Report Code: 12112 | Available Format: PDF | Pages: 226

Home-Use Insulin Delivery Devices Market Research Report: By Type (Insulin Syringes, Insulin Pens, Insulin Pumps), Distribution Channel (Pharmacies, E-Commerce, Diabetes Clinics/Centers) - Global Industry Analysis and Revenue Estimation to 2030

- Report Code: 12112

- Available Format: PDF

- Pages: 226

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

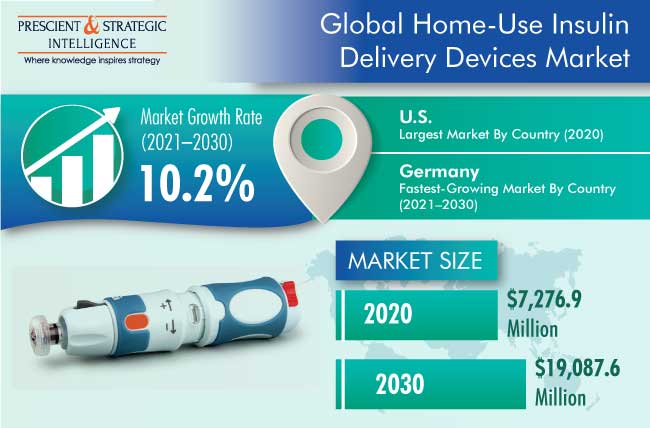

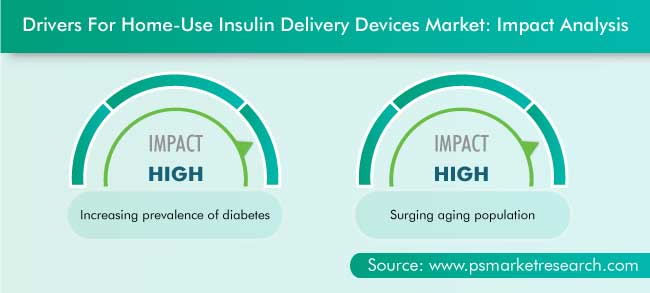

The global home-use insulin delivery devices market generated revenue of $7,276.9 million in 2020, and it is expected to generate $19,087.6 million in 2030, advancing at a CAGR of 10.2% during forecast period (2021–2030). The increasing prevalence of diabetes, technological advancements, surging aging population, and increasing exposure of the population to key risk factors, such as a sedentary lifestyle, obesity, and smoking, are some of the major factors driving the market.

In 2020, the COVID-19 pandemic forced the government of various countries to implement strict measures, such as lockdowns and social distancing, to curb the spread of the virus. Almost every industry was strongly impacted, but the pharmaceutical industry has seen unprecedented growth during this phase. With the inability of people to go to hospitals and clinics to get their insulin dose, they are opting for home-use insulin delivery devices, thus boosting the growth of the industry.

Due to Technological Developments, Insulin Pens Held Largest Share in 2020

The insulin pens category held the largest revenue share in the home-use insulin delivery devices market in 2020, based on type. This is mainly attributed to the increasing prevalence of diabetes, especially in Asia-Pacific (APAC) countries, and technological developments in insulin delivery pens. Additionally, the medical reimbursements provided in developed countries are augmenting the market growth.

Reusable pens held the largest revenue share in 2020, on the basis of the type of insulin pen. This is majorly attributed to the user-friendly design of these pens that helps in minimizing the dosage errors.

Due to Growth of Online Retailing, E-Commerce Category Expected To Be Fastest Growing

The e-commerce category is expected to witness the fastest growth during the forecast period, based on distribution channel in the home-use insulin delivery devices market. This is mainly attributed to the growth of e-pharmacies that offer convenience to the customers. Additionally, the use of e-prescriptions in hospitals is contributing to the category’s growth globally.

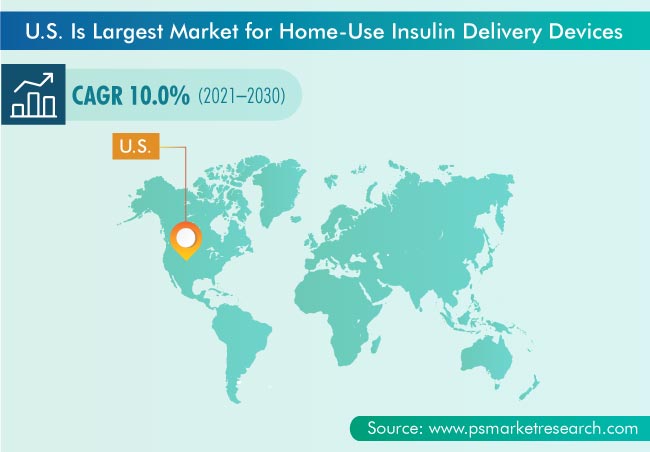

Surging Prevalence of Lifestyle Diseases Has Driven Market of North America

Geographically, North America held the largest share in the home-use insulin delivery devices industry in 2020 due to the surging prevalence of lifestyle diseases, including diabetes and obesity, rising awareness about diabetes management, and increasing healthcare spending. Moreover, obesity and insulin resistance have been considered independent risk factors for diabetes; thus, the rising obese population supports the demand for these devices in the region.

Surge in Usage of Insulin Delivery Devices

Companies such as Novo Nordisk A/S, Eli Lilly and Company, and Sanofi are engaged in the manufacturing of insulin pens for the effective management of diabetes, as the popularity of such devices has increased significantly in recent years. Due to the growing demand for advanced human insulin delivery devices, there have been several improvements in them. For instance, in August 2020, the U.S. Food and Drug Administration (FDA) granted the approval to Medtronic plc’s proprietary product, MiniMed 770G system, which automatically monitors the glucose levels and provides appropriate basal insulin, with or without the requirement for caregivers, to pediatric type 1 diabetes patients.

Surging Aging Population Is Driving Market

The increasing aging population is a key factor stimulating the growth of the home-use insulin delivery devices market. According to a report by the World Health Organization (WHO), people are living longer, meaning that the average life expectancy of the population has increased. Moreover, according to the World Population Ageing report published in 2020, around 727 million people were aged 65 years and above around the world, and this population is expected to reach 1.5 billion by 2050.

Technological Advancements in Insulin Delivery Devices also Key Driver for Market

Technological advancements in insulin delivery devices are leading to their increasing acceptance. Insulin pens, insulin pumps, and insulin inhalers have various advantages, such as accurate dosage of insulin, thereby helping maintain the normal level of the hormone in the body. The usage of insulin pens is less time consuming as compared to syringes with vials. Other advantages of insulin pens include greater patient acceptability and minimum risk of inaccurate dosage.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$7,276.9 Million |

Market Size Forecast in 2030 |

$19,087.6 Million |

Forecast Period CAGR |

10.2% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Regional Breakdown; Companies’ Strategic Developments; Product Benchmarking; Company Profiling |

Market Size by Segments |

By Type; By Distribution Channel; By Region |

Market Size of Geographies |

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; Australia; Mexico; Brazil; Saudi Arabia; South Africa; U.A.E. |

Secondary Sources and References (Partial List) |

World Health Organization; United States Food and Drug Administration; International Diabetes Federation; American Diabetes Association; European Association for the Study of Obesity; Centers for Disease Control and Prevention; National Center for Biotechnology Information, United Nations Department of Economic and Social Affairs, China National Drug Administration, Canada Diabetes Association |

Explore more about this report - Request free sample

Market Players Are Focusing on Product Launches to Gain Competitive Edge

The major players in the global home-use insulin delivery devices market are Tandem Diabetes Care Inc., Biocon Limited, Roche Holding AG, Insulet Corporation, Novo Nordisk A/S, Eli Lilly and Company, Medtronic Plc, and Sanofi.

In recent years, players in the home-use insulin delivery devices industry have engaged in product developments to remain ahead of their competitors.

- In May 2021, Roche Holding AG announced that the Accu-Chek Insight insulin pump can be used with the automated insulin delivery (AID) system from the MedTech company Diabeloop in Switzerland. People with type 1 diabetes now have the opportunity to use an insulin pump that features a pre-filled insulin cartridge and a spectrum of infusion sets to suit individual needs in a CE-labeled hybrid closed-loop system.

- In January 2020, Tandem Diabetes Care Inc. announced its commercial launch of the t:slim X2 insulin pump with Control-IQ technology, an advanced hybrid closed-loop feature designed to help increase time in range (70–180 mg/dL). It is cleared to deliver automatic correction boluses, in addition to adjusting the insulin, to help prevent high and low blood sugar. The system integrates with Dexcom G6 continuous glucose monitoring (CGM) device, which requires no fingersticks for calibration or diabetes treatment decisions.

Key Players in Global Home-Use Insulin Delivery Devices Market Include:

-

Tandem Diabetes Care Inc.

-

Biocon Limited

-

Roche Holding AG

-

Insulet Corporation

-

B. Braun Melsungen AG

-

Becton, Dickinson and Company

-

Novo Nordisk A/S

-

Eli Lilly and Company

-

Medtronic Plc

-

Sanofi

Market Size Breakdown by Segment

The global home-use insulin delivery devices market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type

- Insulin Syringes

- Insulin Pens

- Reusable

- Disposable

- Insulin Pumps

- External/tethered pumps

- Patch pumps

Based on Distribution Channel

- Pharmacies

- E-Commerce

- Diabetes Clinics/Centers

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

- U.A.E

The 2020 value of the market for home-use insulin delivery devices was $7,276.9 million.

The home-use insulin delivery devices industry has been positively affected by the COVID-19 pandemic.

The market for home-use insulin delivery devices is dominated by North America.

The home-use insulin delivery devices industry report has the type, distribution channel, and region segments.

Major players in the market for home-use insulin delivery devices are launching new products.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws