Report Code: 12143 | Available Format: PDF | Pages: 149

North America ISOs Medical Device and Equipment Maintenance and Calibration Services Market, 2014-2030

- Report Code: 12143

- Available Format: PDF

- Pages: 149

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

North America ISOs Medical Device and Equipment Maintenance and Calibration Services Market Overview

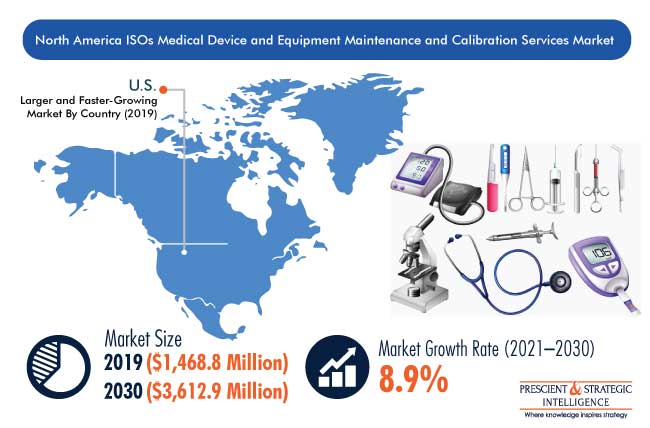

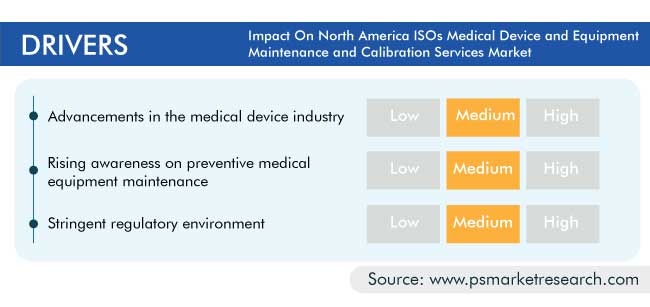

The North American market for medical device and equipment maintenance and calibration services by independent service organizations (ISOs) accounted for $1,468.8 million revenue in 2019, and is expected to grow at a CAGR of 8.9% during the forecast period (2021–2030). The major factors responsible for the market growth include advancements in the medical device industry, rise in awareness on preventive medical equipment maintenance, and stringent regulatory environment.

Due to the COVID-19 pandemic, the North American market for medical device and equipment maintenance and calibration services by ISOs has been negatively impacted. This is mainly due to the strict regulations laid by governments in the region, such as lockdowns and social distancing policies, to save lives. This reduces the demand for the services from end users, such as nursing homes and other healthcare settings, due to the fact that the end users avoided performing any face-to-face interactions typically conducted by sales representatives, medical science liaisons, and other field-based employees of pharmaceutical and medical device companies.

Due to Increasing Number of ICU Beds, Patient Monitoring and Electromedical Category to Witness Fastest Growth

Based on device/equipment type, the patient monitoring and electromedical category is expected to witness the fastest growth in the North American market for medical device and equipment maintenance and calibration services by ISOs, during the forecast period. This can be majorly attributed to the high prevalence of chronic diseases including respiratory and cardiac diseases, increasing number of aging population, and rising number of intensive care unit (ICU) beds, in the region.

Technological Advancements in Automation Solutions Helping Automated Devices to Dominate Market

On the basis of automation, the automated devices category held larger share in the North American market for medical device and equipment maintenance and calibration services by ISOs, in 2019, and is expected to maintain the same trend in upcoming years. This can be ascribed to the continuous technological advancements in automation solutions, increasing government financial support for medical automation, and rising need for reproducibility and accuracy of these devices.

Due to High Maintenance Needs, Floor-Based Category Dominate Market

Based on portability, the floor-based category is expected to dominate the North American market for medical device and equipment maintenance and calibration services by ISOs in foreseeable future. This can be attributed to the fact that floor-based systems are large in size and comprise several components, which need to be regularly checked and repaired to maintain their efficiency and accuracy.

Increasing Foothold of Hospitals Supports their Domination in Market

On the basis of end user, the hospitals category held the largest share in the North American market for medical device and equipment maintenance and calibration services by ISOs, in 2019. This is majorly due to the presence of a large number of publicly-owned healthcare providers in the region.

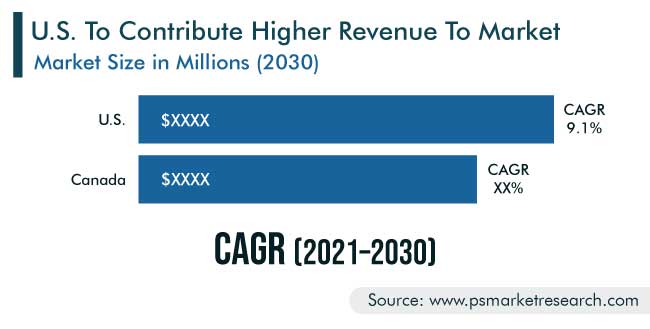

Due to Rising Number of Technological Advancements, U.S. leads Market

The U.S. accounted for larger share in the North American market for medical device and equipment maintenance and calibration services by ISOs, in 2019, and the country is expected to maintain the same trend in coming years. This is mainly on account of the presence of a large number of hospitals and established key players and rise in technological advancements with respect to diagnostic tests, in the nation.

Increasing Adoption of Comprehensive Contracts Is Key Market Trend

In the current scenario, end users in the North American market for medical device and equipment maintenance and calibration services by ISOs are becoming more inclined toward entering into comprehensive contracts offered by various ISOs, in order to reduce the complexities and additional expenses associated with separate services provided under agreements with manufacturers of medical equipment. For instance, Crothall Healthcare offers its preventive and corrective maintenance for all medical equipment and devices used in hospitals, under its healthcare technology solutions (HTS) category. Through the contract, the company offers centralized services and eliminates task redundancy.

Rising Awareness About Preventive Medical Equipment Maintenance Is Boosting Market Growth

Medical devices can be used in number of applications, not being specific to just one area. For example, imaging systems, including ultrasound systems, endoscopes, and X-ray systems, are used in multiple clinical applications. Thus, in order to increase their lifespan, these systems require regular and proper maintenance. Moreover, these services also help in preventing infections caused by the use of medical devices during surgeries. Thus, the emphasis on cleanliness in healthcare facilities is increasing, with many prestigious organizations issuing guidance for improving cleanliness and preventing infections. For instance, the World Health Organization (WHO) has issued guidelines for hospital hygiene, which emphasize equipment maintenance for infection control.

Stringent Regulatory Environment Is Bolstering Demand for Such Services

The presence of a stringent regulatory framework makes medical equipment maintenance a compulsory requirement for end users in North America. For instance, the U.S. Centers for Medicare and Medicaid Services (CMS) regulations and other accreditation requirements (such as those of The Joint Commission [TJC], Healthcare Facilities Accreditation Program [HFAP], and Det Norske Veritas [DNV]), as well as guidelines by original equipment manufacturers (OEMs) and the U.S. Food and Drug Administration (USFDA), necessitate compliance with respect to equipment maintenance among hospitals.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2021-2030 |

Base Year (2019) Market Size |

$1,468.8 Million |

Forecast Period CAGR |

8.9% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Regional Breakdown; Competitive Analysis; Companies’ Strategic Developments; Product Benchmarking; Company Profiling |

Market Size by Segments |

By Device/Equipment Type; By Automation; By Portability; By End User; By Type; By Country |

Market Size of Geographies |

U.S.; Canada |

Secondary Sources and References (Partial List) |

American Registry of Radiologic Technologists; American Medical Resources Foundation; Association for the Advancement of Medical Instrumentation; Center for Devices and Radiological Health; Centers for Medicare and Medicaid Services; Central American Medical Outreach; Health and Human Services; Healthcare Equipment Recycling Organization; International Medical Equipment Collaborative; MAP International; United States Food and Drug Administration |

Explore more about this report - Request free sample

Market Players Are Focusing on Mergers and Acquisitions to Gain Competitive Edge

The North American market for medical device and equipment maintenance and calibration services by ISOs has the presence of several players, such as Sodexo SA, Crothall Healthcare, TRIMEDX Holdings LLC, Agiliti Inc., Renovo Solutions, Ivy Technology, Northfield Inc., NovaMed Corporation, and Diagnostic Equipment Service Corporation (DESCO). In recent years, the players in the market have been actively involved in mergers and acquisitions to gain a competitive edge in the industry.

- In February 2020, Agiliti Inc. acquired Mobile Instrument Service & Repair Inc., which specializes in servicing flexible and rigid endoscopes, powered surgical equipment, general and laparoscopic handheld instruments, video cameras and processing systems, case carts, and rolling stock sterilizers.

- In December 2018, Federal Street Acquisition Corp. and Agiliti Holdco Inc. (a subsidiary of Agiliti Inc.) entered into an amended and restated merger agreement, under which both the companies agreed to reduce the aggregate consideration paid to the selling equity holders of Agiliti Holdco Inc. from approximately $1.58 billion to $1.44 billion.

Key Players in the North American Market for Medical Device and Equipment Maintenance and Calibration Services by ISOs Include:

-

Sodexo SA

-

Crothall Healthcare

-

TRIMEDX Holdings LLC

-

Agiliti Inc.

-

Renovo Solutions

-

Ivy Technology

-

Northfield Inc.

-

NovaMed Corporation

-

Diagnostic Equipment Service Corporation (DESCO)

-

Signature Medical Services Inc.

-

Althea US Inc.

-

InterMed Group Inc.

Market Size Breakdown by Segment

The North America ISOs medical device and equipment maintenance and calibration services market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Device/Equipment Type

- Primary Imaging

- Ultrasound

- Endoscope

- Patient Monitoring and Electromedical

- Infusion pumps

- Continuous positive airway pressure (CPAP)

- Ventilators

- Oxygen concentrators

- Hemodialysis

- Laser devices

- Enteral feeding

- Pulse oximetry

- Blood pressure

- Anesthesia

- Laboratory Instruments

- Clinical chemistry

- Molecular diagnostics

- Industrial laboratory equipment

- Wearables

- Cardiac devices

- Blood pressure monitor

- Wearable pulse oximeter

- Light therapy

Based on Automation

- Automated Devices

- Manual Devices

Based on Portability

- Floor-Based

- Benchtop

- Portable

Based on End User

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Diagnostic Imaging Centers

Based on Type

- Onsite

- Maintenance

- Predictive

- Routine

- Corrective (repair)

- Emergency

- Calibration

- Maintenance

- Depot

- Maintenance

- Corrective (repair)

- Emergency

- Maintenance

- Calibration

Geographical Analysis

- U.S.

- Canada

From $1,468.8 million in 2019, the market will grow to $3,612.9 million by 2030.

The patient monitoring and electromedical category will be the fastest-growing category under the device/equipment type segment.

ISOs in North America majorly provide medical device and equipment maintenance and calibration services to hospitals.

The key drivers for the industry growth are the increasing awareness about preventive maintenance, advancing medical device sector, and strong government regulations.

The North American market has a fragmented nature owing to the existence of a large number of ISOs offering medical device and equipment maintenance and calibration services.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws