Report Code: 11776 | Available Format: PDF | Pages: 111

Kick Scooter Sharing Market Research Report: By Model (Multimodal, First and Last-Mile), Geographical Outlook ( U.S., Canada, Spain, France, Belgium, Switzerland, Austria, Singapore, Malaysia, Thailand, Mexico, Brazil, Colombia) - Industry Trends and Growth Forecast to 2025

- Report Code: 11776

- Available Format: PDF

- Pages: 111

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

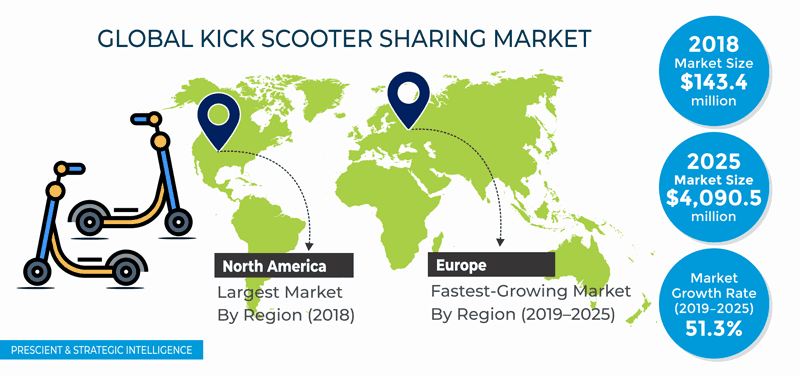

Valued at $143.4 million in 2018, the global kick scooter sharing market is projected to surpass $4,090.5 million by 2025, at a CAGR of 51.3% between 2019 and 2025.

Europe is expected to be the fastest-growing region in the kick scooter sharing market during the forecast period. This can be mainly attributed to the entry of established players in the market, with the intention to capitalize on their success in the North American region. Further, the influx of huge investments from various venture capitalists, along with automobile giants, is responsible for creating ample growth opportunities for kick scooter sharing services in this region.

Fundamentals Governing Kick Scooter Sharing Market

One of the key trends being observed in the kick scooter sharing market is the inflow of heavy investments. Major players, along with the numerous start-up companies in the market, are receiving hefty investments from several venture capitalists. For instance, VOI Technology AB, a Swedish electric kick scooter sharing company, received an investment of $50 million from London-based venture capital firm, Balderton Capital, in 2018. Additionally, Tier Mobility, a Berlin-based electric kick scooter sharing company, raised a funding of $29 million in 2018, for the expansion of its services across European countries.

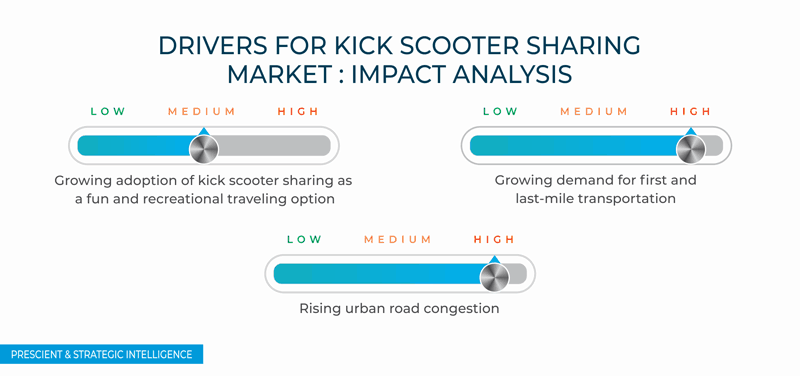

The increasing demand for first and last-mile transportation is a major driver for the growth of the kick scooter sharing market. The mobility services provided by ride hailing, carsharing, and other similar firms have been unsuccessful in bridging the gap for first and last-mile transportation. Kick scooter sharing services play a pivotal role in covering this gap by offering mobility options for shorter distances, i.e. less than 5 km (3.1 miles) per trip, which is propelling the growth of the market. Moreover, these services are mostly offered via the dock-less or station-less model, which allows users to drop off the kick scooters at any place as per their convenience, which is further assisting in first and last-mile traveling.

Kick Scooter Sharing Market Segmentation Analysis

On the basis of model, first and last-mile was the larger category in the kick scooter sharing market during the historical period (2017–2018), and it is expected to remain the dominant category during the forecast period. The prevailing mobility services, which include those offered on cars, are a costlier mobility option, while traveling the first and last miles. Kick scooter sharing services have been successful in replacing the use of cars, especially for first and last-mile commuting, as these are best fitted for traveling shorter distances.

Geographical Analysis of Kick Scooter Sharing Market

North America was the largest kick scooter sharing market during the historical period and is expected to maintain the trend during the forecast period. The dominance of the region is buoyed by the rapid adoption of the service here, along with the existence of the biggest players in the world, including Bird, Lime, and Spin. The region was the first to introduce the kick scooter sharing services, back in 2017, for the purpose of solving the first and last-mile commuting problem. This is why kick scooter sharing is currently viewed as one of the most beneficial commuting options in the region.

During the forecast period, Europe is forecast to witness the fastest growth in the kick scooter sharing market. It is the massive adoption of the services in the North American region which has been playing a pivotal role in influencing their adoption in Europe. The service has been the most popular in Spain among all European countries, followed by France, Belgium, Switzerland, and Austria.

Competitive Landscape of Kick Scooter Sharing Market

The global kick scooter sharing market is consolidated in nature, with the top two players accounting for the major market share in 2018. The major players operating in the market are Neutron Holdings Inc. (Lime), Bird Rides Inc. (Bird), Waybots Inc. (Skip), Social Bicycles Inc. (JUMP), VOI Technology AB, Taxify OU (Bolt), emTransit B.V. (Dott), Beam Mobility Holdings Pte. Ltd. (Beam), LMTS Holding S.C.A. (Circ), TIER Mobility GmbH (Tier), BYKE Mobility GmbH (Wind), Bycyshare Technologies Pvt. Ltd. (Mobycy), Neuron Mobility Pte. Ltd., Grin Scooters SAPI de CV (Grin), mytaxi Polska sp. z o.o. (Hive), and Skinny Labs Inc. (Spin).

Recent Strategic Developments of Major Kick Scooter Sharing Market Players

In recent years, the major players in the kick scooter sharing market have taken several strategic measures, such as service launches, partnerships, and mergers and acquisitions, and raised investments to gain a competitive edge in the industry. For instance, in October 2019, Lime launched its kick scooter sharing service in Roanoke Island, in North Carolina, with a fleet of 100 kick scooters. It aims to deploy 400 more scooters in the coming few weeks, for which charges will be $1.00 to unlock and an additional $0.23 per minute.

Moreover, in October 2019, Tier announced the receipt of an investment of $60 million (EUR 55 million), as a part of its Series B funding round, led by Goodwater Capital and Mubadala Capital. The same month, Bird announced that it had received $275 million, as part of its Series D fund raising round, and this investment has taken the company’s valuation to $2.5 billion.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the kick scooter sharing market?

- What are the historical and present sizes of the categories within the market segments and their future potential?

- What is the number of kick scooter sharing rides registered across different regions?

- What are the business models of the kick scooter sharing service providers?

- What are the regulations governing the kick scooter sharing services in major countries across the world?

- What are the major catalysts for the market and their expected impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- What are the market shares of the major players in different regions as well as globally?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws