Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 797.6 Million |

| 2030 Forecast | 1,058.2 Million |

| Growth Rate(CAGR) | 4.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12723

Get a Comprehensive Overview of the Inspection Machines Market Report Prepared by P&S Intelligence, Segmented by Product (Vision Inspection Systems, Checkweighers, Leak Detection Systems, Metal Detection Systems, Software, X-Ray Inspection Systems, Combination Systems), Type (Manual, Semi-Automated, Fully Automated), Application (Bottles, Ampoules & Vials, Blister Packs, Syringes), End User (Medical Device Manufacturers, Pharmaceutical & Biotechnology Companies, Food Processing & Packaging Companies), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 797.6 Million |

| 2030 Forecast | 1,058.2 Million |

| Growth Rate(CAGR) | 4.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

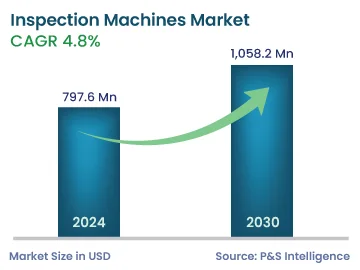

The global inspection machines market was valued at USD 797.6 million in 2024, which is set to reach USD 1,058.2 million by 2030, growing at a CAGR of 4.8% during 2024–2030. This is attributed to the rising number of product recalls, increasing pressure to manufacture high-quality products, technological enhancements in inspection systems, growing number of stringent regulatory policies, and surging adoption of electronic inspection platforms.

In recent years, there has been a tremendous surge in the count of product recalls in several industries, for example, food processing & packaging, pharmaceutical & biotechnology, and medical devices. There can be several reasons for a product recall, such as chemical, microbial, and other impurities. Moreover, issues with packaging, such as labeling and others, in the case of food and pharmaceutical industries lead to product recalls.

Such incidents not only tarnish the company as well as its brands’ image but also take a toll on sales. Additionally, there are high associated costs for eliminating, destroying, and substituting the recalled products. Moreover, the company’s stock price could take a drastic hit from a recall.

According to Food Safety News, the U.S. Food and Drug Administration has constantly recalled food items over the past three years. There were 418 recalls in the year 2020, 414 in the year 2021, and 423 in the year 2022. The recall count increased by a whopping 700% in 2022 in comparison to 2021. The deployment of inspection platforms is mandatory in order to identify contaminants and other defects before the items are shipped out and made available to consumers. Therefore, the increasing rate of recalls has led to the growth of the inspection machines market.

Furthermore, the surge in the consumption of contaminated drugs and food items has resulted in severe effects on consumers’ health. Such cases have led to increased customer dissatisfaction, thereby resulting in the implementation of stringent mandates by governments to ensure the quality of the products.

The rate of technological enhancements in inspection equipment is also surging, due to the large investments being made by the top industry players for the expansion of their product portfolios. The incorporation of investigation platforms, such as machine vision systems and leak detection systems, in the food, biopharmaceuticals, and other industries to minimize errors in the production and packaging of final products are among the technological enhancements observed in the inspection machines sector of late. Additionally, the availability of different types of combination systems aids in improving the development as well as packaging of products, thereby reducing or eliminating the probability of product withdrawals from the market.

In addition, with the improvement in sensors, the camera range has increased, and the resolution has become crisper and more enhanced. With the emergence of cutting-edge technologies, inspection machines providers can now cater better to the food, medical device, and pharmaceutical domains.

Implementation of Stringent Regulatory Mandates To Drive Market Growth

There has been a growing trend of the recall of over-the-counter as well as prescription drugs over the past few years. This is attributable to the increasing competition among the top industry players in the pharmaceutical and biotechnology industries to fast-track medications to marketing, to make new medicines accessible to patients in no time. This has resulted in the production of therapeutics with the presence of foreign particulate matter or contaminants, due to a lack of examination, thereby posing a significant threat to patients’ lives. Such cases have resulted in the implementation of mandatory guidelines by governments to ensure the production of only high-quality medications.

Additionally, many biopharmaceutical, pharmaceutical, as well as biotechnology companies have now increased the number of checkpoints for product investigation across the entire manufacturing line, to ensure the product is free from any defect. In addition, major life sciences companies are increasingly investing to modernize their packaging as well as manufacturing lines, to ensure a high quality of the products.

Due to this reason, life sciences firms are adopting , leak detectors, and metal detectors at several stages of the manufacturing and packaging processes. Such machinery can be installed to investigate defects in the packaging, such as blister packs, bottles, and ampoules & vials.

On the basis of product type, the vision inspection systems category held the largest market share, of 25%, in 2023. This is because this system provides an affordable way to ensure consistency and accuracy in manufacturing operations, which it does better in comparison to traditional human examinations. This eliminates the chances of human error, thereby reducing the risk of lawsuits. Additionally, such machines are faster and conduct high-quality investigation of products, thereby resulting in higher productivity and efficiency.

In addition, the adoption of such machines results in significant cost savings over conventional investigation methods. This is because automated systems eliminate the requirement for human laborers, which, in turn, results in salary expense reductions. Moreover, the products can be processed quickly with the assurance that they meet the quality requirements, before they are sold to consumers. The aforementioned factors ultimately help in reducing the expenditures associated with the rework on the products, thereby maximizing profits. Furthermore, they aid in improving the quality of the data, as well as increasing the customer satisfaction, by ensuring customer safety by upholding product quality.

The X-ray inspection category too held a significant share in the year 2022. This is because X-rays are non-intrusive and non-destructive, which makes them ideal for product examinations in most sectors, as these rays do not alter the quality of the items being examined. The elimination of physical contact enables a thorough examination of high-temperature materials easily. In addition, it enables the analysis of the internal parts of an item, reduces operational costs, and is easy, fast, and feasible to operate.

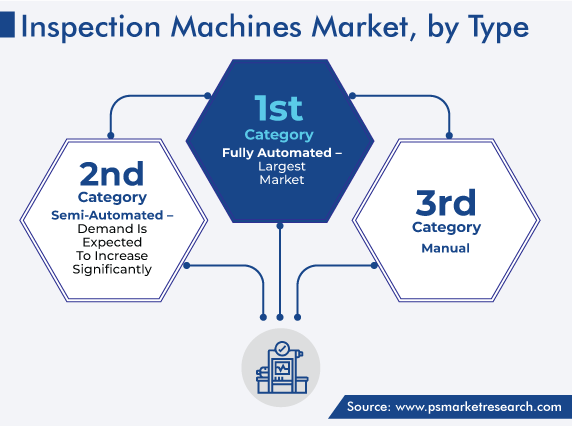

On the basis of type, the fully automated category held the largest market share, of 45%, in 2023. This is because these machines offer multiple benefits over conventional platforms, which include the elimination of human errors, increased speed and efficiency, improved production quality control, and cost-savings. In this regard, the technological advancements in industries and the growing requirement to decrease the chances of a defect in cosmetics and other products drastically boost the demand for such machines.

On the basis of application, ampoules & vials dominated the market, with a share of 30%, in 2023. This is because of the growing usage of biologics, such as vaccines and insulin, across the world. The increase in the prevalence of chronic ailments, such as hypertension and high blood sugar, in part due to the rise in the older population, has significantly augmented the manufacturing of parenteral packaging. Additionally, the demand for ampoules and vials drastically increased following the outbreak of the novel coronavirus due to the surging demand for vaccines. Thus, many biopharma manufacturers increased their production capacity by many times.

Ampoules and vials are majorly utilized to fill and store different types of unstable medications, chemicals, and biologics in the healthcare industry. They prevent the entry of contaminants, thereby ensuring the contents’ purity and patient safety. These instruments are used to store products for extended periods. Therefore, the increasing utilization of such packaging has led to their extensive examination to identify defects beforehand and avoid recalls, which, in turn, is driving the growth of the market.

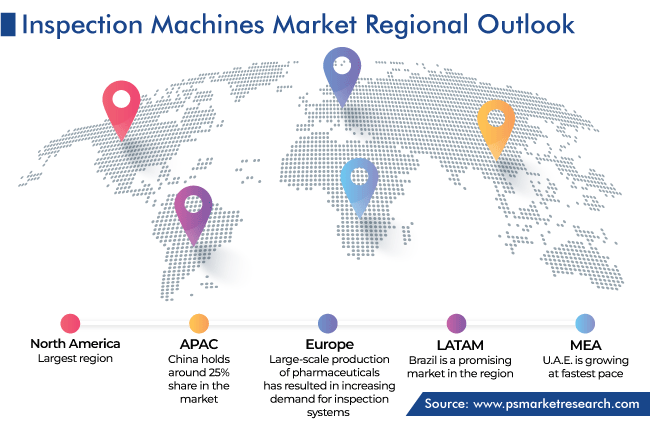

Drive strategic growth with comprehensive market analysis

North America held the largest market share, of 40%, in 2023, because of the implementation of stringent regulatory mandates by the FDA and other government authorities to maintain product quality. For instance, the Food and Drug Administration’s CFR mandates all pharmaceutical organizations to come up with written standard operating procedures for all processes, such as process control and production. Moreover, these standard operating procedures must involve methods to meet all the requirements related to drug purity, quality, identity, and strength and should be reviewed by professionals. Therefore, the stringency in the implementation of such regulatory mandates is resulting in the rapid inspection machines market advancement in the region.

In addition, other factors, such as the presence of a large number of international players in the pharmaceutical, biotechnological, as well as medical device industries in the region is a major contributing factor in the market growth. The rise in the demand for such solutions is also attributed to the growing need for food safety as well as quality assurance.

Furthermore, the advancements in quality control technologies in the region, as well as the growing number of product launches, rising incidence of chronic diseases, such as diabetes and high blood pressure; and growing geriatric population are driving the market growth.

Additionally, Europe held a significant share, attributed to the rising number of chronic ailments and infectious diseases. Additionally, countries in the region, such as France and Italy, were significantly affected by the coronavirus pandemic. European economies witnessed a negative impact due to the pandemic, and health services here became highly focused on serving patients affected by the virus. Pharmaceutical, medical device, and other related firms in Europe boosted their manufacturing processes in order to supply more products. Therefore, the large-scale production of pharmaceuticals has resulted in an increase in the demand for inspection systems to make sure that there are minimal errors as well as fewer product recalls. For instance, Engilico Group provides a seal inspection system that aids in verifying the packaging of coronavirus test supplies.

Furthermore, in May 2020, the European Federation of Pharmaceutical Industries and Associations (EFPIA) introduced different GMP/GDP inspection practices, considering the coronavirus pandemic situation.

This report offers deep insights into the inspection machines industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Type

Based on Application

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages