Key Highlights

| Study Period | 2019 - 2032 |

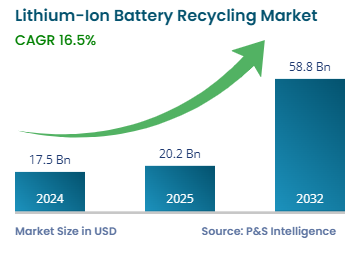

| Market Size in 2024 | USD 17.5 Billion |

| Market Size in 2025 | USD 20.2 Billion |

| Market Size by 2032 | USD 58.8 Billion |

| Projected CAGR | 16.5% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

Report Code: 12004

This Report Provides In-Depth Analysis of the Lithium-Ion Battery Recycling Market Report Prepared by P&S Intelligence, Segmented by Battery Type (Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium-Ion Manganese Oxide (LMO), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Nickel Manganese Cobalt Oxide (NMC)), Recycling Process (Hydrometallurgical Process, Pyrometallurgy Process, Physical/Mechanical Process), Battery Component (Active Material, Non-Active Material), End User (Automotive, Power, Electrical & Electronics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 17.5 Billion |

| Market Size in 2025 | USD 20.2 Billion |

| Market Size by 2032 | USD 58.8 Billion |

| Projected CAGR | 16.5% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The global lithium-ion battery recycling market generated $17.5 billion in 2024, and it will advance at a compound annual growth rate of 16.5% during 2025–2032, to reach $58.8 billion by 2032. The primary driving factors are the limited supply of lithium metal and the rising popularity of EVs across the globe, due to the subsidies given in different countries. Essentially, the declining cost of EVs owing to road tax relaxations and government subsidies is driving their popularity. This, in turn, increases the need for these batteries, especially for e-scooters and e-motorcycles.

Global sales of electric cars were around 14 million in 2023 which accounts for 18% of all cars sold and up from 14% in 2022. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Globally, around 2,50,000 electric cars were sold every week in 2023. Lithium-ion batteries are generally used in most of the electric vehicles, and limited supply of lithium in the market has increased the adoption of the recycled lithium-ion batteries for applications in the automotive sector globally, which is anticipated to witness an increase during the forecast period.

Additionally, increasing investments in the electrical & electronics sector, specifically in emerging countries such as China, India, and Brazil, are expected to create a huge demand for recycled lithium-ion batteries.

The LCO battery category holds the largest market share of 65% in 2024, and it is anticipated to maintain its supremacy throughout the projection period. The high energy density and discharge voltage of LCO batteries, which makes them more suitable for power tools, consumer electronics, such as mobile phones, laptops, and tablets, and hybrid/full electric vehicles, is the key driver for the market in this category.

The NMC category is expected to grow at a significant CAGR during the forecast period, owing to the long life, higher energy density, lower cost, and rising usage of these variants in energy storage systems and EVs.

Further, these battery types are included in the report are:

On the basis of recycling process, the hydrometallurgical process holds the largest market share 60% in 2024. This is due to its high recovery efficiency and lower energy consumption when compared to other methods. Aqueous solutions are majorly used by this process which effectively extracts and separates metals from lithium-ion batteries achieving recovery rates of up to 98% for metals such as manganese, cobalt, and nickel, and over 85% for lithium. Major leaders like Li-Cycle Corp. have developed large scale hydrometallurgical processing facilities globally which highlights the commercial viability and scalability of this technology.

This segment is divided into three categories:

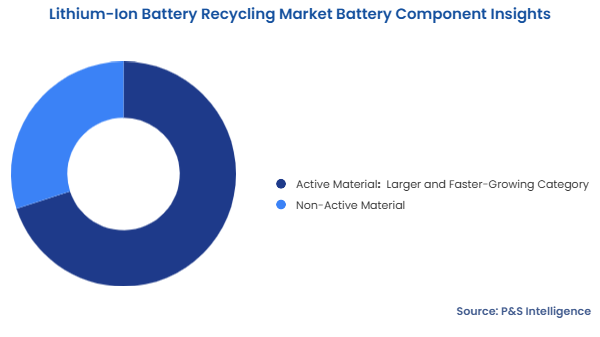

The active material holds the largest market share 70% in 2024 and it is also the faster-growing category during the forecast period. The active material category has necessary battery components such as cathodes and anodes which comprises of precious metals such as manganese, nickel, cobalt, and lithium. Recycling the active materials is crucial since it has high economic value and the environmental consequences of improper disposal.

This segment has two categories:

The automotive category dominates the market in 2024 with a market share of 75% and also exhibiting the highest CAGR from 2025-2032. This can primarily be credited to the booming uptake of electric motorcycles, scooters, buses, trucks, and cars across the globe. Additionally, the limited availability of lithium drives the recycling of these batteries. With the rising demand for electric vehicles, used Li-ion batteries are also predicted to see an expansion in demand in the automotive sector. The declining price of these power storage devices, along with the growing efficiency of electric vehicles, is also a growth factor. This is because the battery makes up over 50% of an EV’s sales price; hence, with the reducing battery costs, EVs are becoming affordable.

The electrical & electronics industry is one of the largest consumers of lithium-ion batteries, due to their usage in mobile phones, laptops, tablets, and several other electronic gadgets. With the growth of the electrical & electronics sector, specifically in the developing nations of the APAC region, such as China, India, and Thailand, the demand for these sources of energy has been on the rise. Moreover, due to the limited availability of lithium against its projected high-volume demand in the electronics sector, the market for recycled lithium-ion batteries holds a strong potential for growth in the coming years.

In this regard, the increasing investments in the electrical & electronics sector are likely to fuel market growth across developing nations. For example, the Made in China 2025 initiative has an aim to make China, the global powerhouse of high-tech industries, along with reducing its reliance on foreign technology imports.

Further, these end users have been analyzed:

Drive strategic growth with comprehensive market analysis

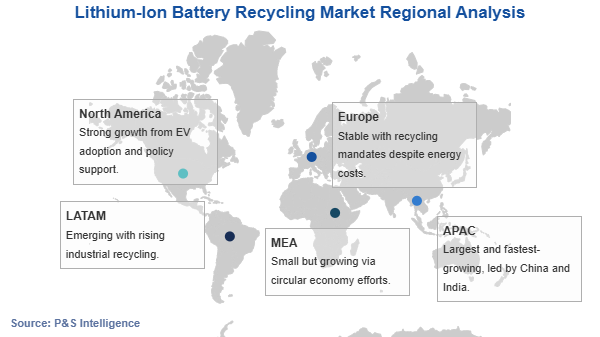

Globally, APAC dominates the market with a share of 40% in 2024 as well as it is the fastest-growing region too during the forecast period, owing to the rising adoption of EVs. Essentially, the rising awareness among customers of the environmental benefits of EVs in the developing countries of the region is set to boost the industry expansion. To fulfill the requirement for Li-ion batteries in automobiles, manufacturers are focusing on the recycling of the used ones.

Further, the Indian government implemented updated Battery Waste Management Rules in 2022, in order to make battery manufacturers responsible for collecting those that have reached the end of their life, recycling them in an environment-friendly manner, and recovering the key materials, also setting targets for the minimum amount of material to be recovered. This is since the country imports most of these power sources and their raw materials from the People’s Republic, which makes the end products, especially EVs, costly for the common folk.

The North American lithium-ion battery recycling market also holds significant share in the market. This can majorly be ascribed to the U.S. being one of the biggest markets in the world for these energy storage systems. The growth in EV usage in the region, with the government's incentives and other policies, is projected to drive this domain in the next few years. Furthermore, the rising investment by top players in the electric vehicle industry, along with the setup of the charging infrastructure, will enhance recycling demand.

Europe is also expected to grow at a significant CAGR during the forecast period, because of the European government's high recycling efficiency standards. Further, the growing awareness on zero-emission vehicles is the key driving factor for this market.

The regions and countries analyzed for this report include:

The lithium-ion battery recycling market is fragmented in nature since many players exist in the market. Specialized companies such as Li-Cycle Corp. are focusing on modern recycling technologies and regional market penetration. Large industrial players like Umicore group capitalize on their vast metallurgical expertise and expansive global networks. Strategies such as agreements, partnerships, collaborations, and mergers and acquisitions are being utilized by key players to survive in the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages