaining the ideal temperature in factories for workers, machines, as well as temperature-sensitive and perishable goods, they are widely demanded in the industrial sector. Various government policies emphasize compliance with the industry standards regarding worker safety and product quality. In such scenarios, a robust cooling system becomes imperative.

The end users evaluated here:

Saudi Arabia dominates the MEA chiller market with revenue of USD 364.4 million in 2024, and it is expected to have the highest CAGR, of 6.2%, during the forecast period. The reason for this is the large-scale infrastructure development and tourism projects in Saudi Arabia, such as NEOM City, Amaala, Qiddiya Entertainment District, and the Red Sea Project. These projects generate a massive demand for chillers for the comfort of residents and visitors.

Additionally, the Saudi Standards, Metrology and Quality Organization (SASO) makes strict provisions for energy efficiency for HVAC systems, including chillers. The government’s initiative to strengthen public health services and the flourishing tourism sector further fuel the expansion of the market.

Egypt is also a potentially opportune market owing to the large-scale infrastructure development, expansion of the economy, and growth in environmental consciousness. The Egyptian economy is performing well as a result of the steady growth in GDP and high foreign investments. The government is modernizing infrastructure and encouraging industrial development, which has led to the initiation of several commercial and industrial construction projects in planned cities. Being a generally hot country, such establishments require efficient cooling mechanisms.

The demand for chillers is also rising in the country due to the increasing hotel and resort construction and renovations along the Red Sea Coast and in Luxor. The Egyptian government has implemented numerous strategies to address energy conservation, which has enhanced energy efficiency in all sectors. With such regulations, energy-efficient chillers are being adopted to cut down on electrcity consumption and operating expenses.

The countries analyzed here are:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages