India Industrial Aerosol Market Future Outlook

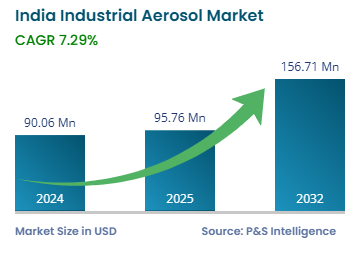

The Indian industrial aerosol market was valued at USD 90.06 million in 2024, and it is expected to witness a CAGR of 7.29% during the forecast period (2025–2032), reaching USD 156.71 million by 2032. The key factors responsible for the growth of the market are the rising demand for aerosols in automobile factories and the aftermarket, expanding Indian manufacturing industry, and increasing number of government initiatives for research and development (R&D) in the Indian manufacturing industry.

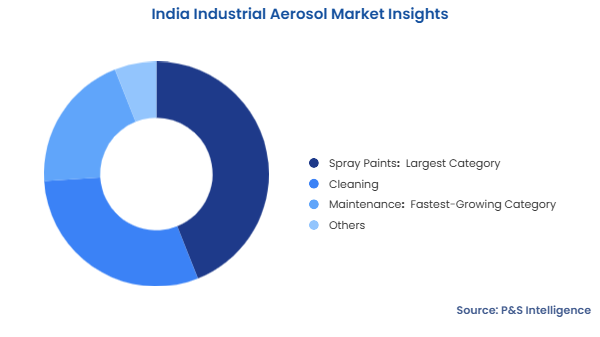

In India, industrial aerosol products are majorly employed as cleaning products, including engine cleaners, tire cleaners, dashboard & console cleaners, and carpet & upholstery cleaners, and maintenance products, including de-icers, anti-fog sprays, puncture repair sprays, tire inflators, aerosol adhesives, and lubricating oils & greases. In addition, these aerosol products find application in the automotive industry, majorly in vehicle maintenance (lubricating vehicle parts and cleaning engine parts) and re-painting and polishing. These products, therefore, find wide adoption among various manufacturing facilities for automobiles, electrical & electronic goods, fast-moving consumer goods (FMCG), and several other products.

According to the IBEF, the Indian manufacturing industry is growing at a significant pace owing to the rising demand for electronic appliances and consumer devices, as well as electrical equipment and machinery. Moreover, according to the Ministry of Commerce and Industry, significant growth has been observed over the past few years in the Indian cosmetics and beauty products industry due to the rising per capita income of people, which is resulting in a higher personal spending. This, in turn, is having a huge impact on the Indian industrial aerosol market.