Market Statistics

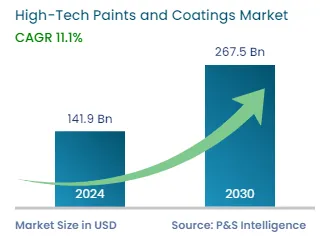

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 141.9 Billion |

| 2030 Forecast | USD 267.5 Billion |

| Growth Rate(CAGR) | 11.1% |

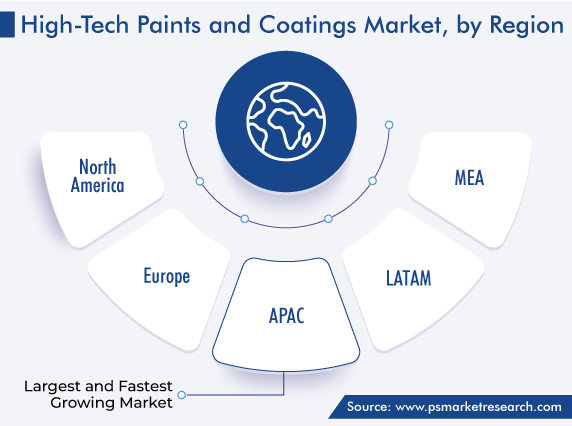

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12536

Get a Comprehensive Overview of the High-Tech Paints and Coatings Market Report Prepared by P&S Intelligence, Segmented by Product Type (Crack Detection Paints, Self-Cleaning Paint, Odor-Absorbing Paint, Waterproofing Paint, Thermal Insulation Paints), Resin (Acrylic, Polyurethane, Polyester, Epoxy), Technology (Waterborne, Solvent Borne, Powder Coatings), End Use Industry (Marine, Automotive, Architectural, Aerospace, Energy, Electronics, Healthcare), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 141.9 Billion |

| 2030 Forecast | USD 267.5 Billion |

| Growth Rate(CAGR) | 11.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The high-tech paints and coatings market revenue stood at USD 141.9 billion in 2024, and it is expected to grow at a compound annual growth rate of 11.1% during 2024–2030, to reach USD 267.5 billion by 2030.

Nanotechnology is being employed to create antimicrobial coatings, which can repel potentially harmful bacteria. Moreover, vinyl wraps, called self-healing wraps, which contain such high-tech coatings, can be used in place of simple paints. Similar to this, the usage of crack detection paints can help carry out visual tests, thus making it easier to find cracks in bridges, foundations of wind turbines, and other civic structures.

The government support for the housing sector and need for a shorter painting cycle have a positive impact on the sector. The growing demand for sustainable development also has a beneficial effect on the market. The industry is responding to the demand for sustainable products by gradually shifting its focus from a single-product approach to the value chain as a whole. Players are transitioning from solvent-borne to water-borne paints, investing in paint lifecycle assessment, and reducing the amount of toxic ingredients in these materials. This positive shift results in the increasing availability of more-sustainable products in the market, thus empowering consumers to make a better product choice.

Due to its reliance on several industries, the high-tech paints and coatings market was badly affected by the COVID-19 pandemic. With the closure of manufacturing facilities during the lockdown period, players as well as end users encountered a liquidity crisis and a drop in the cash flow. However, following the COVID-19 period, transportation and construction activities have all returned to normal, which is expected to boost product demand in the near future.

Based on technology, the high-tech paints and coatings market is classified into water-borne, solvent-borne, powder coatings, and others. Among these, the water-borne category is predicted to expand at the significant rate, of around 9.6%, over the projection timeframe. This can be ascribed to the fact that these variants are majorly used in architectural applications in Europe and North America due to the stricter VOC laws in these regions than APAC. However, with the growing environmental and health concerns, the increasing urbanization rate in APAC countries, which has resulted in a massive demand for new houses, is now driving the consumption of water-borne variants in architectural applications.

The auto industry has received support from the government in a variety of ways, including direct involvement in plans for its restructuring and subsidies for businesses. Investments in technological advancements are leading to improvements in design and manufacturing, increase in the adoption of digital driving systems, and changes in consumer preferences toward EVs. Additionally, in order to lower production costs and increase profits, the world's leading automakers continue to invest in production facilities in emerging markets, especially China, Malaysia, Vietnam, Thailand, and India.

For instance, according to the IBEF, between April 2000 and June 2022, the Indian automobile industry received approximately USD 33.53 billion in equity FDI. By the year 2023, the Indian government anticipates that investments from within India and abroad will be between USD 8 and 10 billion.

In order to encourage foreign investment in the automobile industry, the Indian government has approved 100% FDI through the automatic route. The government has also implemented a policy that allows for the swapping of dead batteries for fully charged ones at designated stations, in order to make EVs more appealing to potential customers.

Based on resin, the market is classified into acrylic, polyurethane, polyester, epoxy, and others. Among these, the acrylic category is predicted to expand at the significant rate, of around 9.9%, over the projection timeframe. Professionals that paint houses and other spaces will continue to use water-based acrylic binders, which are popular for their durability, adaptability, and affordability.

Hence, the development of residential and commercial infrastructure is a major driver for the growth of the market for acrylic paints. They are being used in construction projects because of their resistance to water, superior finish, and consistent drying time. Moreover, they are the preferred choice for exterior surfaces due to the substantial consumer demand for high-performance exterior paints that are sun-reflective and water-resistant, as well as offer an improved finish.

These products also have better adhesion and thermoplastic properties, and they do not deteriorate in direct sunlight. As a result, real estate companies are choosing acrylic paints to stand out from the competition; hence, construction contractors will continue to purchase decorative products with acrylic resins.

Based on product type, the market is categorized into crack detection, self-cleaning, odor-absorbing, waterproofing, thermal insulation, and others. Among these, the self-cleaning category is expected to hold the largest revenue share in the coming years. This would be because self-cleaning paints are available in a wide variety, in terms of functional properties and the industry they are suitable for, such as automotive and construction. They can also be used as an additive to protect various surfaces, such as the exteriors and interiors of buildings and glass panels (to prevent corrosion), make electronic devices waterproof, and offer fabrics germ and water resistance.

Additionally, larger buildings, which are costlier to clean, may see significant savings in upkeep costs with the usage of such paints.

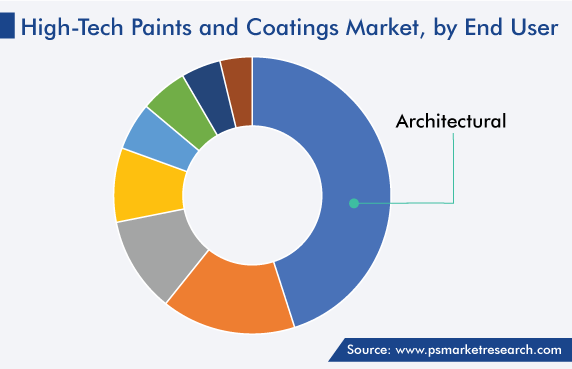

Based on end use, the market is divided into marine, automotive, architectural, aerospace, energy, electronics, healthcare, and others. Among these, the architectural category held the largest revenue share, of 56%, in 2022. This category includes the usage of such coatings on the interior and exterior surfaces of residential and commercial buildings. A boom in the housing sector, increase in the demand for interior decorations, easy availability of housing loans, and a shift from semi-permanent to permanent housing structures are the key driving factors for the architectural category. According to the IBEF, the demand for real estate for data centers is expected to increase by 15–18 million square feet by 2025.

Drive strategic growth with comprehensive market analysis

APAC's revenue contribution to the worldwide market in 2022 was the largest among all the regions. Moreover, the largest market for architectural paints and coatings in Asia-Pacific is China, followed by India and Japan. The demand for architectural coatings in these nations will rise as a result of the increasing living space requirement in urban areas, due to urbanization and the desire of middle-income urban residents to improve their living conditions.

In India, housing construction has been actively encouraged by the government. According to NITI Aayog, in a few decades, half the country will be urban. By 2036, urban expansion is expected to account for 73% of the overall population growth.

Based on Product Type

Based on Resin

Based on Technology

Based on End Use Industry

Geographical Analysis

The market for high-tech paints and coatings will generate USD 267.5 billion in 2030.

Water-borne variants outsell all others in the high-tech paints and coatings industry.

The market for high-tech paints and coatings is growing with the increasing environmental concerns and rampant infrastructure construction.

Architectural applications have the highest value in the market for high-tech paints and coatings.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages