Last Mile Delivery Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Last Mile Delivery Market Report Prepared by P&S Intelligence, Segmented by Service (B2C, B2B), Application (E-Commerce, Package Delivery), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

Last Mile Delivery Market Size

Market Statistics

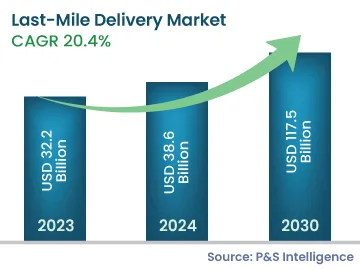

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 32.2 Billion |

| 2024 Market Size | USD 38.6 Billion |

| 2030 Forecast | USD 117.5 Billion |

| Growth Rate (CAGR) | 20.4% |

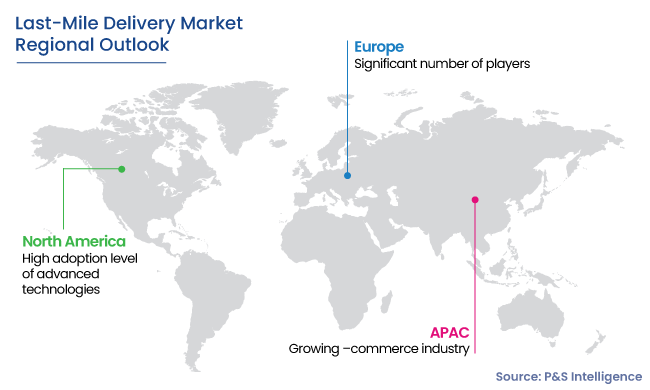

| Largest Region | Asia-Pacific |

| Fastest-Growing Region | North America |

| Nature of the Market | Fragmented |

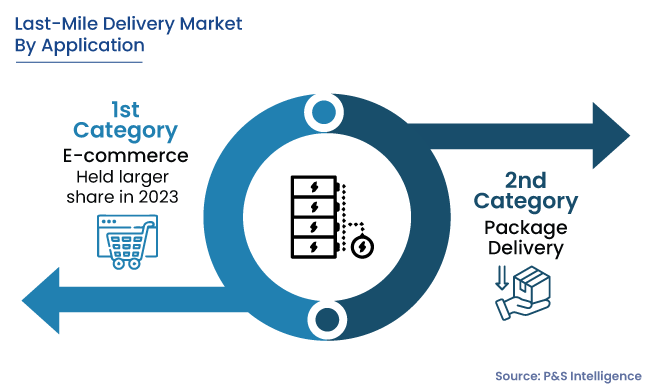

| Largest Application Category | E-Commerce |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

Last Mile Delivery Market Analysis

The global last mile delivery market size stood at USD 32.2 billion in 2023, and it is expected to advance at a compound annual growth rate of 20.4% during 2024–2030, to reach USD 117.5 billion by 2030. The growth can be primarily ascribed to the increasing use of omnichannel retailing, coupled with a significant rise in internet penetration in developing economies, such as India, Thailand, and Indonesia.

Moreover, the e-commerce industry is growing at a tremendous rate across the globe, and it is occupying a large share of the retail market. In 2023, the e-commerce sector accounted for around 22% of all retail sales. As international demand grows for products and services, all service providers in transportation, particularly in the shipping industry, will need to keep up with rapidly changing supporting technologies, while simultaneously improving their customer services.

Furthermore, it allows extensive research and comparison on prices, features, compatibility requirements, specifications, delivery time, offers, etc., which makes it easier for customers to compare products from multiple online sources as compared to brick-and-mortar stores. These additional advantages over brick-and-mortar stores are driving e-commerce sales.

Moreover, with an increase in trust among online buyers, improved website experience coupled with the level of comfort that is provided to online shoppers, e-commerce has gained significant popularity in the last 10 years. This e-commerce boom, majorly in developing countries like China, India, Brazil, and Mexico, is expected to drive the demand for last-mile delivery services during the forecast period.

Last Mile Delivery Trends & Growth Drivers

Development of Autonomous Vehicles for Delivery Is a Key Trend

- Artificial intelligence (AI) is a key technology for autonomous driving systems, as it is the only technology that enables reliable and real-time recognition of objects around the vehicle.

- Autonomous driving technology allows for a drastic reduction in the cost of delivery, thus triggering further growth in e-commerce volume. New types of vehicles and new logistics structures are expected to evolve during the forecast period, to combat this paradigm shift.

- Currently, there is a significant investment in the automotive industry, specifically in the optimization of self-driving technology.

- Automakers such as Daimler AG, Tesla Inc., and Volvo AB; automotive suppliers such as Valeo SA, Delphi Technologies PLC, and Robert Bosch GmbH; and technology companies like Alphabet Inc. and Intel Corporation are working on autonomous trucks and other vehicles for commercial purposes.

- Moreover, major companies are heavily investing in drone technology for last-mile delivery. This will be a future delivery system from the company designed to safely get packages to customers in 30 minutes or less using unmanned aerial vehicles, also called drones.

- Furthermore, in both rural and urban areas, self-driving vehicles and drones will become key to increasing last-mile delivery options while maintaining high reliability and same-day delivery options.

Real-Time Tracking Technology Is a Key Driver

The transportation and logistics industry is confronting significant changes, and the integration of real-time technology is one of them. The internet of things (IoT) is becoming prevalent within several industries, with the transportation and logistics industry being considered as a major sector. In order to help companies maintain the growing demands, technology is transforming the last mile, by providing real-time tracking solutions during the delivery process.

Last-mile tracking for customers provides with customers real-time insights into their delivery and last-mile tracking for delivery partners gives businesses a holistic view of delivery logistics and inspires them to be more customer-centric. Real-time visibility enables companies to identify potential problems and resolve them before escalation.

The e-commerce industry has thrived on this technology and it has become important for e-commerce players as well as logistics service providers to have a robust IT infrastructure in place, which allows efficient tracking of each transaction and movement of shipment at any time.

The industry has witnessed various new start-ups entering the market, which provide last-mile management and solutions. For instance, LogiNext Solutions offers logistics and field service management solutions. Through its LOGINEXT MILE, the company provides real-time tracking, real-time estimated time of arrival (ETA) calculation, automated planning & route optimization, and electronic proof of delivery, among others.

This provides customers the feeling of control and makes them aware of order status, but mostly it helps ensure the safety of products and reduces the chances of theft and losses. Thus, with the integration of real-time tracking technology coupled with the introduction of AI and IoT, the market for last-mile delivery is expected to witness a significant boost during the forecast period.

Data security and data privacy concerns are a key challenge

One of the major factors restraining the market growth is the threat to cybersecurity as connectivity among service providers and fleet operators exposes related information to hackers.

The automotive industry is facing an inflection point, as internet connectivity becomes commonplace. This increases the risk of privacy and even safety. The common communication standard among last-mile logistics vehicles and smartphone applications can lead to cyberattacks on fleet services.

Furthermore, protecting proprietary and customer information is critical for shippers, and avoiding cybersecurity threats in last-mile logistics presents complex problems. Therefore, maintaining adequate safety and security remains a major challenge for the industry.

Last Mile Delivery Industry Outlook

Services Insights

- The B2B category accounted for the majority of revenue share, around 70%, in 2023. This is because it offers several advantages to online retailers to attract B2B consumers, such as easy payment options, reduced time of delivery, heavy discounts on bulk buying, and doorstep delivery of heavy parts reducing management costs.

- Whereas, the B2C category is expected to witness faster growth during the forecast period. This can be due to changing consumer purchasing behavior, growth in organized and omnichannel retailing, and increasing technical knowledge regarding the use of smartphone apps and online platforms.

- Moreover, with continuous growth in emerging economies, an increasing global middle-class population, and expanded internet access, the amplified demand for e-commerce will necessitate logistic companies to deliver products to end consumers present at remote locations in these countries.

Services covered in the report include:

- B2C (Larger Category)

- B2B (Faster-Growing Category)

Application Insights

- The e-commerce category held the largest share and expected to register the fastest growth, advancing at a CAGR of over 20.7%, in the coming years. This can be attributed to the increasing customer base, the changing customers’ buying behavior, fast and free shipping expectations of consumers, competitive pricing, and demographic shifts.

- Thus, organizations are now concentrating on their strategies to overcome the demanding delivery schedule challenges of traditional logistics.

The following applications are included in the report:

- E-Commerce (Larger and Faster-Growing Category)

- Package Delivery

APAC Is the Largest Market

- APAC held the largest share in the last mile delivery market in 2023. This is because this region comprises the largest automotive industry in the world, which is involved in the production of around 50 million vehicles each year.

- North America is expected to be the fastest-growing regional market during the forecast period. This is attributed to the high adoption level of advanced technologies in the region, coupled with the increasing level of efficiency projected by last-mile delivery.

- The region includes developed countries, such as the U.S. and Canada, which are prominent markets for last-mile logistics and e-commerce. According to a report, there were around 274 million online shoppers in 2023 in the U.S.

- In addition, in the region, the digital platform is becoming significantly important, which enables small-sized companies to have a worldwide reach and compete with the industry’s established players.

- The use of updated technologies and management techniques in business processes to provide enhanced services to both suppliers and end users is shaping the regional industry.

- In North America, the U.S. market holds the leading position, and it will grow at a CAGR of around 20.7% during the forecast period. This is attributed to the rising demand for personalized workflow, automation, and streamlining complicated operation processes that have significantly contributed to the shift in how businesses operate.

- Moreover, the presence of a large number of companies that are offering last-mile delivery services, which are one of the services highly in demand in the country.

- On the other hand, the LAMEA market is expected to witness significant growth. This can be ascribed to the economic development taking place in major LATAM countries like Brazil and Mexico, the improving state of logistics, and the growing e-commerce industry in the region.

- Moreover, companies operating in the regional market are focusing on efficient order management, as it is the centerpiece of any last-mile delivery solution and enables them to have access to an interface where they can arrange pick-ups and deliveries for drivers.

- The fully integrated order management system provides complete end-to-end visibility of the on-demand delivery business, as it helps in time-saving and keeping track of orders and potential delays for scheduled last-mile deliveries.

Further, regions and countries analyzed for this report include:

- North America (Fastest-Growing Regional Market)

- U.S. (Larger Country Market)

- Canada (Faster Country Market)

- Europe

- Germany (Largest Country Market)

- U.K.

- France (Fastest-Growing Country Market)

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Largest Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Last Mile Delivery Market Share

Key players in the global last mile delivery market are taking strategic measures to gain a competitive edge over their competitors. The strategic moves range from mergers & acquisitions to business expansions and partnerships. To gain a competitive edge over other players, the companies are focusing on improving their existing offerings and working in collaboration with other market leaders to expand their reach.

Competitiveness is also significantly impacted by regional and national policy frameworks, consequently promoting directly or indirectly various choices of last-mile delivery and logistics solutions. Even though last-mile logistics represent a small portion of the overall transportation and logistics industry, its outlook is positive with the increasing offerings of on-demand solutions and hyperlocal solutions in the market.

Top Last Mile Delivery Companies:

- The United States Postal Service

- United Parcel Service Inc.

- FedEx Corporation

- LogiNext Solutions Inc.

- Deutsche Post AG

- J.B. Hunt Transport Services Inc.

- ArcBest Corporation

- DSV A/S

- Flexe Inc.

- Onfleet Inc.

- Postmates Inc.

Last Mile Delivery Industry News

- In February 2024, FedEx Express, a subsidiary of FedEx Corp., announced the cross-border delivery trial from Malaysia to Singapore via EVs.

- In May 2022, United Parcel Service of America Inc. acquired last-mile tech provider Delivery Solutions.

- In August 2023, LogiNext Solutions Private Limited was considered as a sample Vendor in the latest Gartner Hype Cycle for last-mile delivery solutions.

- In May 2022, Ford Pro and Deutsche Post DHL Group signed an MoU to boost the deployment of electrified vans used for logistics operations globally.

Frequently Asked Questions About This Report

The last mile delivery industry will reach a value of USD 117.5 billion by 2030.

During 2024-2030, the market for last mile delivery will grow at a CAGR of 20.4%.

North America is the fastest-growing industry for last mile delivery.

Development of autonomous vehicles for delivery is the key trend in the last mile delivery market.

The industry for last mile delivery is fragmented in nature. Major players are taking strategic measures to enhance their presence in the market.

E-commerce is leading the last mile delivery industry, and it will further grow at the fastest CAGR, of more than 20.7%, during 2024–2030.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws