Report Code: 12070 | Available Format: PDF | Pages: 178

India Solid and Diode Medical Lasers Market Research Report: By Product Type (Diode Laser Systems, Solid-State Laser Systems) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12070

- Available Format: PDF

- Pages: 178

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

India Solid and Diode Medical Lasers Market Overview

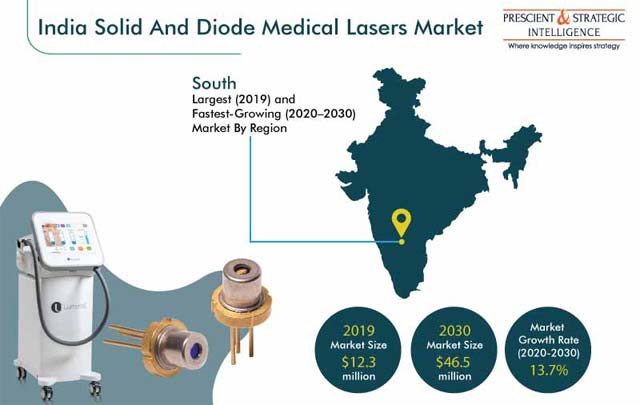

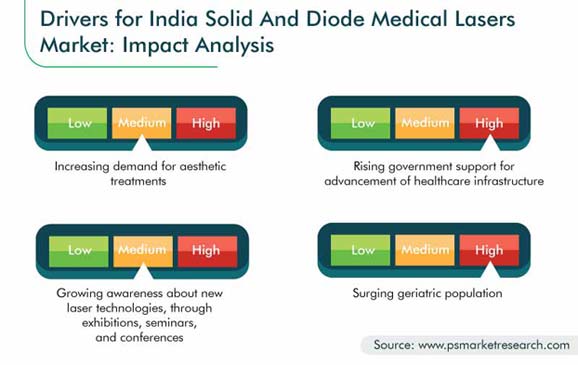

The Indian solid and diode medical lasers market generated revenue of $12.3 million in 2019, and it is expected to progress with a CAGR of 13.7% during the forecast period (2020–2030). The increasing adoption of aesthetic treatments, supportive government initiatives for the advancement of the healthcare infrastructure, growing aging population, and high number of seminars, exhibitions, and conferences being conducted to increase the awareness among consumers about the new laser devices available are the key factors driving the industry.

The continuing COVID-19 pandemic has imposed an adverse impact on the Indian solid and diode medical lasers industry. This is primarily attributed to the hindrance in the supply chain, financial crisis, as well as operational challenges within and outside national boundaries. However, these products are expected to witness a notable increase in demand in the last quarter of 2020, after the restarting of operations in manufacturing plants, lifting of the lockdown, and streamlining of import and export activities.

Diode Laser Systems Category Held Larger Share in Historical Period

The diode laser systems category accounted for the larger share in the Indian solid and diode medical lasers market during the historical period (2014–2019), based on product. This was owing to the wide applications of such systems in dermatology, dentistry, and several other procedures. Moreover, end users are adopting these laser systems to provide more effective and convenient treatment. Additionally, the availability of a range of diode laser systems from international and national players is supporting the growth of this category.

South India – Largest and Fastest-Growing Region

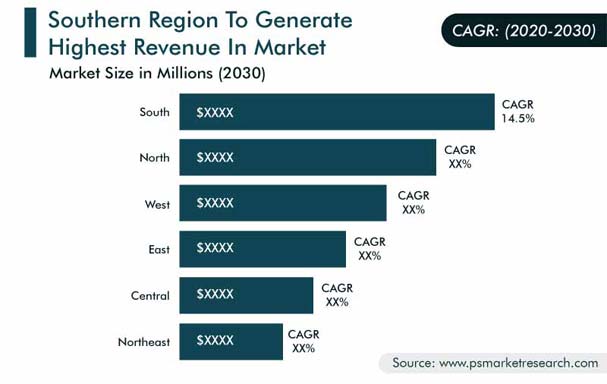

In terms of region, the southern region held the dominating share in the Indian solid and diode medical lasers market in 2019, due to the increasing number of hospitals here. Moreover, dermatology professionals’ preference for diode and solid laser systems, adoption of technologically advanced dermatological procedures, increasing aging population, and improving healthcare infrastructure are some other major factors that would boost the growth of the market in South India at the highest CAGR during the forecast period.

Growing Awareness about Appearance Is Major Industry Trend

The major trend being observed in the Indian solid and diode medical lasers market is the increasing consciousness about appearance and desire to have glowing skin. Dermal problems, including cellulite, fat storage, scars, fine lines, discoloration, acne, large pores, broken blood vessels, and age spots, have a major impact on the skin’s appearance. Due to this, people go for laser treatments to get glowing skin, or for a fresh appearance through hyperpigmentation treatment and hair removal.

Increasing Demand for Aesthetic Treatments

Laser procedures are quite useful in the removal of body and facial hair, acne scars, and tattoos and for skin treatment and surgeries. According to the International Society of Plastic Surgery (ISAPS)’s 2018 report, 895,896 aesthetic procedures were performed in India that year, among which 505,103 were non-surgical laser procedures. Therefore, the increase in the demand for aesthetic treatments is leading to the growth of the Indian solid and diode medical lasers market.

Supportive Government for Advancement of Healthcare Infrastructure

According to the India Brand Equity Foundation, there were 15,000 hospitals in the country in 2015, which increased to around 20,000 in 2017. Moreover, in 2017, the country’s healthcare expenditure was 1.3% of the gross domestic product (GDP), which is targeted to increase to 2.5% by 2025. Further, the government has set a target to increase the healthcare budget from $245.2 million in 2019 to $298.2 million in 2020–21. Hence, the rise in the healthcare expenditure, along with the supportive measurements of the government, is expected to fuel the growth of the Indian solid and diode medical lasers market.

Increasing Number of Seminars, Exhibitions, and Conferences to Raise Awareness

Seminars, exhibitions, and conferences are being organized to create awareness among medical professionals regarding new laser technologies. For instance, the Indian Dental Association (IDA) conducted the 72nd Indian Dental Conference (IDC), regarding the latest dental science technologies, on January 18–20, 2019, in Indore, Madhya Pradesh. Thus, the growing awareness about the advancements in solid and diode medical laser systems would drive the Indian solid and diode medical lasers market.

Surging Aging Population

Aging leads to the loss of muscle tone and thinning skin, which give the face a flabby or droopy appearance. Due to this, the aging population develops wrinkles, dryness, pigmentary alteration, and sagging. India holds a vast population of elderly people. According to the 2019 World Population Ageing report, 87.1 million individuals were aged 65 years or above in the country in 2019, and this number would reach 128.9 million by 2030. Therefore, the rising geriatric population drives the growth of the Indian solid and diode medical lasers market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$12.3 Million |

Forecast Period CAGR |

13.7% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional Breakdown, Impact of COVID-19, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Product, Application, Region |

Market Size of Geographies |

South, North, West, East, Central, Northeast |

Secondary Sources and References (Partial List) |

World Health Organization (WHO), United Nations Department of Economic and Social Affairs (UNDESA), Accreditation Council of International Society for Quality in Health Care (ISQua), Association of Plastic Surgeons of India, Food and Drug Administration (FDA), Ministry of Statistics and Programme Implementation (India), Indian Academy of Aesthetic & Cosmetic Dentistry, Indian Association of Aesthetic Plastic Surgeons, Indian Association of Dermatologists, Venereologists and Leprologists (IADVL) |

Explore more about this report - Request free sample

Industry Players Are Introducing New Products to Gain Competitive Edge

The Indian solid and diode medical lasers market is fragmented in nature, with the presence of key players such as Candela Corporation, Hologic Inc., PhotoMedex Inc., EUFOTON S.R.L., BISON Medical, and IPG Photonics Corporation.

In recent years, players in the solid and diode medical lasers industry of India have involved in product launches to stay ahead of their competitors. For instance:

- In February 2020, Sisram Medical Ltd. launched ClearSkin PRO, which consists of a non-ablative 1,540 nm Er:Glass laser. It enables the synthesis of the new dermis and helps regenerate the extracellular matrix, while maintaining a high level of safety.

- In March 2019, HALO, a distinguished partner program, was launched by Sciton Inc. The HALO treatment delivers both ablative and non-ablative wavelengths to the same microscopic treatment zone, thus addressing epidermal and deeper-dermal pigmentation, as well as skin tone and texture.

- In February 2019, Cutera Inc. launched the excel V+ laser platform, which optimizes the delivery system and parameters better, as compared to the existing excel V, for higher precision in treating vascular lesions and pigmentation.

Some of the Key Players in the Indian Solid and Diode Medical Lasers Market Include:

-

BIOLASE Inc.

-

Sisram Medical Ltd.

-

Lumenis Ltd.

-

Cutera Inc.

-

Fotona D.o.o.

-

Candela Corporation

-

Hologic Inc.

-

PhotoMedex Inc.

-

EUFOTON S.R.L.

-

BISON Medical

-

IPG Photonics Corporation

-

Coherent Inc.

-

JENOPTIK AG

-

Jeisys Medical Inc.

-

Sciton Inc.

-

EL.EN. S.p.A

Indian Solid and Diode Medical Lasers Market Size Breakdown by Segment

The Indian solid and diode medical lasers market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Product Type

- Diode Laser Systems

- By application

- Dermatology

- Skin resurfacing

- Pigment treatment

- Hair removal

- Dentistry

- Dermatology

- By application

- Solid-State Laser Systems

- By type

- Neodymium: yttrium– aluminum–garnet laser (Nd:YAG)

- Erbium: yttrium–aluminum– garnet laser (Er:YAG)

- Holmium: yttrium–aluminum– garnet laser (Ho:YAG)

- Potassium titanyl phosphate

- Ruby

- Alexandrite

- By application

- Dermatology

- Skin resurfacing

- Pigment treatment

- Hair removal

- Dentistry

- Dermatology

- By type

Geographical Analysis

- West India

- By product type

- By application

- South India

- By product type

- By application

- North India

- By product type

- By application

- Central India

- By product type

- By application

- East India

- By product type

- By application

- Northeast India

- By product type

- By application

The Indian solid and diode medical lasers market is likely to grow at a CAGR of 13.7% during 2020–2030.

The Indian solid and diode medical lasers industry has been segmented based on type and region.

Solid and diode medical lasers are used for the removal of facial and body hair, tattoos, and acne scars, and skin surgeries and treatment.

The southern region will dominate the Indian solid and diode medical lasers market in the future.

The Indian solid and diode medical lasers industry is fragmented in nature.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws