Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 60.0 Million |

| 2025 Market Size | USD 68.0 Million |

| 2030 Forecast | USD 127.6 Million |

| Growth Rate(CAGR) | 13.4% |

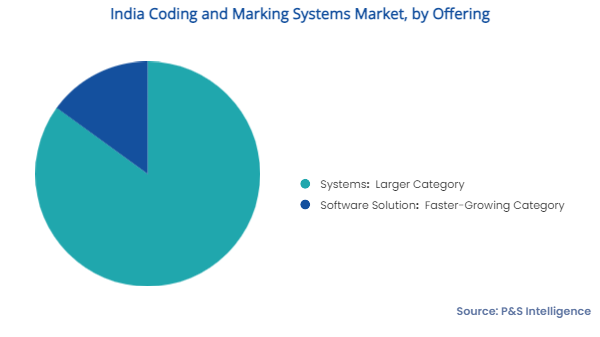

| Largest Offering Category | Systems |

| Largest End User Category | FMCG |

| Nature of the Market | Consolidated |