Report Code: 12821 | Available Format: PDF | Pages: 240

Lab Supplies Market Size and Share Analysis by Based on Offering (Product, Equipment), End User (Hospitals, Diagnostic Centers, Research and Development Centers, Academic Institutions), Distribution Channel (Direct, Distributors and Suppliers, Retail, E-Commerce) - Global Industry Demand Forecast to 2030

- Report Code: 12821

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Lab Supplies Market Size & Share

The global lab supplies marketis valued at an estimated USD 40.3 billion in 2023, which is expected to reach USD 66.4 billion by 2030, growing at a CAGR of 7.6% during 2024–2030. This is ascribed to the increasing research and development activities due to the rising spending on this aspect by life sciences firms, their surging numbers, and widespread prevalence of infectious ailments.

Pharmaceutical and biotechnology firms have made a drastic increase in the investment in their R&D departments. This is attributable to the fact that severe contagious ailments have seen a sudden rise in prevalence, resulting in a high mortality rate, in the last few years. The coronavirus pandemic is one such prominent example that has resulted in a surge in research activities in the life sciences sector. Thus, the lab supplies market is set to witness constant growth due to the need for a steady availability of a range of equipment and disposables at clinical and research laboratories.

Furthermore, over the years, the burden of severe long-term ailments has increased across the globe, which has resulted in a significant dependence on medicines. For instance, the World Health Organization has stated that non-contagious ailments kill 41 million people every year, accounting for 71% of the deaths across the world. The rising disease burden has resulted in a consistent demand for lab supplies, thereby positively impacting the growth of the market.

In addition, biopharmaceuticals are a prominent life sciences subsector in regard to research funding. Many firms are engaging in the production of new lead compounds and accumulating large amounts of samples, therewith creating a need for lab supplies. Moreover, many companies are involved in the production of vaccines and other kinds of therapeutics due to the increasing prevalence of diseases. Furthermore, the incorporation of cutting-edge technologies across several research domains is boosting the demand for laboratory supplies.

In order to perform novel investigations and tests, it is mandatory for research labs, medical labs, educational labs, quality assurance centers, and other such facilities to have a wide range of instruments and consumables. The utilization of such instruments enables efficient analyses, which, in turn, adds value to the labs themselves, by increasing the testing capacity of the equipment and enabling it to carry out more tests in the same time. Faster processes might even enable the tests to be conducted on fewer pieces of equipment, which can, in turn, reduce the requirement for regulatory documentation and maintenance and, ultimately, decrease users’ operational expenses.

Additionally, there has been a growing adoption of sustainability practices in clinical laboratories. Lately, a number of initiatives and campaigns have begun to encourage the use of sustainable lab supplies. For instance, the avoidance of single-use plastics is a trend; similarly, instead of plastic, glass equipment is being promoted. One prominent company concerned with sustainability in the laboratory environment is My Green Lab. It is a non-profit organization that focuses exclusively on lab environments and aids in enhancing sustainability in scientific research.

Technological Advancements in Laboratory Testing Equipment To Drive Market

The integration of cutting-edge technologies into clinical testing devices and instruments has significantly improved the overall lab capabilities over the years. Ground-breaking processes and technologies allow researchers and lab techs to work precisely and effectively. Artificial intelligence, automation, smart control and analysis tools, and miniaturization have become a crucial part of the lab environment, helping efficiently manage the workflow and obtain more-precise results.

Simultaneously, the pressure to provide results as quickly as possible is on the rise; therefore, it is essential for laboratories to be fast and efficient. Improvements in the buying procedure followed by lab managers can significantly enhance this efficiency. In addition, companies that cater to these establishments with instruments and consumables are constantly trying to make their item selection and ordering procedures easier.

Furthermore, the technological enhancements in lab instruments are significantly boosting the market growth. Advanced instruments possess capabilities that make the operation simpler and faster than the traditional instruments. For instance, BrandTech Scientific Inc. provides an electronic repeating pipette with automatic tip ejection and a touchscreen, which enables users to access all its functions with just a swipe.

| Report Attribute | Details |

Market Size in 2023 |

USD 40.3 Billion |

Market Size in 2024 |

USD 42.9 Billion |

Revenue Forecast in 2030 |

USD 66.4 Billion |

Growth Rate |

7.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Offering; By End User; By Distribution Channel; By Region |

Explore more about this report - Request free sample

Equipment Category Dominates Offering Segment

On the basis of offering, the equipment category holds the largest lab supplies market share, of 70%, in 2023. This is ascribed to the fact that pharmaceutical and biotechnology companies, R&D centers, labs, and other scientific organizations require quality instruments to carry out a wide range of experiments, tests, and studies. In addition, the results produced during such activities are highly dependent on the durability, quality, and strength of the instruments. Equipment that helps in improving the efficiency of work and providing accurate results is, therefore, needed.

In addition, equipment is indispensable for carrying out studies involving tissue or cell cultures, which is important for research on drug toxicity, drug efficacy, precision medicines, and cancer therapies. A range of devices are used for quality assurance tests, process control, and experiments.

The consumables demand is also growing, because a wide variety of consumables are commonly utilized in research, biotechnology, pharmaceutical, biopharmaceutical, quality assurance, and other sectors. Consumables such as pipettes, cuvettes, dishes, gloves, masks, tips, and tubes are used on a daily basis to carry out even the smallest tasks in laboratories. Such disposables are utilized in medicine, biology, and chemistry for storage, transportation, culturing, dispensing, liquid volume measurement, and many other purposes. In addition, most consumables used for these purposes are small, portable, and easy to use, which is resulting in small lab supplies gaining significant traction in the market.

Additionally, the recent technological enhancements in these products are expected to boost the market growth. For instance, the launch of technologically advanced pipettes is making the operation easy, fast, and user-friendly for personnel. In this regard, in February 2022, Switzerland-based company INTEGRA Biosciences AG launched the D-ONE single-channel pipetting module, which enables the ASSIST PLUS pipetting robot to automatically carry out sample transfers. This eliminates the errors that arise while performing manual sample transfers using conventional pipettes.

Research and Development Centers Lead End User Segment

The research and development centers category hold the largest market share, of 40%, in 2023 in the end user segment. This is ascribed to the increasing count of research initiatives in the biopharmaceutical, pharmaceutical, and biotechnology industries. The rising need for advanced drugs and tests has led to a growth in research and development activities, thereby resulting in the increasing engagement of R&D labs.

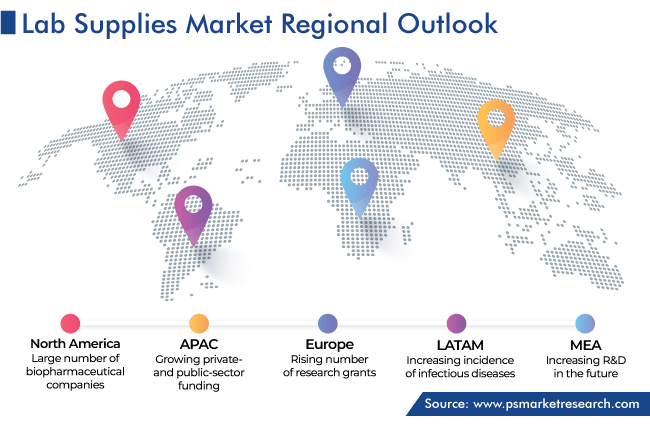

North America Is Highest Revenue Contributor

North America leads the sector with a substantial revenue share. This is because a large number of biopharmaceutical, pharmaceutical, and biotechnology giants based in the region are actively engaged in R&D activities. Additionally, many research agencies in the region are enhancing their infrastructure with the funds provided by government organizations. Moreover, the excellent quality of the data provided by the major players in the region and their excellent track records are predicted to attract funds for research during the projection timeframe.

In addition, the high prevalence of severe ailments is resulting in a growing number of drug launches, which, in turn, is increasing the frequency of clinical trials to check their efficacy as well as safety. This is itself because a significant number of government and non-government organizations are providing funds for advancing the healthcare industry, which would create a lucrative growth opportunity for the regional market players.

In addition, Europe is expected to display a high growth rate over this decade, ascribed to the significant number of research institutes in the region. Moreover, there has been a rise in the number of research grants across Europe. For instance, in January 2023, the European Research Council granted EUR 657 million to scientists across the region to conduct studies on a range of topics, from engineering to life sciences. Additionally, the implementation of stringent guidelines regarding the safety of medications makes quality assurance activities necessary, thereby resulting in the regional market expansion.

Germany accounts for a significant share in the European region. This is ascribed to the fact that people are becoming aware of drug safety, which, in turn, is boosting quality assurance testing, thereby increasing the demand for lab disposables and equipment.

Top Lab Supplies Providers Are:

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Danaher Corporation

- Agilent Technologies Inc.

- Merck KGaA

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

Market Size Breakdown by Segment

This report offers deep insights into the lab supplies market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Offering

- Product

- Cell culture consumables

- Cell imaging consumables

- Cuvettes

- Dishes

- Gloves

- Masks

- Pipettes

- Tips

- Tubes

- Equipment

- Autoclaves and sterilizers

- Centrifuges

- Incubators

- Lab air filtration system

- Laminar flow hood

- Micro manipulation systems

- Scopes

- Sonicators and homogenizers

- Spectrophotometers and microarrays

Based on End User

- Hospitals

- Diagnostic Centers

- Research and Development Centers

- Academic Institutions

Based on Distribution Channel

- Direct

- Distributors and Suppliers

- Retail

- E-Commerce

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for lab supplies values USD 403. billion in 2023.

In 2030, the lab supplies industry will generate USD 66.4 billion.

Equipment sales generate the highest revenue in the market for lab supplies.

Sustainable equipment and consumables are the biggest trend in the lab supplies industry.

R&D laboratories dominate the market for lab supplies.

North America is the highest-revenue-generating lab supplies industry.

The highest CAGR in the market for lab supplies is visible in APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws