Lithium-ion Battery Metals Market Future Prospects

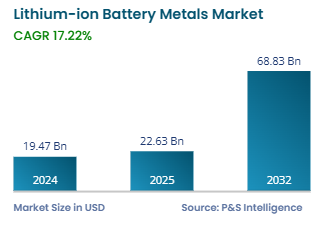

The global lithium-ion battery metals market was valued USD 19.47 billion in 2024, which is set to increase to USD 68.83 billion by 2032, advancing at a CAGR of 17.22% during 2025–2032. Increasing needs for electric vehicles due to the rising trend of automobile manufacturers' deployment of sustainable transportation solutions drive this growth process. In addition, a growth in renewable energy storage solutions, such as solar and wind power, has increased demand by users for effective management of these resources through lithium-ion batteries.

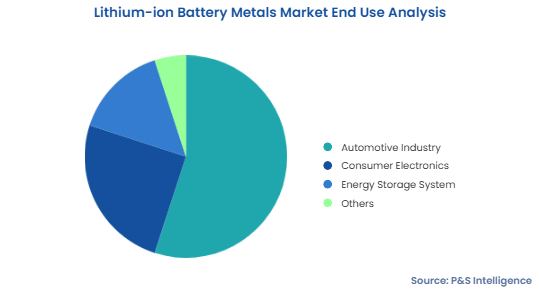

The ever-increasing consumer electronics market of smart phones, laptops, and wearables is driving this demand. Technology innovation in battery efficiency, lifespan, and safety, together with advancements in solid-state batteries and improved lithium extraction processes, also plays a critical role. Besides, the growing concern for sustainability such as the recycling of used batteries and the discovery of new applications for the second life of used batteries is a key trend in the market.

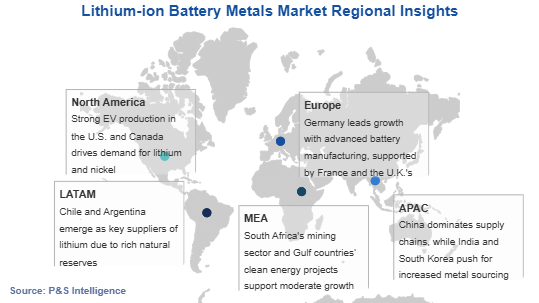

Moreover, companies are diversifying their supply chains to get raw materials in the form of lithium, cobalt, and nickel, thus reducing risks and costs. Government policies and incentives around the world are encouraging adoption of EVs and battery production. Collaborations between automotive, technology, and battery industries drive innovation. Such a convergence of demand, innovation, and sustainability places the lithium-ion battery metals as a key player in the global energy landscape.