Report Code: 10361 | Available Format: PDF

Manufacturing Execution System Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2023-2030

- Report Code: 10361

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

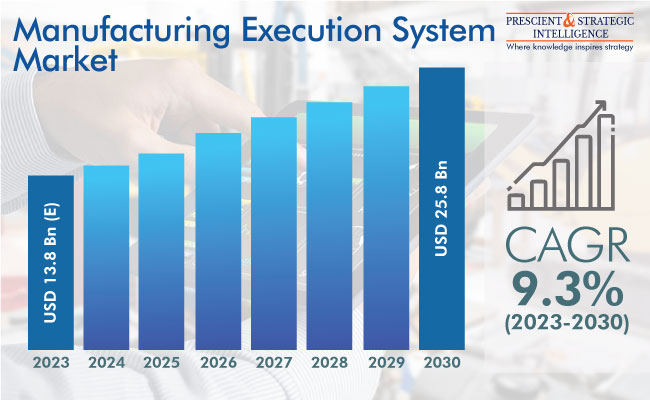

The total size of the manufacturing execution systems market is USD 13.8 billion in 2023, and it will grow at a rate of 9.3% from 2023 to 2030, to reach USD 25.8 billion by 2030.

The key drivers for the market are the growing manufacturing sector, rapid adoption of IoT and other process automation technologies, government support for Industry 4.0 approaches, and rising requirement to control production costs, enhance resource optimization, and boost output, while maintaining product quality.

Need For Mass Production and Connected Supply Chain

The requirement for a connected distribution chain in the manufacturing sector is a main propeller for the MES industry. A smooth data flow throughout the factory is vital for boosting manufacturing output, profitability, and quality. IoT systems can be utilized for tracking the location of parts and final products, checking inventory, and monitoring mass-produced items as they go through the supply chain.

Connected industrial solutions aid in the smooth flow of data across the whole supply chain, which helps in making it simple for businesses to respond to the altering industry conditions. Real-time data supports firms in reducing inventory expenses, detecting risk, and attaining production as per the industry requirements.

The surge in bulk production activities worldwide, coupled with the enhancements in quality, is propelling the requirement for cutting-edge smart factory software systems. Further, the focus on using MES is boosted by the growing addition of production orders, procedure steps, and certifications sourced straight from ERP and enterprise business systems.

MES acceptance has been further augmented by a lack of laborers in developed countries and the surge in the adoption of automatic machining systems. Additionally, the key players' efforts to advance the knowledge of their MES solutions are projected to quicken the industry expansion. For instance, Insequence launched a new user certification training program in 2022, allowing clients to attain knowledge of the company’s manufacturing management system and SPD Pro.

Several sectors, such as energy generation, automotive, and oil & gas, have transformed their operations after the pandemic. MESs essentially help these industries tackle distribution network and labor problems that arose during the lockdowns. To survive amidst these challenges, several modifications were made in the operational processes of the manufacturing sector, which will continue to drive the usage of MESs.

Ability of Manufacturing Execution Systems to Reduce Energy Usage

The ability of such systems to surge production, decrease price, allow for product tracking, and improve quality and information gathering in real-time supports in increasing production productivity. The deployment of such systems also helps in reducing power usage and waste during the manufacturing procedure. For instance, while utilizing an MES solution on a shop floor, extra IT resources are not needed, and the requirement for storage space and paperwork is removed.

Hybrid Category Is Expected To Experience Fastest Development

The hybrid category is projected to advance at the highest rate during the projection period, based on deployment mode, because of the increasing deployment of such systems in the oil & gas industry. This is credited to the augmenting criticality of real-time data tracking in numerous E&P processes. Furthermore, the ability of the hybrid model to offer added storage capacity and guarantee the security of the information is enticing manufacturers to accept such solutions.

Services Category To Witness Rapid Growth

The increasing focus on the post-implementation procedure of numerous industrial implementation systems is the main driver for the category. A range of services are offered by companies for MESs, including consulting & training, integration & deployment, software upgrades, data backup, and cybersecurity. An efficiently functioning MES augments output, reduces waste, and shortens the time to market in numerous industries, such as pharmaceuticals, food & beverages, and customer packaged goods.

Additionally, the software category holds the larger share in the manufacturing execution systems market, because of the consistently increasing expenditure on R&D activities. Additionally, the launch of new analytical tools and upgraded software by the major players will drive this category over the forecast period. MESs have become an important integration into industrial control and factory automation systems, as the former gathers data from varied production systems and extracts meaningful insights.

Pharmaceuticals Category Is Dominating Industry

The pharmaceuticals category holds the largest industry share, under the end user segment, and it is also projected to be dominant in the future. This is because of the constantly altering market dynamics and increasing demand to adapt the production processes to them. Additionally, the supply chain monitoring capabilities of MESs helps tackle fraudulent drugs and stop their transit before they reach customers. As per Interpol, global illicit pharmaceutical trade fetches over USD 4 billion in revenue each year, at the cost of endangering patients’ lives.

| Report Attribute | Details |

Market Size in 2023 |

USD 13.8 Billion (E) |

Revenue Forecast in 2030 |

USD 25.8 Billion |

Growth Rate |

9.3% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Dominating Industry

North America holds the largest industry revenue share, and it is projected to remain dominant throughout this decade. The regional market development is boosted by the existence of key players, including Honeywell International Inc., Emerson Electric Co., Oracle Corporation, and Rockwell Automation. Hence, the easy obtainability of such systems, coupled with the growing consumer awareness of innovations in the manufacturing sector, will contribute to the regional market growth.

To augment productivity and reduce costs, manufacturers in the U.S. continue to adopt smart factory solutions. The country also has huge pharmaceutical, automotive, semiconductors, and aerospace industries, where production efficiency and quality are critical. Additionally, the emergence of cloud computing has brought such solutions within the grasp of a large number of medium-scale manufacturers in the country.

The APAC region is set to undergo the fastest development during this decade. This will mainly be because of the rising acceptance of advanced technologies, growing demand from numerous sectors, and fast industrialization. India and China are the most-rapidly developing nations in the region, boosted by their expenditure on R&D.

Moreover, the increasing awareness of execution systems for industrial procedures among different industries will drive the market. For instance, in May 2021, Siemens AG introduced its Opcenter Execution Discrete 4.1, which is fortified with powerful MES abilities, coordinated production procedures for supply chain management, and functionalities that enable compliance with numerous quality standards.

Key Players in Manufacturing Execution Systems Market

- Siemens AG

- Rockwell Automation

- SAP SE

- ABB Ltd.

- Honeywell International Inc.

- Applied Materials Inc.

- Werum Software & Systems AG

- General Electric Company

- Emerson Electric Co.

- Epicore Software Corporation

- Oracle Group

- Dassault Systems SE

- Schneider Electric SE

- PSI Metals GmbH

- Andea Solutions Sp. z o.o.

- Samsung Group

- Accenture PLC

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws