India Electric Bus Market Analysis

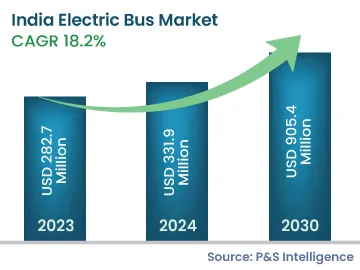

The Indian electric bus market generated revenue of USD 282.7 million in 2023, which is expected to witness a CAGR of 18.2% during 2024–2030, to reach USD 905.4 million by 2030.

India is witnessing rapid urbanization, which is leading to an increasing demand for public transportation. Further, due to the rising environmental concerns and the need to curb emissions from automobiles, electrically powered buses are becoming a favorable option.

The Government of India is also taking numerous initiatives to encourage the usage of electricity-powered buses in the country. The National Electric Mobility Mission Plan (NEMMP) 2020 was launched by the government in 2013 to boost the manufacturing of hybrid and EVs in India and increase their adoption, by offering attractive incentives. Further, the government invested USD 12.5 billion (INR 80,000 crore) under the Green Urban Transport Scheme 2017 to enable the shift toward EVs for public transportation.

Moreover, the Bharat Stage (BS) VI emission norms were introduced in 2020. With this, India’s automobile industry needs to adopt concrete emission control measures, which would further act as a catalyst for the demand for such vehicles.

Further, domestic manufacturing growth is a key driving factor for the market. The government's need for more-energy-efficient automobiles and the stringency of the emission standards have caused original equipment manufacturers (OEMs) to turn their attention to alternative-fuel vehicles.