Key Highlights

| Study Period | 2019 - 2032 |

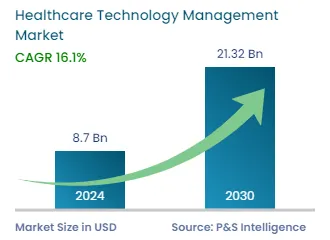

| Market Size in 2024 | USD 8.7 Billion |

| Market Size in 2025 | USD 10 Billion |

| Market Size by 2032 | USD 28.4 Billion |

| Projected CAGR | 16.1% |

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

Report Code: 12558

This Report Provides In-Depth Analysis of the Healthcare Technology Management Market Report Prepared by P&S Intelligence, Segmented by Component (Services, Software, Hardware), Delivery Mode (On-Premises, Cloud-Based), End User (Healthcare Providers, Healthcare Payers), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 8.7 Billion |

| Market Size in 2025 | USD 10 Billion |

| Market Size by 2032 | USD 28.4 Billion |

| Projected CAGR | 16.1% |

| Largest Region | Europe |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The global healthcare technology management market size was USD 8.7 billion in 2024, and the market size is predicted to reach USD 28.4 billion by 2032, advancing at a CAGR of 16.1% during 2025–2032.

The growth can be primarily attributed to the rising adoption of cloud technology and associated human-computer interaction (HCI) services, the increasing demand for telehealth and mHealth solutions, the surging implementation of numerous healthcare reforms such as the patient protection and affordable care act (PPACA), the growing aging population, and the rising number of chronic diseases. The market finds widespread acceptance because healthcare facilities require efficient asset tracking, maintenance solutions, and compliance management systems to support advanced care delivery for growing aging populations, and chronic disease patients.

Healthcare operations are transforming because biomedical equipment management now relies on centralized software-driven methods. Emerging economies will experience significant growth in the healthcare market because IoT, machine learning, and remote diagnostics technologies continue to develop. The market demonstrates promising growth potential because of rising investments and regulatory support which will lead it to become a fundamental foundation for delivering technology-enabled healthcare to worldwide populations at affordable costs and high-quality standards.

The services category held the largest market share, of 45%, in 2024. This is as the heart of healthcare technology management is maintenance, asset lifecycle management, compliance testing, and technical support. A majority of healthcare settings, irrespective of size, count on recurring service contracts, through in-house biomedical engineering staff or third-party suppliers, to maintain their medical equipment safely, and efficient running. Services are vital to regulatory compliance, keeping equipment downtime at a minimum, and maximizing clinical performance overall. Considering the ongoing requirement of monitoring and upkeep over a diverse range of hardware, the level of demand for the market services is always in high, and fundamental to the industry.

The software category will grow at a highest CAGR, of 16.5%, during the forecast period. This is because software solutions provide centralized management of medical devices, data-driven decision-making, and compliance reporting automation, with features that are increasingly becoming non-negotiable for contemporary healthcare operations. The transition toward connected healthcare environments, IoT-facilitated devices, and AI-driven devices is driving the adoption of software, particularly for facilities looking to increase efficiency, lower operational expenditure, and facilitate in patient safety through more intelligent monitoring.

The components analyzed here are:

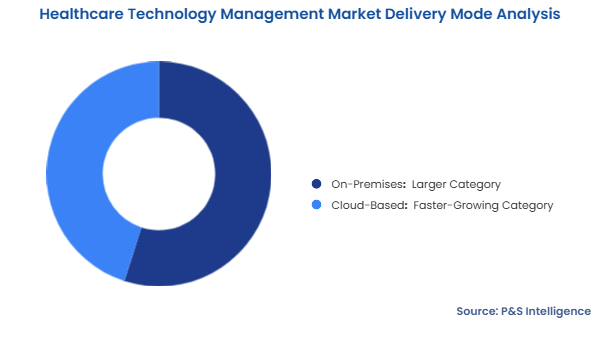

The on-premises category held the larger market share, of 55%, in 2024. This is owing to its historical presence, and perceived control of sensitive patient and equipment information. Most healthcare institutions, particularly large hospitals and diagnostic centers prefer on-premises solutions out of concerns related to data security, regulatory compliance, and system customization. These deployments enable more integration with traditional systems and more autonomy to handle, and maintain the healthcare technology management platforms without depending on outside servers or third-party access. This delivery method continues to remain most dominant in countries with stringent healthcare regulations or limited cloud infrastructure deployment. The cloud-based category will grow at a higher CAGR, of 16.8%, during the forecast period. This is because it offers real-time monitoring, centralized asset tracking, predictive repair, and automated software upgradeability, making them extremely appealing to healthcare systems. The exponential growth of telehealth, distributed care models, and AI-based analytics further fuels cloud growth, particularly among mid-sized health providers and in emerging markets. Moreover, improvements in cybersecurity and compliance platforms are slowly overcoming earlier resistance, driving strong growth in this segment.

The delivery modes analyzed here are:

The healthcare providers category held the larger market share, of 60%, in 2024, because they own and manage large inventories of medical equipment. Hospitals, diagnostic facilities, and ambulatory care sites heavily depend on a wide variety of technologies such as imaging platforms, surgical equipment, and patient monitoring equipment, all of which need ongoing maintenance, and lifecycle management. Hospitals, more than any other, are the most prevalent as they tend to have in-house or outsourced functions to provide operational effectiveness, patient safety, and adherence to strict healthcare standards. The rise in the use of high-tech systems and the pressure to reduce downtime make the management services a requirement in all provider facilities. The healthcare payers category will grow at a higher CAGR, of 17%, during the forecast period. This is as payers and governments increasingly see the cost-saving opportunities provided by strong technology management. Through cooperation with providers and vendors, payers can drive procurement, and lifecycle management decisions that enhance care outcomes while decreasing financial risk. As value-based care models become more prevalent, payers are also making investments in technology-based analytics and digital solutions to enhance clinical efficiency monitoring, eliminate wasteful expenses, and maintain compliance.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

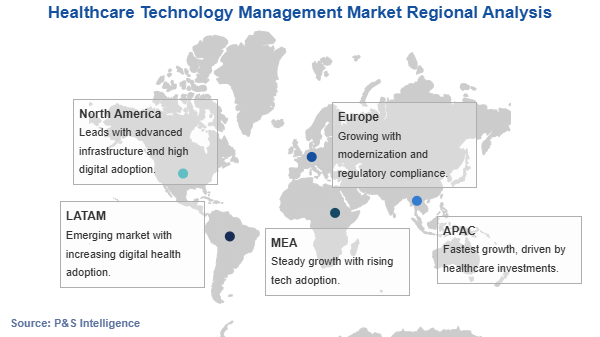

Europe held the largest market share, of 35%, in 2024. This is due to the region's superior healthcare infrastructure, high healthcare expenditures, and rigorous regulatory requirements demanding frequent maintenance and quality control of medical devices. Germany, U.K., and France have top healthcare technology companies and hospital chains that incorporate the latest diagnostic and therapeutic devices, which are necessitating continuous management and maintenance. Moreover, well-established reimbursement policies, and government support for digital health initiatives further strengthen Europe's lead in this market.

The APAC region will grow at a higher CAGR, of 17.5% during the forecast period, because of rapid urbanization, expanding healthcare infrastructure, and rising investments in healthcare technology across countries such as China, India, and Japan. Advanced medical devices, along with digital health platforms, are witnessing increasing demand due to increasing populations, rising chronic disease burdens, and government efforts to update public health systems. The comparatively lower market penetration also offers tremendous opportunities for expansion, as local and international companies look to build a greater presence in this high-growth region.

The regions analyzed in this report are:

The industry is highly fragmented owing to the range of services involved from medical equipment lifecycle management, maintenance to digital health integration, and clinical asset optimization. The fragmentation arises from the different regional regulations, differences in healthcare infrastructure, and the broad range of healthcare providers from small clinics to large hospital systems. The market is expanding at a fast pace due to growing digitization, mature medical equipment, and growing demand for cost-effective healthcare delivery systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages