Report Code: 11638 | Available Format: PDF

- Home

- Power & Energy

- India DG Set Market

India Diesel Genset Market Share Analysis by Power Rating (5 kVA–75 kVA, 76 kVA–375 kVA, 376 kVA–750 kVA, Above 750 kVA), Application (Commercial, Industrial, Residential) - Industry Growth and Demand Forecast to 2030

- Report Code: 11638

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

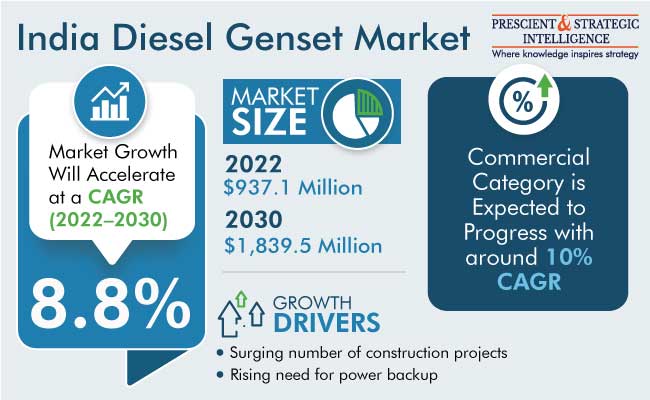

The Indian diesel genset market size estimated at $937.1 million in 2022, and it is expected to advance at a compound annual growth rate of 8.8% during 2022–2030, to reach $1,839.5 million by 2030.

The development of the industry is attributed to the need for a reliable and continuous power supply and the upgradations in technology. However, the Indian diesel genset market might confront obstacles during the forecast period because of the push for sustainable power, especially through ventures that aim to curb the usage of fossil fuels.

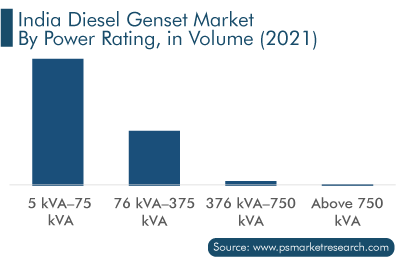

5kVA–75kVA Power Rating Held Largest Share

In the power rating segment, the 5 kVA–75 kVA category held the largest volume share in 2021 which is attributed to the low maintenance cost and easy availability of the spare parts of these variants across the country. Moreover, the economic growth in the country and the surge in the count of construction projects are expected to result in a high demand for these gensets for meeting prime and auxiliary power requirements.

Commercial Application Is Expected To Show Fastest Growth

Based on application, the commercial category is expected to register the fastest growth in the forecast period, at a CAGR of around 10%. These systems provide an uninterrupted power supply, to keep operations going and minimize any revenue loss. The rising need for power backup at shopping malls and other public spaces and the rapid expansion of data centers drive the market. Furthermore, generators are critical in the healthcare sector, to avoid an irregular power supply, which could cause the death of people on life support.

Based on application, the residential category accounts for the largest revenue share in the Indian diesel genset market. This is mainly ascribed to the rising demand for backup and prime power in residential facilities. Essentially, the growth of this category is complemented by the rapid construction of residential buildings.

Other factors, such as the recovery in the Indian residential and commercial real estate sectors, commissioning of new construction projects, and resurgence in investments in the manufacturing sector, are expected to support the growth of the Indian diesel genset market during the forecast period.

Karnataka To Witness Fastest Growth

In India, Karnataka is expected to witness the fastest growth, over 10%, ascribed to the increasing investments in the telecom sector, rampant development of commercial infrastructure, and rising demand for prime and backup power in residential units. In September 2022, the Karnataka Congress launched the Better Bengaluru Action Plan Committee, seeking public opinion to improve the infrastructure. With the improvement in the infrastructure in the state, the need for power backup and diesel gensets will increase in the coming years.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$937.1 Million |

Revenue Forecast in 2030 |

$1,839.5 Million |

Growth Rate |

8.8% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Power Rating; By Application; By State |

Explore more about this report - Request free sample

Telecom Towers Dominate Market under Commercial Applications

In terms of volume, telecom towers are expected to dominate the market during the forecast period, under commercial applications, because of the recent investments in the telecom sector to enhance urban and rural connectivity, to meet the requirements of an increasing subscriber base. This is driving the installation of telecom towers across India, which, in turn, is resulting in the increasing demand for diesel gensets. The telecom industry in India is the second-largest in the world with a subscriber base of 1.17 billion, as of August 2022, says Invest India. Moreover, the country has an overall tele-density of 83.25%. Additionally, the tele-density of the rural parts of the country, which stands at 58.15%, is largely untapped; while the tele-density of urban India is 129.88%.

Manufacturing Category Accounted for Highest Demand among All Industrial Applications

The manufacturing category is expected to be the largest in the coming years due to the rising demand of small and large-scale manufacturing companies for small and medium-sized gensets. In the near future, fiscal initiatives and policies, coupled with foreign direct investments and the improvements in the transportation and logistics network, are expected to drive the growth of the Indian manufacturing sector and, in the process, offer impetus to the demand for diesel gensets in the country.

Rising Demand for Power for Commercial Applications and Construction Projects

The Indian construction industry is driven by the large private and public investments in urban housing infrastructure, telecom towers, and logistics centers. Diesel generators are an indispensable part of this industry as they offer a secure and constant power supply at construction sites, which remain abuzz round the clock. Moreover, gensets ensure power supply for construction projects in remote locations with inadequate grid connectivity, to power machinery and equipment. This encourages the installation of diesel gensets for meeting the prime and backup power needs at commercial sites.

India, in recent years, has witnessed high economic growth, in addition to the initiation of several construction projects, including highways, roads, buildings, ports, and refineries, by both public and private players. Furthermore, government support has amplified, in terms of budgetary allocations and regulatory reforms, for infrastructure projects, which is opening new sectors to private involvement and investments.

One of the key civil construction projects underway is the double-line Mumbai–Ahmedabad high-speed railway, which includes viaducts & bridges, maintenance depots, tunnels, earth structures, and stations; the entire project needs to be completed by 2028. For such construction projects, the need for diesel gensets is often experienced at locations where power availability is a concern. Besides, construction and expansion plans by public transportation agencies, such as railway and metro rail authorities, are on the anvil, which is expected to translate into a huge demand for high-power diesel generators for auxiliary and prime power requirements at stations and tunnels and for signaling and telecommunications systems.

Key Players in India Diesel Genset Market Are:

- Kirloskar Oil Engines Limited

- Ashok Leyland

- Greaves Cotton Limited

- VE Commercial Vehicles Limited

- Mahindra Powerol

- Cummins Inc.

- Caterpillar Inc.

- Kohler Co.

- Tractors and Farm Equipment Limited

India DG Set Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the market, to offer accurate market estimations for 2017-2030.

Based on Power Rating

- 5 kVA–75 kVA

- 76 kVA–375 kVA

- 376 kVA–750 kVA

- Above 750 kVA

Based on Application

- Commercial

- By user

- Retail establishments

- Offices

- Telecom towers

- Hospitals

- Hotels

- By power rating

- 5 kVA–75 kVA

- 76 kVA–375 kVA

- 376 kVA–750 kVA

- Above 750 kVA

- By user

- Industrial

- By user

- Manufacturing

- Energy & power

- By power rating

- 5 kVA–75 kVA

- 76 kVA–375 kVA

- 376 kVA–750 kVA

- Above 750 kVA

- By user

- Residential

Based on State

- Tamil Nadu

- Andhra Pradesh

- Karnataka

- Maharashtra

- Uttar Pradesh

- Madhya Pradesh

- Rajasthan

- West Bengal

- Gujarat

- Rest

In 2030, the diesel genset market of India will value $1,839.5 million.

In terms of volume, the Indian diesel genset industry is dominated by 5kVA–75kVA variants.

Uttar Pradesh is the largest diesel genset market in India, while Karnataka will grow the fastest.

The Indian diesel genset industry is driven by the government’s numerous initiatives for infrastructure development across the residential, industrial, and commercial sectors.

In terms of volume, telecom towers lead the commercial application category of the diesel genset market of India; while, within the industrial sector, manufacturing plants generate the highest revenue.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws