Report Code: 10966 | Available Format: Excel

Integrated Passive Devices Market Size and Share Report - Global Trends, Development and Demand Forecast to 2030

- Report Code: 10966

- Available Format: Excel

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

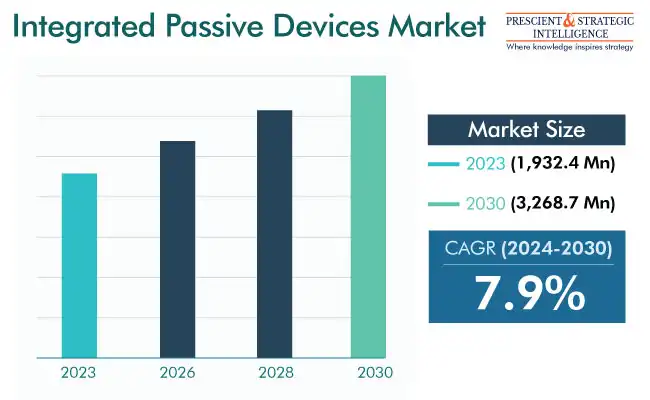

The global integrated passive devices market is valued at USD 1,932.4 million in 2023, and it will grow at a rate of 7.9% during 2024 and 2030, to reach USD 3,268.7 million in 2030.

The increasing requirement for small electronics is projected to drive the market development. Further, the advancement in materials and integration technologies has contributed to the reduction of components’ size, while making them more dependable. The creation of wireless IoT gadgets with low energy consumption has further advanced the growth potential for the market.

Businesses are placing a robust emphasis on convenient semiconductor manufacturing methods to make such devices easily obtainable and speed up their acceptance in several applications. Thus, the surging utilization of IPDs in IoT and implantable healthcare equipment is projected to fuel the market advance.

Additionally, the extensive adoption of LEDs in digital devices, such as hard drives, tablets, laptops, and routers, as well as in the healthcare and automotive sectors, is aided by their minimal electricity consumption. In the same way, the utilization of RF IPDs enables seamless and easy Wi-Fi communication.

Moreover, emerging technologies, such as wafer fabrication, are gaining traction because of their advanced overall performance in contrast to the traditional copper–silicon IPD technology. Therefore, the integration of wafer-based devices in electronics, pushed by their price-effectiveness, is set to propel the market growth in the foreseeable future. Additionally, IPDs made of superior materials, such as gold-on-GaAs, are penetrating high-end healthcare applications, especially implantable devices.

Growing Trend of Smart, Portable Electronic Devices

The augmenting utilization of smart, handheld consumer electronic items, such as smartphones and laptops, has propelled the need for integrated passive devices. The requirement for a reduction in the size of these devices is rising too, which is a key factor driving the industry, as IPDs enable miniaturization.

For example, smartphones have experienced a strong demand for such devices because several features require to be packed in a smaller package. This augmenting utilization of IPDs is because of their many advantages, such as reduced package footprint, advanced performance, higher dependability, and simpler interconnection capability.

Due to these benefits, IPDs are also being extensively utilized in vehicles, to aid manufacturers in cutting down on prices and making them lightweight. The high performance of IPDs despite a better energy efficiency has positively impacted the market growth. Furthermore, their utilization in IoT sensors, 5G terminals, AI devices, and LED items, popular for their lower power usage, has significantly augmented the sales revenue for market players.

As per the GSM Association, 5G subscriptions will surpass 1.4 billion by 2025, creating a lucrative opportunity for companies to produce low-energy 5G devices with the IPD technology. Moreover, the rising need for portable medical devices provides substantial development opportunities for major players. This is due to the increasing popularity of wearable medical devices, connected implants, and small instruments that can be used at home for health tracking.

Rising Demand for Faster Connectivity

While the developing world moves from 3G to 4G, the developed world is already transitioning to 5G and, further, pursuing the development of 6G networks. This is because of the increasing demand for faster connectivity and higher bandwidths. This need is not only dire among individuals but also governments, city administrations, military & defense organizations, transportation & logistics companies, commercial entities, and industries.

In the future, the interoperability of all kinds of household, wearable, industrial, and commercial devices will help steer the human race toward sustainability. For this, real-time data gathering, sharing, and analysis are mandatory, which can only be enabled by fast internet connections. IPDs are widely integrated into base stations, transmission towers, and even smartphones, laptops, tablets, and almost all kinds of connected devices to facilitate smooth connectivity.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,932.4 Million |

Revenue Forecast in 2030 |

USD 3,268.7 Million |

Growth Rate |

7.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

LED Lighting Category Is Projected To Grow at Fastest Pace

During the projection period, the LED lighting category is projected to be the fastest-growing, propelled by the better performance of LEDs with silicon-powered IPDs. This technology helps counter several problems seen in traditional lighting systems and provides advantages such as low energy usage, enhanced performance, effective heat dissipation, and high dependability.

EMS and EMI protection is projected to hold a significant share in the coming years. The utilization of such integrated passive components in smartphones is a substantial contributor to the development of this category. IPDs designed for protection from EMS and EMI prevent transmission loss and advance signal reception.

Automotive Sector Leads Integrated Passive Devices Market

In recent years, the automotive end use category led the overall market. The largest share of the category can be credited to the wide utilization of integrated passive devices in-vehicle electronics for wireless communication. The growth in the popularity of connected cars is the biggest driver for this category as these vehicles depend on robust internet connectivity with other vehicles, roadside infrastructure, and passengers’ consumer electronics.

Consumer electronics are projected to advance at a significant pace in the market. The extensive use of mobile phones and other IoT devices is a major propeller for the growth of the integrated passive devices industry in this category. Furthermore, the creation of smaller chips has made electronic devices more compressed, thus leading to the rising popularity of smartphones, LED TVs, tablets, and laptops.

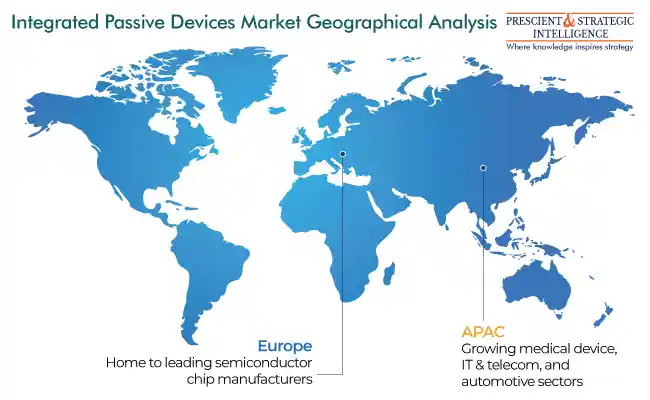

European Region Contributes Significant Revenue to Market

The European region is a key integrated passive devices market shareholder. The industry in the region is characterized by the existence of major players, such as IPDiA, Infineon Technologies, and STMicroelectronics, who are strongly focused on R&D. Additionally, the presence of highly productive electronics, healthcare, and automotive, industries encourages investments from market players.

Lucrative Opportunities in APAC Region

The highest CAGR in the market is predicted in the APAC region, led by China, India, Taiwan, Japan, and South Korea. All of them are major semiconductor and electronics manufacturers and also home to growing end-use industries, such as automotive, medical devices, and IT & telecommunications.

Further, many countries in the region have mandated some level of vehicle autonomy and certain connected features, which is propelling the demand for IPDs. In the same way, the burgeoning consumer electronics sales are encouraging market players to augment their IPD output. Moreover, the growing trend of at-home health monitoring is a pivotal propeller for the industry, all aided by people’s rising purchasing power.

Recent Developments

- In September 2022, Johanson Technology launched an IPD for Semtech's SX1262, SX1261, and LLCC68 LoRa transceivers. The objective is to advance radiofrequency, expand the range, and stabilize signals.

In May 2022, STMicroelectronics partnered with Microsoft to bring security features and higher boot and storage in IoT devices.

Major Integrated Passive Devices Companies

- STATS ChipPAC Ltd.

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Amkor Technology Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Advanced Furnace Systems Corp

- Johanson Technology Incorporated

- Murata Manufacturing Co. Ltd.

- Texas Instruments Incorporated

- 3DiS Technologies

- Broadcom Inc.

- NXP Semiconductors N.V.

- CTS Corporation

- Global Communication Semiconductors LLC

- MACOM Technology Solutions Holdings Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws