Report Code: 12879 | Available Format: PDF | Pages: 310

Internet of Things (IoT) Medical Devices Market Size and Share Analysis by Product (Vital Signs Monitoring Devices, Imaging Systems, Respiratory Devices, Implantable Cardiac Devices, Patients Monitors, Infusion Pumps, Fetal Monitoring Devices, Neurological Devices, Ventilators), Type (Stationary, Implantable, Wearable), Connectivity Technology (Bluetooth, Wi-Fi, Zigbee), End User (Hospitals & Clinics, Nursing Homes & Homecare Settings) - Global Industry Demand Forecast to 2030

- Report Code: 12879

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

IoT Medical Devices Market Size & Share

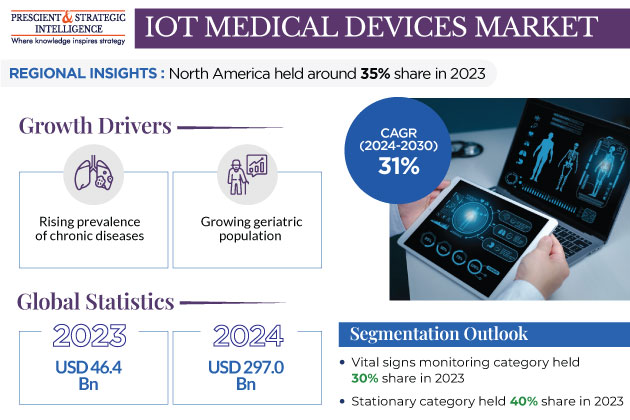

The global IoT medical devices market valued USD 46.4 billion in 2023, and it is projected to register a CAGR of 31% during 2024–2030, reaching USD 297.0 billion by 2030. This is attributed to the rising prevalence of chronic diseases, such as diabetes, hypertension, respiratory disease, cardiovascular diseases, COPD, and asthma around the world.

- Moreover, the increasing geriatric population and burgeoning global population are expected to fuel the expansion of the market.

- The growing geriatric population and lack of primary healthcare facilities in developing countries are increasing the demand for remote patient monitoring services and the development of hospitals.

- Globally, the number of people aged 60 years or above is expected to reach 2.1 billion by the end of 2050, as per the World Health Organization (WHO).

COVID-19 outbreak has positively impacted the demand for IoT devices, especially oximeters, because people suffering with COVID-19 have low levels of oxygen in their blood. Low oxygen levels can be an early sign that medical care is needed. SARS-CoV-2, the virus that causes COVID-19, infects the cells along the airways. Essentially, the COVID-19 pandemic increased demand for IoT medical devices for remote monitoring because patients were unable to visit doctors due to their conditions and restrictions on movement.

Vital Signs Monitoring Devices Are Dominating Market

By product, the vital signs monitoring category held the largest share, of 30%, in 2023, and it is expected to grow at a CAGR of 30% during 2024–2030. This is due to the rising prevalence of self-manageable diseases, such as diabetes and high blood pressure/hypertension, which have no cure and can be managed only by regular monitoring. Vital signs monitoring devices include blood glucose monitors, heart rate monitors, blood pressure monitors, multiparameter monitors, and oximeters.

- IoT sensors in such medical devices provide data related to a patient’s vital signs, which are transferred from a medical device to a cloud-based platform, where it is stored and analyzed.

- This way IoT in medical devices improves the quality of life, supports real-time disease management, lowers the cost of care, and improves patient outcomes.

- It also helps in making informed decisions in a timely manner.

The other factor contributing in the growth of this category is the continuous research and development in products and techniques, especially non-invasive variants. For instance, in September 2021, the KSU created a non-invasive process for glucose monitoring that can detect the exact value with 90% accuracy, without a blood sample. This technology eliminates the painful process of pricking the finger several times for blood sampling, making it beneficial for patients who have a phobia of blood or needles.

Moreover, a smartwatch might have numerous clinical features, such as heart rate monitoring, alerts & notifications, blood pressure monitoring, and sleep monitoring. Therefore, leveraging the trends of both remote patient monitoring and wearable medical devices, companies are launching more-advanced watches/bands to boost their sales. For instance, in October 2022, OPPO Malaysia launched the new generation of OPPO Band, OPPO Band 2.

- It is equipped with an ultra-clear large screen and a full range of upgraded sleep, workout, and health functionality. The wearable band aims to offer high-quality, healthy, and smart experience to users.

- In addition, for more accurate workout and health data monitoring, OPPO Band 2 has a built-in high-precision, dix-axis motion sensor, as well as blood oxygen and heart rate sensors.

- A new mode is able to record five types of data: strokes, activity duration, racket swings, calories burned, and heart rate.

- It also offers upgraded functionality with heart rate monitoring during running, running speed suggestions, cardiorespiratory fitness (CRF) assessment, and 13 more courses of running.

Moreover, in April 2022, Eseye Ltd. announced that its remote patient monitoring devices, including a blood glucometer, blood pressure monitor, pulse oximeter, and thermometer, have achieved the eUICC certification.

In a similar way, companies are getting approvals for their devices from the FDA. For instance, in September 2022, Garmin International Inc. introduce the FDA-cleared Index BPM, a smart BP monitor that can measure systolic and diastolic blood pressure at home.

Partnership, Mergers & Acquisitions Are Foremost Trends

- In January 2023, Cognizant Technology Solutions Corporation acquired Mobica, an IoT software engineering services provider, to enhance its offerings of IoT software engineering.

- In January 2022, Johnson & Johnson Medical Devices Companies (JJMDC) announced that it will collaborate with Microsoft Corporation to enable JJMDC’s secure and compliant digital surgery ecosystem. In the partnership, Microsoft served as JJMDC’s preferred cloud provider for digital surgery solutions and help build its digital surgery platform and IoT device connectivity.

| Report Attribute | Details |

Market Size in 2023 |

USD 46.4 Billion |

Market Size in 2024 |

USD 58.7 Billion |

Revenue Forecast in 2030 |

USD 297.0 Billion |

Growth Rate |

31.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product, By Type, By Connectivity Technology, By End User, By Region |

Explore more about this report - Request free sample

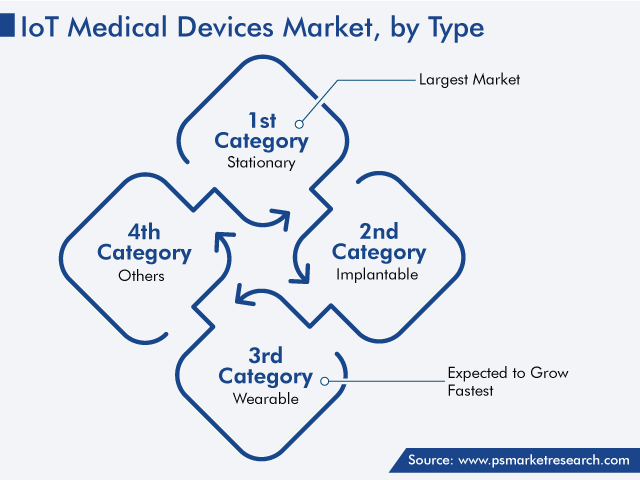

Stationary Medical Devices Accounted for Larger Share

By type, the stationary category held the larger share, of 40%, in 2023. This is because of the extensive use of stationary devices, including ultrasound, MRI, X-ray, and other machines, at hospitals. In addition, they are costlier than any other kind of device, which leads to their major share in the segment.

Wearable medical devices are expected to grow at the higher CAGR. A key factor driving the wearable medical devices market is the rising inclination of consumers to monitor their own health.

- According to a report by the European Commission, the use of technologically advanced wearable medical devices can boost data collection on consumer feedback, which drives down the cost of traditional market research.

- Moreover, the wearable medical gadgets help in continuously monitoring patients’ health conditions, which allow healthcare providers to prescribe treatments timely.

Wi-Fi-Based Devices Hold Largest Share in Connectivity Technology

In the connectivity segment, the Wi-Fi category accounted for the largest share in 2023, and it is expected to grow at a significant CAGR during 2022–2030. This is because Wi-Fi is better for larger stationary devices that need a direct connection to the internet. Additionally, Wi-Fi has a high speed of data transfer, and it is easily available at homes and hospitals.

Hospitals and Clinics Category Accounts for Highest Revenue

The hospitals and clinics segment held the largest share in 2023 in the end user segment. This is because of the increasing number of hospitals in developing countries, itself owing to the increasing investment by governments to enhance their healthcare infrastructure. Further, these healthcare settings cater to the largest population of patients, which is why numerous pieces of connected medical devices are used here.

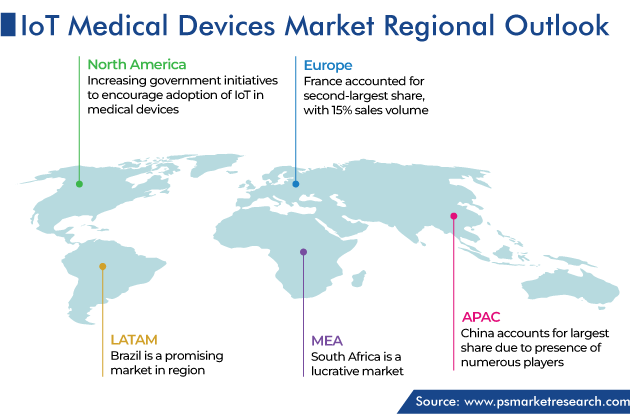

North America Projected To Be Largest Regional Market

Geographically, North America is the largest IoT medical devices market, with share of 35% in 2023, and it is expected to remain dominant during the forecast period. This is because of:

- Developments in the healthcare industry

- Increasing government initiatives to encourage the adoption of IoT devices in the healthcare field

- Rising prevalence of chronic diseases in the region

- Surging R&D activities and developments in the connectivity technology

In addition, the increasing healthcare spending has raised the affordability of IoT-based healthcare technologies for the treatment and management of diseases, which further contributes in the growth of the IoT healthcare market in the region. Furthermore, the U.S. government spends a significant portion of its gross domestic product (GDP) on healthcare every year.

Asia-Pacific is projected to be the fastest-growing region in IoT devices market globally. The market here is primarily driven by the increasing investments by public and private organizations, surging geriatric population, and rising prevalence of chronic diseases in the region. Furthermore, the rising demand for advanced healthcare devices and surging awareness of a healthy lifestyle lead people to get health checkups regularly and monitor their health via smart, wearable medical devices daily.

Key Market Players Are:

- Siemens AG

- Abbott Laboratories

- Medtronic plc

- General Electric Company

- Koninklijke Philips N.V

- Honeywell International Inc.

- BIOTRONIK SE & Co KG

- Boston Scientific Corporation

- Johnson & Johnson Services Inc.

- AgaMatrix Inc.

Market Breakdown

This report offers deep insights into the IoT medical devices market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Product

- Vital Signs Monitoring Devices

- Imaging Systems

- Respiratory Devices

- Implantable Cardiac Devices

- Patients Monitors

- Infusion Pumps

- Fetal Monitoring Devices

- Neurological Devices

- Ventilators

Segment Analysis, By Type

- Stationary

- Implantable

- Wearable

Segment Analysis, By Connectivity Technology

- Bluetooth

- Wi-Fi

- Zigbee

Segment Analysis, By End User

- Hospitals & Clinics

- Nursing Homes & Homecare Settings

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws