Report Code: 12822 | Available Format: PDF | Pages: 240

Influenza Diagnostics Market Size and Share Analysis by Product (Test Kit and Reagents, Instruments), Test Type (Traditional Diagnostic Test, Molecular Diagnostic Test), End User (Hospitals, POCT Centers, Laboratories) - Global Industry Demand Forecast to 2030

- Report Code: 12822

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Influenza Diagnostics Market Size & Share

The global influenza diagnostics market generated USD 946.9 million in 2023, which is expected to rise to USD 1,603.1 million by 2030, witnessing 7.9% CAGR between 2024 and 2030.

The need for influenza diagnosis solutions is projected to rise as a result of the increasing frequency of chronic diseases, many of which are worsened by the flu; growing elderly population, and expanding government activities to monitor the spread of this disease. The development of technologically sophisticated diagnostic tools for the infection is another key driver for the market.

Since influenza is known to be a cause of serious illnesses and mortality in humans, several diagnostic tools have been developed to lessen its negative effects on health and the economy. For instance, according to the Centers for Disease Control and Prevention, the flu was responsible for 18,000 deaths during the autumn and winter of 2022–2023. Additionally, the rising research funding for the early diagnostics and control of the same is likely to fuel the industry advance.

Moreover, there has been a significant expansion of the government programs to fight the flu, by creating precise diagnostic tools. For instance, the National Institutes of Health (NIH) granted Qorvo Biotechnologies a USD 4.1-million contract in February 2022 to expedite the development of the SARS-CoV-2/flu combo assay and associated antigen test.

Influenza tests, which were earlier majorly used by large hospitals and diagnostic centers, have now become a potentially transformative diagnostic tool even for small-scale clinics and research institutes. The rapid advancements in diagnostic technologies and their lowering costs are principally responsible for this shift.

The market is also expected to boom as a result of the developments in the point-of-care technology, which merges COVID-19 and influenza A/B screening tools. For instance, Roche declared its intention to release a combination COVID-19 quick antigen test and influenza A/B rapid antigen test for professional usage in December 2021. The firm collaborated on the same with SD Biosensor, a company headquartered in South Korea.

Furthermore, a wide range of tests and technologies helpful in the detection and management of the flu have been developed as a result of the Human Genome Project and developments in the molecular diagnostics and biomedical technologies. The development of novel influenza virus vaccines is aided by these new technologies, which are based on genomic methods (such as PCR) and proteomics methods (such as microarray detection). They provide a lucrative business potential by enabling improved surveillance and speedy detection of infectious diseases.

Extensive Research for Creating More-Effective Diagnostic Tools To Offer Lucrative Growth Opportunities

The increasing prevalence of influenza around the world has prompted the launch of R&D initiatives to improve detection and treatment. The majority of the research is directed at creating quicker and more-precise diagnostic tools for flu viruses. The Collaborative Influenza Vaccine Innovation Centers (CIVICs) program was started in 2019 by the U.S. NIH's National Institute of Allergy and Infectious Diseases (NIAID) to fund a wide range of influenza research initiatives. USD 51 million in funding for CIVICs was announced by NIAID in the first year of its launch itself.

Test Kits and Reagents Category Leads Product Segment

The test kits and reagents category dominate the market, with 60% share, in 2023. This is credited to the significant prevalence of infectious diseases and growing awareness regarding their early diagnosis.

The advantages of test kits, including their easy accessibility at pharmacies, retail stores, and online distribution channels without the need for a prescription, ease of usage, rapid results, and affordability, will propel the category’s growth.

With the use of over-the-counter test kits, concerns about spreading the flu are completely eliminated, as they enable one to get tested in isolation, without coming near other people, who might be carriers. Additionally, POC testing also eliminates the need for healthcare professionals, in turn, reducing expenses due to their ease of use.

Furthermore, the instruments category is expected to witness the highest CAGR, of 8.3%, during the forecast period. This is attributed to the rising healthcare expenditure globally, which results in an increase in the number of hospitals and diagnostic centers, thus driving the demand for the instruments used to detect the presence of the pathogen. Additionally, the ongoing research studies and emerging technologies are key contributors. Moreover, due to their specificity and sensitivity, they offer higher reliability than test kits, which is fueling their usage rapidly.

| Report Attribute | Details |

Market Size in 2023 |

USD 946.9 Million |

Market Size in 2024 |

USD 1,015.6 Million |

Revenue Forecast in 2030 |

USD 1,603.1 Million |

Growth Rate |

7.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Test Type; By End User; By Region |

Explore more about this report - Request free sample

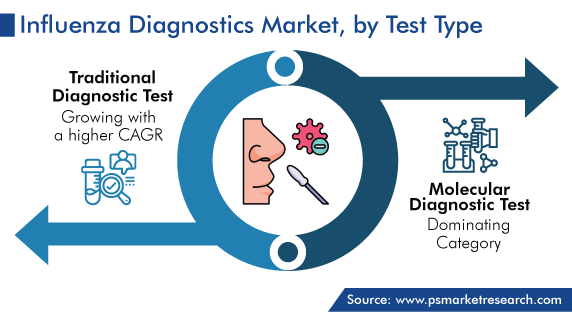

Traditional Diagnostic Tests Category Holds Significant Market Share in Test Type Segment

On the basis of test type, the traditional category holds the significant market share, of 40%, in 2023, and it is also expected to witness the higher CAGR during the projection period.

Further, within this category, rapid influenza diagnostic tests (RIDTs) contribute the highest revenue, credited to their ease of use and quick results. Furthermore, there has been a significant rise in the need for patient management and surveillance testing for this infection in clinical settings. There are many RIDTs that are allowed for use at homes and offices. Clinical Laboratory Improvement Amendments (CLIA) have also given them approval for usage in places such as point-of-care facilities.

For instance, ProtonDX announced in August 2022 that its quick and portable diagnostic tests will be utilized to track the spread of respiratory diseases, such as influenza, among athletes and coaches during the Commonwealth Games 2022. Thus, the extensive flu surveillance and monitoring conducted during public events are expected to encourage the creation of even better RIDTs.

Furthermore, viral cultures will display significant growth as well, because they offer higher sensitivity than RIDTs. Moreover, due to the possibility of false negative RIDT results, particularly during times of peak influenza epidemics, doctors often consider verifying the negative test results with viral cultures or other methods, particularly in patients who are hospitalized, or during probable institutional influenza epidemics. In addition, cultures help in identifying other causes of a viral disease.

Molecular diagnostic assays also hold a larger share, in 2023. This is because the utilization of RT-PCRs is increasing due to the lower sensitivity of RIDTs in identifying influenza B and their inability to provide full information, such as the type and subtype of the virus. Further, RT-PCR is regarded as a routine test by laboratories to determine whether a patient has the flu or not.

In this regard, the rise in flu cases in the last few years has significantly spiked the usage of RT-PCRs, due to their high specificity. Additionally, this test has a smaller margin of error since it is less likely to become contaminated. Moreover, it is able to gauge the infection's severity.

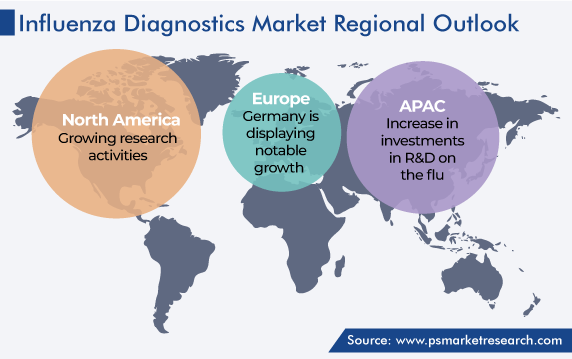

North America To Hold Largest Revenue Share

North America holds the greatest revenue share, of 65%, in 2023. This industry expansion in the region is credited to the extensive government surveillance activities, presence of top players, growing research activities, technological advancements, and rising need to better the patient care quality. Moreover, the established healthcare infrastructure, beneficial reimbursement policies, significant prevalence of the flu, and a growing need for quick disease diagnoses drive the market.

In addition, significant initiatives are being taken by several institutions to create awareness regarding the detection and treatment of the flu. For instance, the American College of Obstetrics and Gynecology (ACOG) initiated a new seasonal flu campaign, called ACOG Fights Flu, in September 2021 for this purpose.

Additionally, in order to protect people from catching this common yet often deadly infection, the Canadian government recommends that almost everyone aged 6 months or older get shots.

The European Union is expected to hold a significant share as well, attributed to its notable elderly population. According to research, more than one-fifth of the people in the European Union was 65 years of age or older in 2021. The likelihood of the flu is rising due to the growing senior population. As a result, one of the WHO's suggestions is to vaccinate senior citizens. Furthermore, in order to detect and monitor its spread, online surveillance platforms have been set up by the region’s government, including InfluenzaNet and EuroMOMO.

Germany is displaying notable growth in the market in the European region. In 2022, the nation witnessed a sudden spike in the flu incidence, which has resulted in many people taking leaves of absence from their jobs. Trains were also canceled as a result of worker absence due to the illness, according to national and regional train operators. Along with Deutsche Post, airlines suffered due to this reason. Furthermore, the hospitalization rate surged, thus putting an increased burden on the healthcare community.

Additionally, an increase in the medical budget, presence of established online surveillance platforms, and growing awareness regarding the same are the major contributors in the expansion of the country’s market.

Top Influenza Diagnostics Solution Providing Companies Are:

- 3M Company

- Abbott Laboratories Inc.

- Becton, Dickinson and Company

- Meridian Bioscience Inc.

- QuidelOrtho Corporation

- F. Hoffmann-La Roche Ltd.

- SA Scientific Ltd.

- Sekisui Diagnostics LLC

- Thermo Fisher Scientific Inc.

- Hologic Inc.

Market Size Breakdown by Segment

This report offers deep insights into the influenza diagnostics market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

- Test Kit and Reagents

- Instruments

Based on Test Type

- Traditional Diagnostic Test

- Rapid influenza diagnostic test (RIDT)

- Viral culture

- Direct fluorescent antibody (DFA) test

- Serological assay

- Molecular Diagnostic Test

- RT-PCR

- Nucleic acid sequence-based amplification (NASBA) test

- Loop-mediated isothermal amplification-based assay (LAMP)

- Simple amplification-based assay (SAMBA)

- Others

Based on End User

- Hospitals

- Point-of-Care Testing (POCT) Centers

- Laboratories

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The CAGR of the market for influenza diagnostics solutions is 7.9%.

The influenza diagnostics industry will generate USD 1,603.1 million in 2030.

The market for influenza diagnostics solutions is driven by the rising prevalence of the flu, increasing geriatric population, and expanding testing service availability.

Test kits and reagents hold the largest influenza diagnostics industry share, while instrument sales are growing the fastest.

Traditional tests, specifically RIDTs, are preferred in the market for influenza diagnostics solutions.

Companies in the influenza diagnostics industry are performing R&D and launching new products with approval from regulatory agencies.

North America is the largest market for influenza diagnostics solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws