Luggage Market Analysis

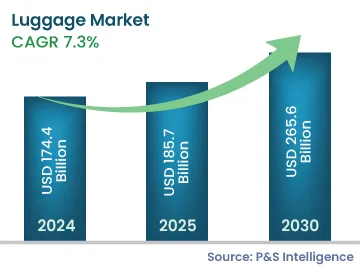

The luggage market size is expected to rise from USD 174.4 billion in 2024 to USD 265.6 billion by 2030, with a compound annual growth rate (CAGR) of 7.3% during 2024– 2030. The expansion of the travel and tourism sector, changing consumer preferences, and increasing disposable income in emerging economies are driving this increase.

Furthermore, a shift in the consumer preferences for high-end bags, as well as the increase in the level of urbanization, are likely to drive the demand for bags during the forecast period. These bags' cutting-edge features, including GPS trackers, high-security locks, USB connections, robust wheels, and expandable capacity, meet the expectations of today's travelers.