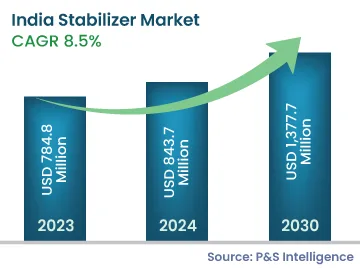

India Stabilizers Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

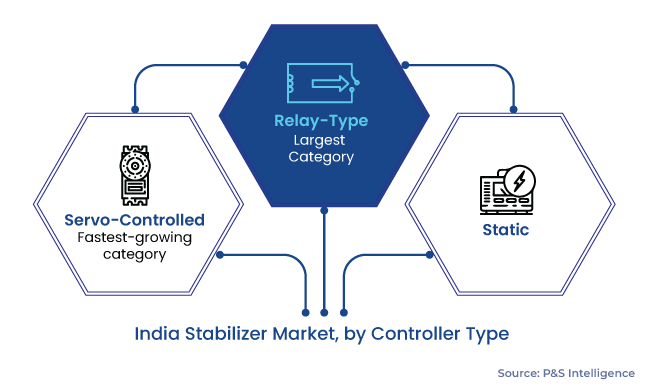

Get a Comprehensive Overview of the India Stabilizers Market Report Prepared by P&S Intelligence, Segmented by Controller Type (Relay-Type, Servo-Controlled, Static), Cabinet Type (Plastic-and-Metal Cabinet, Fully Metal Cabinet), Phase Type (Single-Phase, Three-Phase), End User (Packaging, Automotive, Construction, Electronics, Commercial, Residential), Application (Mainline, AC, TV, Washing Machine, Refrigerators), and Geographic Regions. This Report Provides Insights From 2017 to 2030.