Report Code: 11072 | Available Format: PDF

Integration Platform as a Service Market Report - Size, Share, Growth and Forecast to 2030

- Report Code: 11072

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

iPaaS Market Size & Share

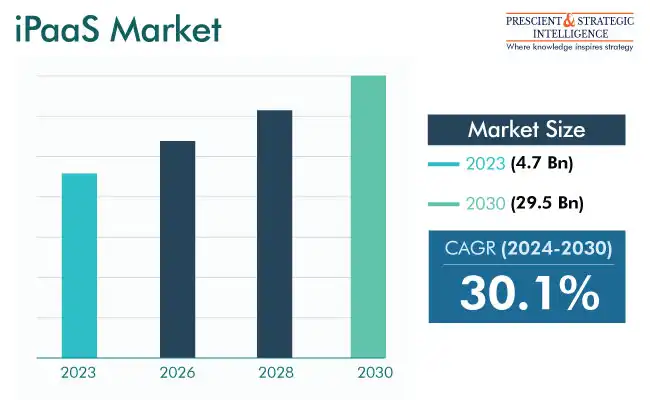

The global integration platform as a service (iPaaS) market is valued at USD 4.7 Billion (E) in 2023, and it is expected to grow at a rate of 30.1% during 2024–2030, reaching USD 29.5 Billion in 2030.

The industry is driven by the increasing requirement for business agility, growing awareness regarding iPaaS among business enterprises, quicker deployment & scalability of cloud-based solutions, rising acceptance of SaaS applications, and reduced cost of ownership.

The global catastrophe caused by the COVID-19 pandemic brought about substantial transformations in the way products and services are bought and sold. Many research entities, ranging from large corporations to SMEs, observed a rise in their advertising costs both during and after the COVID-19 lockdown period. The pandemic left its mark on every facet of society, impacting individuals and groups universally.

The worldwide technological panorama has played a crucial role in responding to these shifts. Therefore, the adoption of iPaaS solutions saw a surge across many sectors during the COVID-19 pandemic. This was driven by the desire of users to capitalize on the benefits of software/app development and cost reduction provided by these solutions. Despite the global economic slowdown, around half the subscription-based businesses grew without being negatively affected by the pandemic.

Public Cloud Is Preferred Mode of Deployment

Public cloud holds the largest share within the deployment segment. This is attributed to the lower costs associated with public cloud, as multiple users share one cloud platform, universally accessing the programs and applications available via it. Moreover, companies that face fewer compliance regulations and can afford to offload data storage to third-party servers either partially or completely prefer public clouds.

Further, as all the hardware and software are owned by the cloud service provider, companies also face lower IT expenses. Additionally, as these platforms are standardized, they are easier to implement across business operations.

Growing Trend of Hybrid and Multi-Cloud Infrastructures

The adoption of hybrid and multi-cloud strategies by various organizations is one of the biggest trends in the cloud computing space. This strategic shift is primarily motivated by an increasing reluctance among businesses to depend solely on a single cloud vendor for their diverse needs. According to IBM Corporation, 80% of the businesses were expected to use more than 10 cloud platforms by 2023.

The appeal of the hybrid cloud lies in its unique capacity to amalgamate and leverage the benefits of both public and private clouds. This integration translates into enhanced flexibility, allowing organizations to seamlessly navigate and operate across different cloud solutions. This adaptability is particularly advantageous in managing diverse types of data, where the private cloud serves as a secure repository for confidential information, while the public cloud facilitates the storage of non-sensitive, public data.

As the technological landscape advances, the demand for specialized offerings will continue to grow. This evolving complexity encourages commercial enterprise managers and decision-makers to choose multi-cloud and hybrid solutions. Such strategic selections enable corporations to run their systems with elevated effectiveness and performance, catering to the specific needs of their operations.

Application Programming Interfaces (API) Management Category Is Dominating Market

Based on service, the application program interface (API) management category is leading the industry. Computer and mobile apps are rapidly taking over traditional business models, generating massive amounts of data, in turn. With APIs, developers can create new platforms to use that data more effectively.

Adopting a cloud-based API management approach enables companies to easily take care of the entire API lifecycle, as well as providing users with a platform to design, create, deploy, govern, and manage those APIs. Further, being able to manage APIs is crucial for integrating enterprise systems and best utilizing the overall iPaaS model.

| Report Attribute | Details |

Market Size in 2023 |

USD 4.7 Billion (E) |

Revenue Forecast in 2030 |

USD 29.5 Billion |

Growth Rate |

30.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

BFSI Vertical To Be Large Contributor to iPaaS Industry

The banking, financial services, and insurance (BFSI) sector has been thriving, with technical improvements transforming the user experience for businesses and customers. The primary reason for the industry’s increasing adoption of iPaaS solutions is the growing popularity of online banking. Mechanizing the boring data entry, enabling seamless information sharing between SaaS and on-premises systems, and managing workflows for advanced efficiency are the major requirements of BFSI firms nowadays.

The profitable opportunities for iPaaS vendors in the BFSI industry are due to the complex procedure of integrating cloud services and on-premises systems in this sector. Banks are progressively investing in iPaaS for central process management, aiming to reduce operational expenses, in alignment with their business strategies. Key players in this domain include Dell Boomi, Oracle, IBM, and Informatica, who are taking several initiatives to tap the BFSI customer base.

IoT Revolution Drives IPaaS Market Growth

In the coming years, key technologies, including data mapping & transformation, routing & orchestration, integration flow improvement & equipment lifecycle management, API lifecycle management, business-to-business (B2B) & cloud integration, and internet of things (IoT), are expected to take centerstage. IPaaS serves as a unifying platform, facilitating the seamless integration of these technologies into companies’ operations.

Moreover, the evolution of IoT has improved the growth momentum of the market as this technology generates high volumes of data, which companies are using to make informed decisions. Be it healthcare, retail, manufacturing, automotive, power & energy, oil & gas, or any other industry, thousands of sensors share data, which needs a proper program for storage and analysis. With iPaaS, all the different big data analysis platforms can be integrated for enhanced visibility into enterprise operations.

Manufacturing Automation Fuels Demand for iPaaS Solutions

The growing level of automation in the manufacturing industry is projected to push the need for iPaaS solutions in the coming years. The automation is itself credited to the rising demand for food & beverages, metallic components, plastic & rubber items, and all sorts of imaginable products. Since merely having a superior product does not help companies anymore in the era of the shifting consumer preferences, having ample stock ready for instant shipment is key.

Automation not only helps augment productivity but also reduces the likelihood of human error and injuries at the workplace. Rather than working near and around heavy machines, workers are now merely required to monitor and control automated machines remotely. Automation also means that working hours can be extended, operational expenses can be reduced, energy can be conserved, quality can be maintained, and wastage can be limited.

Since different automated machines are controllable via different software, iPaaS enables companies to integrate different computer programs, to enable centralized control. Moreover, this way, the data generated during operations can also be combined for easer viewing, analysis, and interpretation.

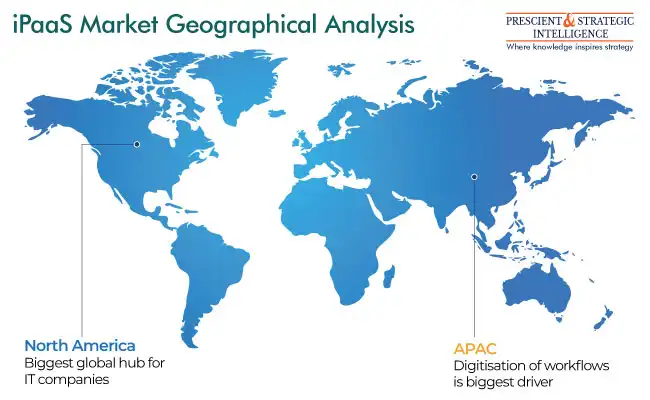

APAC To Grow at Highest CAGR during Forecast Period

The APAC region is set to grow at a significant rate during the forecast period. This development is mainly driven by the growing cloud and device portability trends in Australia, China, New Zealand, Japan, and India. The government steps to boost digital infrastructure are also propelling the acceptance of iPaaS in the region. The APAC market is also driven by the rising manufacturing output. Furthermore, digitization in the energy & utilities, manufacturing, retail, consumer goods, and all other industries propels the market.

The iPaaS industry is currently led by the North American region, primarily due to the presence of key players offering advanced solutions and the substantial investments in IPaaS technologies. Additionally, the rapid adoption of cloud-based services by numerous establishments in the continent contributes to this dominance. The increasing demand for advanced integration services and the migration of workloads to the cloud are further expected to drive the demand for IPaaS solutions.

Top Integration Platform as a Service Producers:

- Informatica

- Boomi Inc.

- SAP SE

- MuleSoft LLC

- Jitterbit Inc.

- Workato Inc.

- SnapLogic Inc.

- Software AG

- IBM Corporation

- Microsoft Corporation

- Tibco

- Celigo

- Zapier

- Amazon Web Services Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws