Report Code: 10654 | Available Format: PDF | Pages: 225

Hot Melt Adhesives Market Research Report: By Resin Type (Ethylene Vinyl Acetate, Styrenic Block Copolymer, Polyurethane, Polyamide, Amorphous Polyalphaolefin, Metallocene Polyolefin, Polyester), Application (Packaging, Diaper, Furniture, Footwear, Textile, Automotive, Electronics, Bookbinding) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 10654

- Available Format: PDF

- Pages: 225

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Hot Melt Adhesives Market Overview

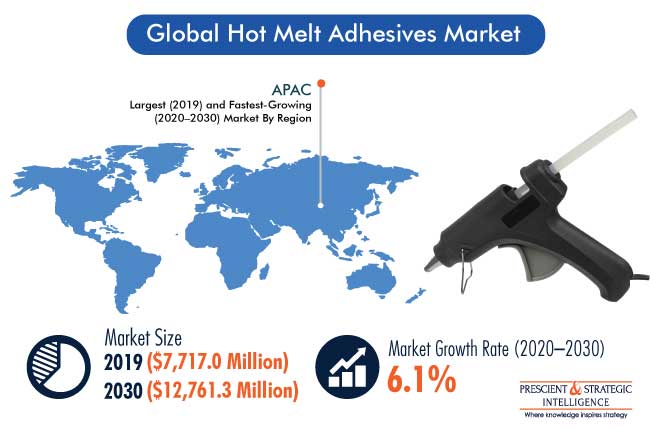

The hot melt adhesives market stood at $7,717.0 million in 2019 and is expected to showcase a CAGR of 6.1% during the forecast period (2020–2030). The market is primarily being driven by the increasing consumer spending and the growing adoption of these adhesives in several industries, including packaging and automotive. On account of their various benefits, such as fast curing ability and eco-friendly nature, hot melt adhesives witness high consumption among the end users across the world.

However, in the wake of COVID-19, several countries implemented a strict lockdown during the first two quarters of 2020. Moreover, several European nations are witnessing the second wave of the pandemic, as a result of which countries are again planning to impose restrictions through lockdown to curtail the spread of the disease. Owing to such factors, industrial operations are being affected globally, due to which the demand for hot melt adhesives is also witnessing a drop.

Ethylene Vinyl Acetate (EVA) Dominated the Market under Resin Type

The EVA category accounted for the largest share in the hot melt adhesives industry in 2019, based on resin type. This is majorly driven by the extensive application of EVA hot melt adhesives in the automotive, furniture, electronics, and packaging industries. Since these industries require adhesives that are easy to apply, have a quick setting time, and can work in a wide temperature range, EVA-based hot melt adhesives continue to witness a high-volume demand from these industries.

Packaging Will Remain the Largest Application Area of Hot Melts

The packaging industry is expected to account for the largest market size in 2030, on the basis of application. This can be attributed to the increasing demand for packaged food and beverage products, driven by the rise in disposable income. Furthermore, growth in the pharmaceutical industry, propelled by the rising healthcare expenditure across the world, is resulting in the increased demand for packaging solutions in this industry, which, in turn, is boosting the demand for hot melts. Owing to these factors, the packaging industry is projected to continue remaining the largest application area of these adhesives in the near future.

Asia-Pacific (APAC) Region Accounted for the Largest Market Share

The APAC region held the largest share in the hot melt adhesives market in 2019. The region is a manufacturing hub, with major production carried out across China, Japan, South Korea, and India. Furthermore, the shifting of several industries from western countries to the APAC region due to low raw material and labor cost is one of the key factors for the large-volume consumption of hot melt adhesives in the region.

APAC to Witness the Highest Consumption Surge

Besides holding the largest market share, APAC is expected to witness the highest consumption surge during the forecast period, on account of the growing population and increasing per capita income in the region. Owing to these factors, the demand for automobiles, packaged goods, and electronics is expected to increase, as a result of which the demand for hot melt adhesives would increase.

Shift from Conventional to Advanced Automotive Assembly Techniques

The major trend being observed in the global hot melt adhesives market is the switching of automobile manufacturers from conventional to advanced assembly techniques. Conventional ways of bonding different components of automobiles involve the use of mechanical fasteners or welds. However, with the increasing preference of consumers for lightweight vehicles and electric vehicles (EVs), the demand for hot melts for adhesion applications has grown manifold. Automobile manufacturers have started using hot melt adhesives, owing to the advantages offered by these high-performance adhesives in terms of flexibility during the production process. Moreover, hot melt adhesives can be used to join different types of substrates used in automobiles.

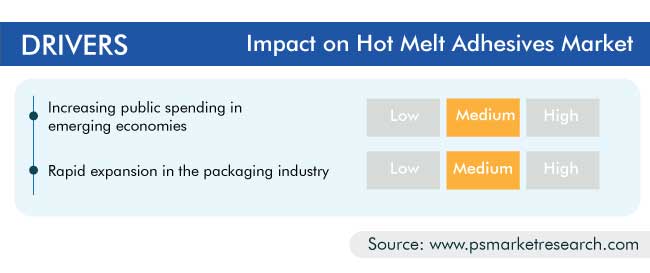

Increasing Public Spending in Emerging Economies

Emerging economies such as India, China, and Indonesia have undergone rapid economic growth in recent years, characterized by a rise in per capita income and increase in disposable income. This, in turn, has led to the increased demand for products such as clothes, footwear, and electronics, all of which require the use of hot melt adhesives during their production processes. Thus, the increased demand for these goods is driving the market growth of hot melt adhesives.

Rapid Expansion in the Packaging Industry

Globally, the packaging industry is growing at a rapid pace due to the rising demand for packaged food and beverages. Furthermore, robust growth in e-commerce is propelling the demand for packaging solutions. For instance, as per the Packaging Industry Association of India, the Indian packaging industry was valued at $50.5 billion in 2019 and is expected to reach $204.8 billion by 2025, registering a CAGR of 26.7% during the period 2020–2025. Since packaged products require both flexible and rigid packaging, in which hot melt adhesives are widely used, the demand for these adhesives is expected to increase with the rise in the consumption of packaged food products and increase in online shopping.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$7,717.0 million |

Forecast Period CAGR |

6.1% |

Report Coverage |

Market Dynamics, Value Chain Analysis, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies’ Strategic Developments, Competitive Benchmarking, Company Profiling |

Market Size by Segments |

Resin Type, Application, Region |

Market Size of Geographies |

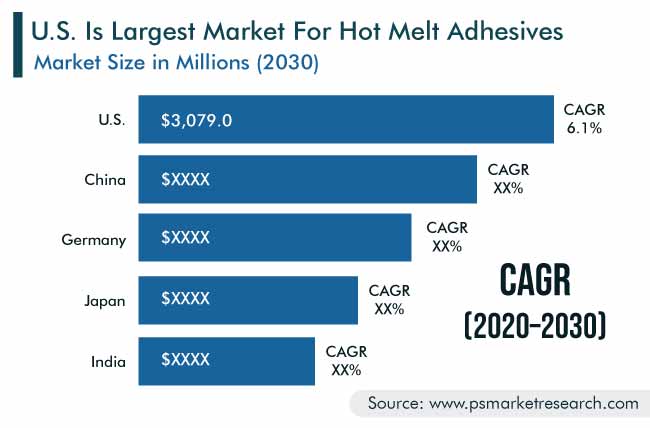

U.S., Canada, Germany, U.K., France, Italy, China, Japan, India, South Korea, Taiwan, Indonesia, Thailand, Philippines, Malaysia, Australia, New Zealand, Vietnam, Brazil, Mexico, Saudi Arabia, South Africa |

Secondary Sources and References (Partial List) |

Adhesive and Sealant Council, Adhesives and Sealants Manufacturers Association, Adhesives and Sealants Association, Association of European Adhesives and Sealants Manufacturers, Association of the Adhesives Industry Switzerland (FKS), Australian Packaging Covenant Organisation, British Adhesives and Sealants Association, China Adhesives and Tape Industry Association |

Explore more about this report - Request free sample

Leading Players Are Focusing on Mergers and Acquisitions to Consolidate Their Market Position

The hot melt adhesives market is fragmented in nature, with the presence of numerous small regional players. Therefore, leading players are increasingly focusing on mergers and acquisitions as a business strategy to increase their market share and consolidate the market.

Some of the major players offering hot melt adhesives in the market are Henkel AG & Co. KGaA, Sika AG, 3M Company, H.B. Fuller Company, The Dow Chemical Company, Ashland Global Holdings Inc., DuPont de Nemours Inc., Huntsman Corporation, Evonik Industries AG, Avery Dennison Corporation, Arkema Group, Westlake Chemical Corporation, Jowat SE, and Beardow & Adams (Adhesives) Limited.

In recent years, these players have focused on the strategic measure of mergers and acquisitions in order to capture a larger share in the industry. For instance,

- In July 2020, Arkema Group proposed the acquisition of Fixatti NV, a company manufacturing thermobonding adhesive powder. Fixatti NV owns two production sites in Europe and one in China. The transaction would help Arkema Group strengthen its hot melt adhesives product portfolio and is in line with the company’s vision to become a pure specialty materials player by 2024.

- In June 2018, Follmann GmbH & Co. KG acquired a majority stake in adhesive manufacturer Paramelt RMC B.V. (ZAO Intermelt) based in St. Petersburg, Russia. ZAO Intermelt is engaged in the manufacturing and distribution of hot melt adhesives, primarily used in the packaging industry. The acquisition strengthened Follmann GmbH & Co. KG’s market position in Russia.

Some of the Key Players in Hot Melt Adhesives Industry

-

Henkel AG & Co. KGaA

-

Sika AG

-

3M Company

-

H.B. Fuller Company

-

The Dow Chemical Company

-

Ashland Global Holdings Inc.

-

DuPont de Nemours Inc.

-

Huntsman Corporation

-

Evonik Industries AG

-

Avery Dennison Corporation

-

Arkema Group

-

Westlake Chemical Corporation

-

Jowat SE

-

Beardow & Adams (Adhesives) Limited

Market Size Breakdown by Segment

The report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Resin Type

- Ethylene Vinyl Acetate (EVA)

- Styrenic Block Copolymer (SBC)

- Polyurethane (PU)

- Polyamide (PA)

- Amorphous Polyalphaolefin (APAO)

- Metallocene Polyolefin (MPO)

- Polyester

Based on Application

- Packaging

- Diaper

- Furniture

- Footwear

- Textile

- Automotive

- Electronics

- Bookbinding

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Vietnam

- Taiwan

- Indonesia

- Thailand

- Philippines

- Malaysia

- Australia

- New Zealand

- Rest of World (RoW)

- Brazil

- Mexico

- Saudi Arabia

- South Africa

The hot melt adhesives market size in 2030 will be $12,761.3 million.

Packaging is the largest hot melt adhesives industry application.

The fastest hot melt adhesives market growth will be witnessed in APAC.

The key hot melt adhesives industry trend is the adoption of advanced assembly techniques over conventional ones in the automotive sector.

Mergers and acquisitions are the most-significant strategic developments in the hot melt adhesives market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws