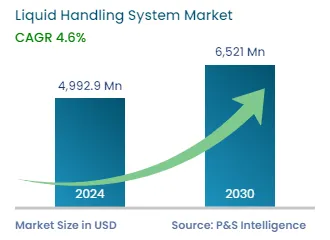

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,992.9 Million |

| 2030 Forecast | USD 6,521 Million |

| Growth Rate(CAGR) | 4.6% |

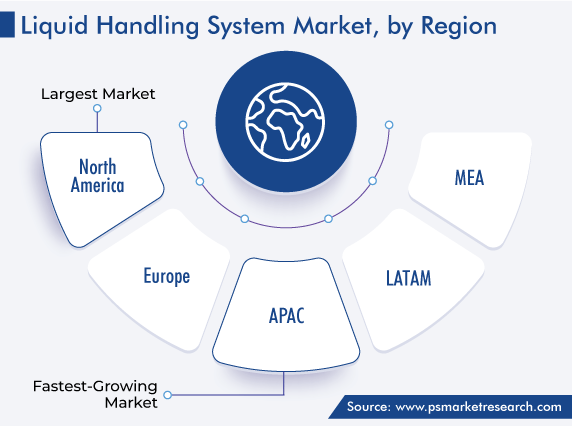

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12567

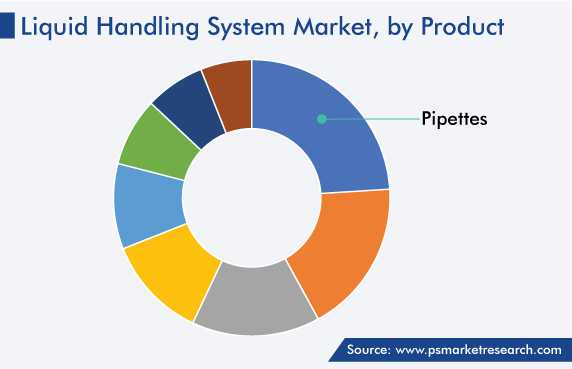

Comprehensive Overview of the Liquid Handling System Market Report, Segmented by Type (Electronic Liquid Handling System, Automated Liquid Handling System, Manual Liquid Handling System), Product (Pipettes, Consumables, Microplate Reagents Dispensers, Liquid Handling Workstations, Burettes, Microplates Washers, Software), Application (Drug Discovery, Genomics, Clinical Diagnostics, Proteomics), End Users (Biotechnology & Pharmaceutical Companies, Research Institutes, Hospitals & Diagnostics Laboratories, Academic Institutes). This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,992.9 Million |

| 2030 Forecast | USD 6,521 Million |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global liquid handling system market was valued at USD 4,992.9 million in 2024, which is expected to reach USD 6,521 million by 2030, progressing with a CAGR of 4.6% between 2024 and 2030. The growth is attributed to the booming life sciences industry, increasing prevalence of chronic diseases, and rising investment by companies for developing innovative and effective therapeutic agents.

Moreover, due to the pandemic, the demand for these products drastically increased throughout the world. These systems were utilized during all types of laboratory work that was carried out during the testing of COVID-19 samples. Additionally, the spur in the count of clinical trials of vaccines and other kinds of promising treatments increased the demand for such systems.

Emerging economies, such as China and India, are offering lucrative opportunities to drug manufacturers and other life sciences companies. For instance, in May 2022, Pfizer Inc. opened an R&D center at IIT Madras Research Park, Chennai, India, to advance pharmaceutical research in the country.

The demand for automated systems is forecast to increase faster in the coming years. Such variants reduce the need for manpower and provide accurate dispensing. Moreover, the increasing R&D investment by drug manufacturers and life science companies and the strong government support for the establishment of advanced research centers are playing a pivotal role in the growth of the category.

Moreover, the launch of new automated liquid handling equipment is driving the market during the forecast period. For instance:

The manual category also holds a significant share in the market, and it will grow with a robust CAGR during the forecast period. In developing countries, such as India, China, and Brazil, the smaller laboratories still prefer manual systems over automated or digital ones, due to the former’s low cost and ease of use.

In 2022, pipettes held the largest share, of more than 21%, in the liquid handling system market, and this trend will be maintained throughout the forecast period. It is due to the increase in the number of pipette calibration service providers and the introduction of advanced pipettes. For instance, in May 2022, Eppendorf Corporate opened the Sophisticated Pipette Laboratory and Service Hub (SPLASH) in Chennai.

The dispenser category also holds a significant share, due to the introduction of advanced dispensing systems. Sartorius’s rLINE robotic liquid handling dispenser is one such advanced product. It provides accurate and reliable sample processing with its electronic braking system, DC motor, optical sensor, conductive robotic tips, and liquid level sensor.

Liquid handling systems are the most frequently used for making drug discoveries, which is why this category held a major share in 2022. More than 20,000 drugs under development are expected to be launched in the coming years. Liquid handling systems hold high importance in each stage of the drug discovery process. Moreover, companies are focusing on capacity expansions for discovering drugs.

The clinical diagnostics category holds the second-largest share, primarily due to the increasing prevalence of chronic diseases. Liquid handling systems are widely used at diagnostic centers and even the diagnostic laboratories at hospitals.

Drive strategic growth with comprehensive market analysis

North America held the largest share, of around 36%, in 2022 due to the increasing number of mergers & acquisitions among biotechnology companies. Moreover, the growing pharmaceutical and biotechnology industries are having a positive impact on the market growth. Moreover, companies are investing in the consumer healthcare business to develop effective therapies.

The U.S. market is predicted to generate a significant revenue by 2030, growing at a CAGR of around 4.5% during the forecast period. This can be mainly attributed to the presence of a large number of major healthcare device and pharmaceutical companies and the increase in the need for the proper management and stabilization of pharmaceutical and biotechnical production processes.

Moreover, European market generated a significant growth in 2022. This regional market is significantly supported by the rising awareness of the DNA’s medical significance, ample financial capacity to purchase pricey tools, and favorable reimbursement policies. Numerous cutting-edge applications in studies, including genotyping, expression analysis, and molecular diagnostic testing, may present opportunities for the market players in the region.

Additionally, government bodies are increasingly investing in the development of advanced labs, in partnership with numerous research institutes and organizations, because they provide important genetic insights into the nature of diseases. The growing demand for liquid handling solutions and increasing government funding for R&D in Europe are the main factors driving this market. The rising use of personalized medicine and diagnostics and the latest genetics-enhancing technology and the lessons learned from genetic sequencing are also driving the region's market growth.

Moreover, the APAC region is projected to witness the fastest growth, at a CAGR of over around 5.1%, during the forecast period, attributed to the rise in the investments in the field of biotechnology. In APAC, the Chinese market held the largest revenue share in 2022, and it is projected to progress at a significant CAGR during the forecast period. This is mainly due to a large number of R&D activities underway in the life sciences industry in the country.

Japan has contributed significantly to the APAC market as well. The country is witnessing collaborations among various industry participants and stakeholders, such as the International Nucleotide Sequence Database Collaboration (INSDC) between the European Bioinformatics Institute (EMBL-EBI), the National Centre of Biotechnology Information (NCBI) in the U.S., and the DNA Data Bank of Japan (DDBJ). The DDBJ provides share data from life science research and analyzes it.

India will witness considerable market growth in this region as it is investing massively in the advancement of its healthcare and medical research ecosystems. The country is home to a highly heterogeneous population and genetic diversity, which also contribute to the high prevalence of recessive alleles, often translating into genetic diseases, including rare diseases. Thus, to reduce the burden of these diseases and accelerate their diagnosis and management, the government is planning to speed up research in the field with various projects.

LATAM is comparatively a small market for liquid handling systems, and it is set to witness moderate growth during the forecast period. The growing biotechnology industry and, consequently, the increasing use of analytical technologies and the rising R&D expenditure by the pharmaceutical companies in the region have been driving the growth of the LATAM market.

The MEA market holds the smallest share in the global market, and it will witness significant growth during the forecast period. The increasing requirement for customized medicines, technological advancements, and increasing financing for proteomics ventures are driving the MEA market.

Based on Type

Based on Product

Based on Application

Based on End Users

Geographical Analysis

The increasing number of mergers and acquisitions is one of the major trends being observed in the market. The objective of this strategic development is an increase in the share for companies, their geographical expansion, enrichment of their product portfolios, and the achievement of a larger customer base.

Some of the recent mergers & acquisitions are:

The 2024 size of the market for liquid handling systems was USD 4,992.9 million.

Pipettes dominate the liquid handling system industry, based on product.

The market for liquid handling systems is driven by the expanding life sciences industry, itself due to the rising prevalence of all kinds of diseases.

North America holds the largest share in the liquid handling system industry and Europe the second-largest share; APAC will have the highest CAGR.

Drug discovery is the biggest application in the market for liquid handling systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages