Report Code: 12856 | Available Format: PDF | Pages: 250

Machine Safety Market Size and Share Analysis by Component (Presence Sensing Safety Sensors, Two-Hand Safety Controls, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls), Implementation (Individual, Embedded), Application (Assembly, Material Handling, Metalworking, Packaging, Robotics), Sales Channel (Direct, Indirect), Offering (Systems, Sensors), Industry (Food & Beverages, Metals & Mining, Oil & Gas, Pharmaceuticals, Power Generation, Aerospace, Automotive, Semiconductors & Electronics) - Global Industry Demand Forecast to 2030

- Report Code: 12856

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

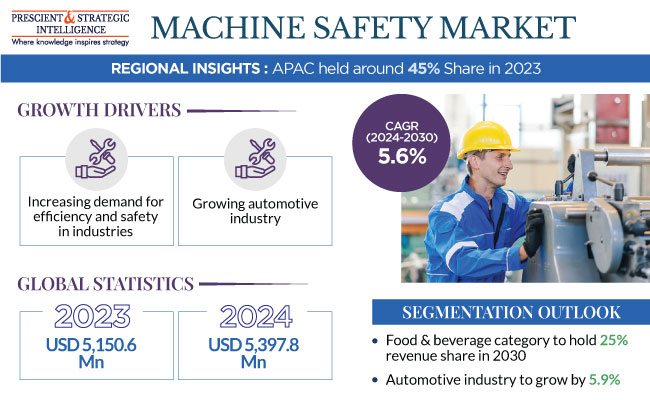

The global machine safety market is estimated to have stood at USD 5,150.6 million in 2023, and it is set to reach USD 7,479.6 million by 2030, advancing at a CAGR of 5.6% during 2024–2030. This can be attributed to the increase in the demand for efficiency and safety in industries such as semiconductors, automotive, and food & beverage, along with the increase in the awareness of the fact that the machine condition can influence worker safety.

The safe use of tools and powerful machines in industries including construction, manufacturing, and mining is referred to as machine safety. It involves teaching the staff the safe methods of operating machines, applying safety rules & procedures, along with designing the equipment with incident prevention & control features such as interlocks, guards, and emergency stops, to minimize the risk of injuries and accidents. This not only allows industrialists to boost productivity and reduce downtime but also comply with the stringent worker safety regulations, such as those of the OSHA.

The International Labour Organization estimates that nearly 2.3 million people around the world succumb to work-related accidents or diseases every year. The global safety standards for machinery are governed by the International Electrotechnical Commission (IEC) 61508 and International Organization for Standardization (ISO) 13849, which require integrating safety systems into machinery and equipment.

As the number of fatalities and injuries due to machines is rising, employers are making efforts to prevent such mishaps and safeguard their workers, to reduce the financial risk. The financial loss may include medical bills, workers’ compensation claims, property and equipment damages, decreased productivity, legal settlement fees, and associated legal actions.

Following proper machine safety measures ensures that protective systems and controls are properly designed, specified, maintained, and installed. Safety components such as programmable safety systems, sensors, and end devices are indispensable elements of such measures.

Automation-Driven Industry 4.0 Technologies Are Biggest Market Trend

The demand for these components is influenced by the increasing level of automation and the adoption of Industry 4.0 technology. The decision to automate is itself motivated by the goal of cutting expenses, elevating productivity, and boosting efficiency. Nonetheless, ensuring the safety of both machines and personnel becomes paramount as automation continues to advance. Consequently, businesses are integrating advanced, certified industrial safety systems into their production lines with the aim of diminishing the chances of accidents.

These systems encompass interlocks, physical barriers, control modules, and emergency shutdown devices, which offer an additional layer of safety for both personnel and valuable assets. This, in turn, results in the prevention or reduction of the risk of injury and provides an emergency shutdown solution in the case of breakdown or downtime.

Presence Sensing Safety Sensors Generate Highest Revenue

The presence sensing safety sensors category held the largest machine safety market revenue share, of 30%, in 2023, based on component. These sensors are well-suited for applications in which individuals require frequent, convenient yet secure entry to potentially hazardous zones. These include the area around hydraulic and filter presses; stamping, robotic welding, and machining zones; and packaging equipment.

These sensors are designed to ensure a secure output by relying on the signals they receive from logic circuits. The various kinds of presence sensing sensors finding their way into industrial facilities include laser scanners, safety edges, safety light curtains, optoelectronic devices, and safety mats, which encompass hand detectors, multi-beam sensors, and single-beam sensors. Their incorporation ensures the efficiency of human–machine collaboration and serves as a preventive measure against accidents.

Such a revolution in the machine safety industry has been possible due to the technological advancements in controllers, advanced sensors, and machine learning algorithms. Such emerging technologies stimulate innovations in factory safety solutions by enhancing risk evaluation, real-time monitoring, and hazard detection.

Moreover, the two-hand safety control system category is witnessing robust growth in the market as these components ensure the safe handling of machinery by requiring the use of both hands simultaneously. They consist of buttons and control panels placed at a safe range from the work area. The machine only works when the operator moves two separate controls or buttons simultaneously with their hands, thus ensuring that both the operator’s hands are safely away from the hazardous area, before the machine begins its operation.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,150.6 Million |

Market Size in 2024 |

USD 5,397.8 Million |

Revenue Forecast in 2030 |

USD 7,479.6 Million |

Growth Rate |

5.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By Implementation; By Application; By Sales Channel; By Offering; By Industry; By Region |

Explore more about this report - Request free sample

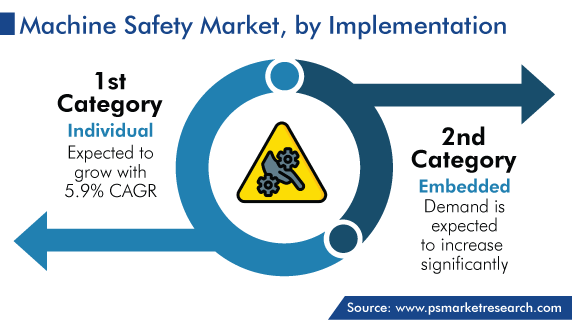

Individual Category Is Growing at Higher Rate

Between the embedded and individual categories, the individual category is expected to witness the higher CAGR, of 5.9%, during the forecast period. Safety sensors have a crucial function in identifying potential dangers and triggering control measures. They are capable of detecting movement, light, presence, proximity, and other parameters, thus assisting in the monitoring of the machine's operating surroundings. The growth in industrial automation is propelling the utilization of safety sensors. In situations where machines and human operators work closely, these devices play a vital role in identifying the presence of individuals or objects near the machinery and initiating suitable actions.

Largest Market Share Is Captured By Assembly

Among the various application categories, assembly is expected to generate the highest revenue in the forecast period. A combination of safety components, devices, and systems is integrated into machines that carry out assembling operations to ensure their safe functioning. The combinations could be of sensors, controllers, and emergency stop buttons, all of which can be customized as per the machine to meet the specific operational requirements. They are designed to detect and respond to potentially dangerous situations, such as equipment malfunctions or unexpected machine behaviors.

Moreover, most often, assembly machines have real-time monitoring and feedback systems incorporated into them. They constantly evaluate the machine's operations and activate safety measures if any abnormality or unsafe condition is detected.

The packaging category is witnessing a considerable CAGR, as integrated packaging machines, conveyors, robots, and labeling, coding, and marking equipment are all being automated. These machines handle several products, such as food items, pharmaceuticals, consumer goods, and industrial products. Ensuring the safety of these automated machines is important to protect workers, prevent accidents, and maintain product quality.

Potential hazards in the packaging industry can include pinch points, moving parts, high-speed operations, sharp edges, and heavy loads. Physical protective barriers, including interlocks, can be used with a packaging automation system to ensure that the machine stops when the guard is opened.

The robotics category also holds a significant share in the segment as robotics is integral to various industries and applications. The primary purpose of robots is to automate tasks, such as material handling, welding, pick-and-place, and assembly. The robotics automation process does not only enhance efficiency but also reduces the requirement for manual labor in potentially hazardous environments, thereby improving overall safety.

Food & Beverage Industry Leads Market

The food & beverage category is expected to generate the highest revenue share of 25% in 2030. Food & beverage companies widely embrace machine safety systems to enhance both production flexibility and precision. These systems play a pivotal role in achieving greater operational transparency across production lines.

The growth of this industry can be attributed to the increasing demand for processed & packaged food, rising focus on ensuring the safety of workers, and widespread adoption of automation. Moreover, international and national agencies impose safety regulations and standards to prevent contamination, uphold hygiene standards, and safeguard workers from potential hazards. These regulations are designed to ensure the safety and integrity of products, processes, and personnel within industries, including food & beverage manufacturing.

Essentially, the need to comply with regulations of the FDA and Hazard Analysis and Critical Control Points (HACCP) drives the use of machine safety technology in the industry. Proper machine operations and effective infection prevention measures aid in preventing the spread of dust, chemical contaminants, allergens, microbes, and other foreign particles, which could compromise both food safety and the company's reputation.

The aerospace industry is another major shareholder in the market as it is renowned for its rigorous operational standards, which encompass machine safety and performance parameters. In the aerospace industry, operational safety is a critical concern due to the inherent risks associated with complex machinery, equipment, and systems.

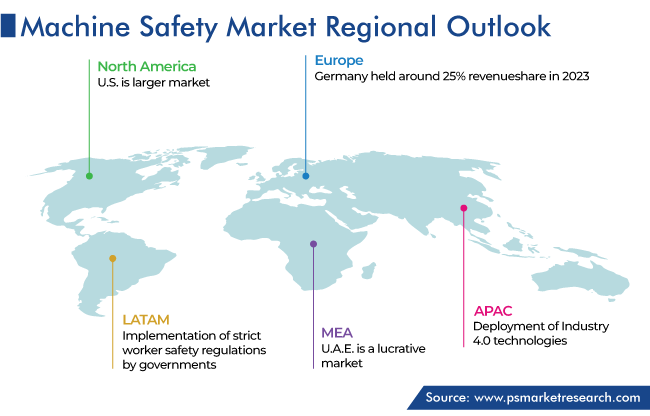

Asia-Pacific Is Expected To Be Largest Regional Market

The APAC machine safety market is the largest in the world, with a share of around 45% in 2023. One of the chief factors responsible for the adoption of safety solutions at the manufacturing sites in APAC is government mandates. Moreover, with the establishment of new factories and growth in the level of factory automation, the demand for safety systems increases.

Additionally, the deployment of Industry 4.0 technologies and the increasing awareness of worker safety are contributing to the market growth. For instance, ABB India has enlarged and upgraded its smart power factory in Bengaluru in response to an increase in the demand for its equipment. This advanced facility leverages collaborative robots, artificial intelligence, and other advanced digital technologies to enhance human–machine collaboration.

Moreover, the LATAM market is predicted to have a CAGR of 5.4% in the forecast period. The central reason for the growth is the increasing awareness among industries regarding the significance of worker safety. Further, strict regulations are being imposed by the governments of regional countries to ensure the safety of workers, which is resulting in an increase in the need for machine safety systems. For instance, the Brazilian Association of Technical Standards (ABNT) has set exacting guidelines regarding machine safety, which businesses are obliged to follow.

Other main drivers for the demand for such products and services in the LATAM region are the rapid integration of Industry 4.0 technology and the growing adoption of automation. Essentially, businesses are turning to automation technologies, such as machine vision and robotics, to enhance the productivity and efficiency of their operations. The secure operation of machinery and equipment requires the implementation of safety measures alongside these technologies.

Key Global Players in Machine Safety Market Are:

- ABB Ltd.

- Emerson Electric Co.

- General Electric Company

- Schneider Electric SE

- Rockwell Automation Inc.

- Siemens AG

- Omron Corporation

- Mitsubishi Electric Corporation

- Sick AG

- Honeywell International Inc.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the machine safety market, to offer accurate market estimations for 2017–2030.

Segment Analysis, by Component

- Presence Sensing Safety Sensors

- Safety edges

- Laser scanners

- Safety light curtains

- Safety mats

- Two-Hand Safety Controls

- Safety Controllers/Modules/Relays

- Programmable Safety Systems

- Safety Interlock Switches

- Electromechanical

- Hinge pins

- Limit switches

- Non-contact interlock switches

- Trapped key interlock switches

- Emergency Stop Controls

- Push buttons

- Rope pull buttons

Segment Analysis, by Implementation

- Individual

- Embedded

Segment Analysis, by Application

- Assembly

- Material Handling

- Metalworking

- Packaging

- Robotics

Segment Analysis, by Sales Channel

- Direct

- Indirect

Segment Analysis, by Offering

- Systems

- Sensors

Segment Analysis, by Industry

- Food & Beverages

- Metals & Mining

- Oil & Gas

- Pharmaceuticals

- Power Generation

- Aerospace

- Automotive

- Semiconductors & Electronics

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for machine safety solutions valued USD 5,150.6 million in 2023.

The machine safety industry CAGR is 5.6%.

Presence sensing safety sensors generate the highest revenue in the market for machine safety solutions.

Automation and Industry 4.0 are trending in the machine safety industry.

Food & beverage is the largest category in the market for machine safety solutions on the basis of industry.

The machine safety industry is propelled by the rampant industrialization and the stringent government mandates for worker safety.

APAC is the largest market for machine safety solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws