Report Code: 12266 | Available Format: PDF | Pages: 99

India Residential Diesel Genset Market Research Report: By Type (Stationary, Portable) - Industry Analysis, Trends and Growth Forecast to 2030

- Report Code: 12266

- Available Format: PDF

- Pages: 99

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

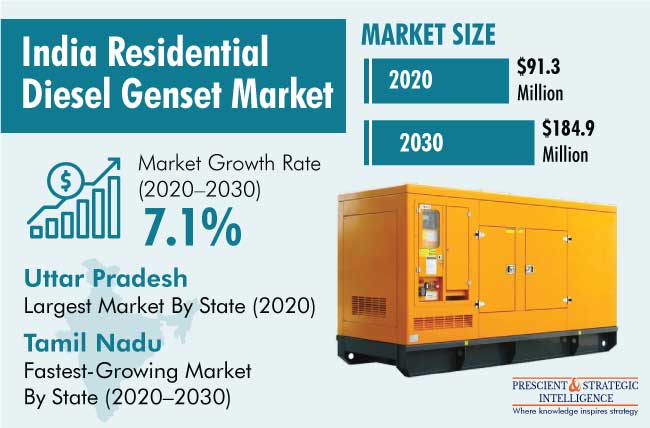

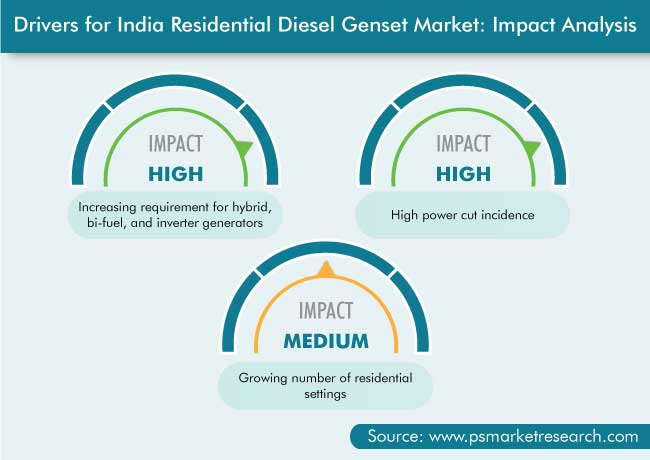

The Indian residential diesel genset market generated $91.3 million revenue in 2020, and it is expected to grow at a CAGR of 7.1% during 2020–2030. The key factors responsible for the growth of the market include the surging number of residential settings, increasing requirement for hybrid, bi-fuel, and inverter generators, and high power cut incidence.

The market for residential DG set in India was negatively impacted due to the certain government regulations implemented in 2019 and 2020. During COVID-19, the Indian government issued guidelines regarding the usage of air conditioners (ACs), evaporative coolers, and fans, to control the spread of the coronavirus. Moreover, in 2020, diesel gensets were banned in order to curb air pollution. Another major factor that negatively impacted the market growth was the rise in the fuel prices owing to the high taxes, which reduced the gross domestic product of India by 7.3% in 2020.

Stationary Diesel Gensets Held Larger Share

The stationary diesel gensets category held the larger share in 2020, both in terms of volume and value, based on type. Moreover, it is expected to retain its position during the foreseeable future due to the rising adoption of stationary diesel gensets in the residential sector as they provide a continuous supply of electricity and ensure uninterrupted operations.

Moreover, the 5-kilovolt-ampere (kVA)–10kVA category held the lion’s share in the market for residential diesel generator set in 2020, and it is expected to retain its position during the foreseeable future. In India, a large number of households have a grid capacity ranging between 0 and 5 kilowatts (kW). Around 92% of the household have a grid supply of up to 2 kW, whereas that of 4% ranges between 2 and 5 kW. Therefore, generators operating in this power range held a significant position in the market.

Further, the standby bifurcation held the larger share in the market, both in volume and value terms, in 2020, and it is expected to retain its position during the forecast period (2021–2030). India has achieved a 100% electrification rate for all its households, owing to which only during the time of a power failure is a generator required. As a result, the demand for standby generators held a considerable market position.

Tamil Nadu To Witness Fastest Growth

Geographically, Tamil Nadu is expected to witness the fastest growth in the residential diesel genset market during the forecast period. This can be mainly ascribed to the increasing demand for residential buildings in Tamil Nadu, which has led to a rise in the demand for diesel generators. For instance, according to a press release in The Indian Express in July 2021, Chennai recorded a 93% year-on-year increase in housing demand in the first half of 2021, as sales jumped from 2,981 units in the first half of 2020 to 5,751 units sold in the first half of this year.

Shifting Focus from Low-Power-Rating to High-Power-Rating Gensets Is Key Market Trend

People are now choosing high-power-rating gensets over low-power-rating gensets as the need for electricity has increased, which has become a major trend of the market. The rising population has been one of the major reasons for the growing demand for these gensets, due to which the major players are launching more-powerful gensets. For instance, in August 2021, Cummins India Ltd. unveiled its ‘Made in India’ QSK60 G23: 2,500–2,750kVA diesel genset, which is designed to meet the increasing power requirements by data centers and large settings, such as airports and real estate spaces. It is capable of withstanding the extreme Indian climatic conditions, to deliver reliable performance.

Growing Number of Residential Buildings and High Power Cut Incidence Are Key Drivers

The number of investments by industrialists and initiatives by the government is rising in India’s residential sector, which is driving the demand for residential diesel gensets. The growth of this sector is complemented by that in the corporate sector, as it is driving the need for urban and semi-urban accommodation. According to the India Brand Equity Foundation (IBEF), by 2040, India’s real estate market will grow to $9.30 billion from $1.72 billion in 2019. Additionally, 86,139 housing units were sold across the top eight Indian cities, namely Bengaluru, Ahmedabad, Pune, Chennai, Delhi, Noida, and Dehradun, in second half of 2020.

Moreover, as per a press release published in Reuters in October 2021, over half of India's 135 coal-fired power plants, which, in total, supply around 70% of India's electricity, had fuel stocks for less than three days. Further, according to an article published in The Times of India (ToI) on May 19, 2021, more than 13 lakh electricity consumers in the Mumbai Metropolitan Region (MMR) were facing power outages as a result of destruction caused by Cyclone Tautke. Such factors result in the rising demand for diesel gensets and lead to significant growth of the market.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$91.3 Million |

Market Size Forecast in 2030 |

$184.9 Million |

Forecast Period CAGR |

7.1% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Company Profiling |

Market Size by Segments |

By Type; By Power Rating; By Application; By State |

Explore more about this report - Request free sample

Market Players Involved in Expansions and Product Launches to Gain Significant Position

The Indian market for residential DG set is fragmented in nature due to the presence of several key players. Major players in the market are adopting different strategic developments, including expansions and product launches. For instance:

- In May 2021, Cooper Corporation Pvt. Ltd. announced the launch of a 5KVA compact diesel genset, Bolt Mini, which offers low fuel consumption and maintenances costs.

- In March 2021, Mahindra Powerol Ltd. inaugurated a plant to manufacture the Perkins range of diesel generators for the northern region, through its GOEM Perfect Generators Technology Pvt. Ltd., Ghaziabad. This strategic launch gives Mahindra Powerol an edge in offering its products in the northern part of the country and widening its reach.

Key Players in India Residential Diesel Genset Market Include:

- Kirloskar Oil Engines Limited

- Ashok Leyland Limited

- Greaves Cotton Limited

- Mahindra Powerol Ltd.

- Cummins India Ltd.

- Caterpillar Inc.

- Cooper Corporation Pvt. Ltd.

- Kohler Power India Ltd.

- FG Wilson

- Tractors and Farm Equipment Limited

Market Size Breakdown by Segments

The Indian residential diesel genset market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Type

- Stationary

- 5 kVA–10 kVA

- Prime & continuous

- Standby

- 11 kVA–20 kVA

- Prime & continuous

- Standby

- 5 kVA–10 kVA

- Portable

- 5 kVA–10 kVA

- Prime & continuous

- Standby

- 11 kVA–20 kVA

- Prime & continuous

- Standby

- 5 kVA–10 kVA

Geographical Analysis

- Tamil Nadu

- Andhra Pradesh

- Karnataka

- Maharashtra

- Uttar Pradesh

- Madhya Pradesh

- Rajasthan

- West Bengal

- Gujarat

- Rest of India

The residential DG set market of India valued $91.3 million in 2020.

Stationary variants witness the higher sales in the Indian residential diesel genset industry.

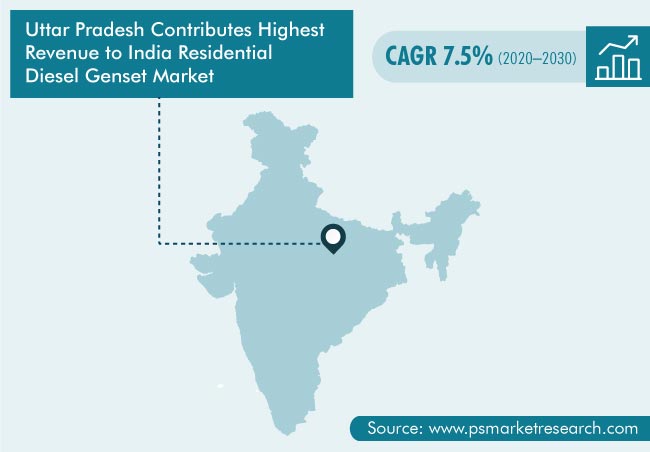

The residential diesel genset market of India is led by Uttar Pradesh.

The Indian residential DG set industry is driven by the growing residential real estate sector and frequent power cuts in the country.

Major players in the residential DG set market of India are expanding their geographical reach and launching new products.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws