Report Code: 10358 | Available Format: PDF

Learning Management Systems (LMS) Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10358

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

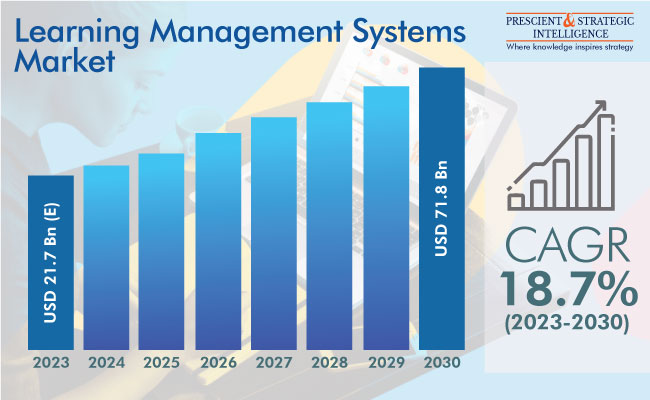

The global learning management systems market is expected to grow from USD 21.7 billion (E) in 2023 to USD 71.8 billion in 2030, at 18.7% CAGR between 2023 and 2030.

This is majorly attributed to the arrival of various innovative education technologies due to the COVID-19. Further, the progressions in high-speed telecommunication networks, the cost-effectiveness of digital devices, and the advancement in multimedia graphics aid in the surging utilization of LMSs. Moreover, the industry is gaining substantial funding from educational institutions, governments, and IT vendors catering to the education sector.

Additionally, AI, big data, mobile learning, and online learning are the important trends boosting the expansion of the industry. Advanced communication technologies are significantly transforming classroom teaching all over the world. Utilizing gamification approaches in teaching offers an engaging technique to both teachers and students, thereby enhancing user retention.

Arrival of Multichannel Learning Is Key Market Trend

The advent of multichannel learning is a key trend being observed in the industry. With the advent of Generation Y, there has been a shift in the method of employee training, reflected in the burgeoning usage of e-learning tools. The capability of such tools to provide employees with advanced, faster, and application-oriented skills is expected to boost the progress of this industry.

Multichannel platforms offer flexible access to learning and training material at any time, apart from an inclusive, user-friendly, and flexible eco-system. This approach also improves flexibility by providing customized training sessions and independence from a specific schedule, thus becoming popular in the corporate sector. It aids in the acceptance of a rapidly changing work culture, which is likely to boost its requirement.

Government Initiatives to Digitize Education Sector

Around the world, governments are strongly focusing on digitization, including in the education sector. This is being done to make the learning experience more interactive for students, which involves realistic simulations of scientific concepts. For instance, India has implemented numerous initiatives to promote e-learning and smart classes, including DIKSHA, PM E-Vidhya, SWAYAM Prabha TV, E-Pathshala, and VidyaDaan.

Advancements in IT & Telecom Infrastructure

Another key factor enabling the rapid adoption of learning management systems is the continuous improvements in the IT & telecommunications infrastructure. For such platforms to prosper, a robust, high-speed, continuous, and low-latency internet connection is vital. Hence, with 5G being deployed around the world, content sharing and storage are becoming easier. Similarly, the development of data centers has allowed content libraries to syndicate massive volumes of educational videos, photos, essays, audio files, and podcasts and make them available on demand.

Learning Management Platform Utilization Higher in Academic Institutes

More academic institutions than corporate entities utilize learning management systems. During the COVID-19 pandemic, the online learning trend took off, with most schools and colleges shifting to online classes. Further, since even before the pandemic, smart classes had started becoming popular in developed and developing countries. Interactive whiteboards, tablets/smartphones, learning apps, and student information systems are the key elements of the smart classes of today.

Solutions Category Is Leading Component Segment

The solutions category, based on component, is leading the industry owing to the increasing integration of advanced technologies, such as analytics, AI, and ML, into LMS platforms. For example, Cornerstone OnDemand Inc. introduced new content offerings for corporate workforces in November 2021.

The service category is expected to observe substantial growth during this decade, attributed to the increasing need for technical assistance and software installation. Learning or education software vendors also provide consultation, pre- and post-sales support, and implementation, to make the usage experience better.

On-Premises Category Is Major Contributor

The on-premises category, based on deployment, is the larger contributor to the LMS industry. On-premises software offers customization, complete control, stronger security to the data, and better integration with the central hardware, servers, and database. Most businesses utilize technology-assisted learning to enable employees to create, display, and save new ideas in the workplace. Businesses that implement mobile learning solutions have observed enhanced creativity, loyalty, and productivity among their workforces.

The cloud category is expected to observe substantial growth during the forecast period, attributed to the shift toward cloud-based solutions from on-premises ones by most vendors. Cloud-based solutions are easier to install as they negate the need for expensive on-premises hardware. In addition, they enable on-demand scalability and anytime, anywhere access.

Instruction-Led Training Category To Observe Fast Growth

Based on delivery mode, the instructor-led training category is expected to observe a high growth rate during the projection period. Instructor-led training programs boost interaction and discussion between employees or learners with the instructor. The requirement for LMSs in academic institutions has surged as it helps manage online course administration, student work assessment, and educational content syndication and sharing.

Large Enterprises Are Dominating Enterprise Size Segment

The large enterprises category, based on enterprise size, is dominating the global LMS industry. Large businesses utilize LMS software for its centralized training resources, lower expenses, and quicker training. Multinational companies have a workforce distributed in numerous countries, while most major universities offer distance learning programs, where LMSs prove useful.

The small & medium enterprises category is expected to observe substantial growth. Smaller corporate enterprises and educational institutions are adopting cloud-delivered LMSs for tracking employee progress, saving on expenses, and providing employee training.

| Report Attribute | Details |

Market Size in 2023 |

USD 21.7 Billion (E) |

Revenue Forecast in 2030 |

USD 71.8 Billion |

Growth Rate |

18.7% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Leading Industry

North America is leading the industry, and it will remain in the lead throughout this decade, owing to the surging EdTech activities. Moreover, the U.S. has the largest number of smart colleges and universities, which will generate various opportunities for the industry players to expand their business. The surging need for high-quality and effective learning is essentially boosting the progress of the market in the region. Moreover, the acceptance of cloud-based services by numerous businesses is expected to create significant openings for the market.

APAC will observe growth at the highest CAGR over the forecast period. This can be credited to the surging funding for LMS platforms and their adoption to encourage wholesome learning and development, particularly in China, Japan, and India. Thus, in February 2021, LTG plc acquired Bridge, a learning management system platform that improves the performance and skills of students.

Major Companies in Learning Management System Market Include:

- International Business Machines Corporation

- Cornerstone OnDemand Inc.

- Pearson PLC

- LTG plc

- Xerox Corporation

- D2L Corporation

- Blackboard Inc.

- SAP SE

- Blackboard Inc.

- PowerSchool Holdings Inc.

- Instructure Inc.

- Adobe Inc.

- Oracle Corporation

- Moodle Pty. Ltd.

- Google LLC

- McGraw-Hill

- John Wiley & Sons Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws