Report Code: 10201 | Available Format: PDF | Pages: 185

Graphite Market Research Report: By Type (Natural, Synthetic), Application (Electrodes, Refractories, Lubricants, Foundries, Graphite Shapes, Batteries, Friction Products), End-Use Industry (Metallurgy, Automotive, Electronics)- Global Industry Trend and Growth Forecast to 2030

- Report Code: 10201

- Available Format: PDF

- Pages: 185

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Graphite Market Overview

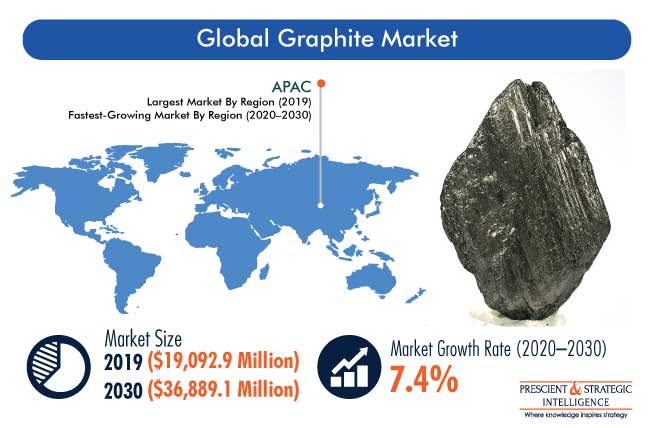

The global graphite market was valued at $19,092.9 million in 2019, and it is projected to witness a CAGR of 7.4% during the forecast period (2020–2030). This is primarily attributed to the growing demand for graphite products in the metallurgy and electronics industries across the globe. Furthermore, graphite is widely consumed during the production of lithium-ion (Li-ion) batteries, which is likely to pave the way for the adoption of graphite in the automotive industry, which, in turn, will boost the global graphite industry.

Owing to the lockdown in various countries, the operations of various industries, including metallurgy and automotive, were temporarily halted or reduced, in order to curtail the spread of the disease. Since graphite is widely used in the production of various crucial components of automobiles and industrial machinery, the market for this material has been negatively affected by the pandemic.

Synthetic Graphite Is Larger Category, Due Rising Demand of Electrodes in Electric Arc Furnaces

In 2019, the synthetic graphite category accounted for the larger size in the market for graphite, on the basis of type. This is ascribed to the widescale usage of synthetic graphite in the manufacturing of electrodes for electric arc furnaces, which are used to manufacture metallic products. Furthermore, synthetic graphite has the ability to withstand high temperature, and it exhibits superior thermal expansion and thermal shock resistance.

The synthetic graphite category is sub-categorized into graphite electrode, carbon fiber, and others, on the basis of form. Amongst them, graphite electrode held the largest market share in 2019 owing to the rising production of iron and steel in emerging countries, especially China and India, and rising availability of steel scrap in China. This further increases the usage of electric arc furnaces, where graphite electrodes are highly important, thereby propelling the market for graphite.

Batteries Expected To Be Fastest-Growing, Owing To Expanding Production of Hybrid and Electric Vehicles

The batteries category, based on application, is projected to witness the fastest growth in the graphite market during the forecast period. This is attributed to the rapidly expanding production of hybrid and electric vehicles, particularly in North America and Europe. In developing countries, the improving disposable income and consumer spending are expected to support the sales of high-drain electronics, which, in turn, will boost the demand for batteries containing graphite.

Metallurgy Is Highest-Revenue-Generating End-Use Industry, Due To Rising Metallic Product Demand

Historically (2014–2019), the metallurgy classification held the largest share in the end-use industry segment. This is ascribed to the growing demand for the ferrous and non-ferrous products used to manufacture industrial machinery, automobile components, and electronic devices. Furthermore, the significant growth in the electric vehicle industry is responsible for driving the metallurgy end-use industry category in the graphite market.

Asia-Pacific (APAC) — Largest and Fastest-Growing Region, Due to Booming Manufacturing Industry

During the historical period, APAC held the largest market share owing to the expanding manufacturing industry in this region. Further, the growing investments in the electric vehicle industry are expected to raise the demand for graphite in the coming years. Moreover, this region is also expected to be the fastest-growing market for graphite during the forecast period. This is attributed to the high-volume integration and production of graphite electrodes in emerging economies, such as China and India.

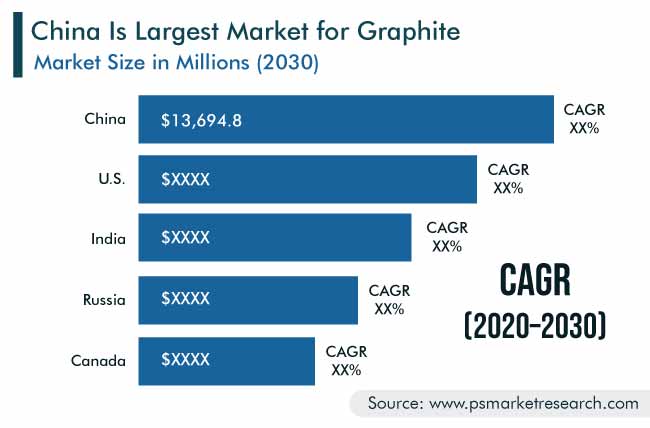

China held the largest graphite market share in the APAC region in 2019 on account of the rising production of crude steel, which witnesses a high demand from various sectors for producing ferrous and non-ferrous metallic products. Additionally, the increasing share of electric-arc-furnace-based steel production in the country is boosting the demand for graphite.

Usage of Graphite in Pebble-Bed Nuclear Reactors Is Key Market Trend

The most-prominent trend being observed in the graphite market is the usage of pebble-bed reactors, over conventional reactors, for producing electric power using uranium fuel. It is estimated that around 3,000 tons of graphite are needed to run a 1,000-MW pebble-bed nuclear reactor in the initial phase, while the annual requirement for graphite is around 600–1,000 tons. In addition, instead of water, helium gas is used to cool the spherical fuel elements of pebble-bed reactors.

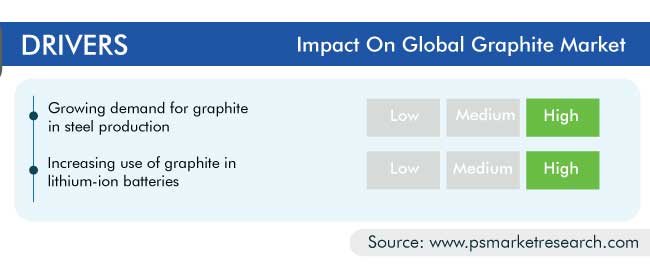

Surging Demand for Graphite in Steel production and in Li-Ion Batteries Propels the Market

According to the World Steel Association, the global production of crude steel stood at 1,869 million tons in 2019, against 1,814 million tons in 2018. The rise in the production of steel is due to the growing demand for steel products in various end-use industries, including oil & gas, automotive, construction, and residential (household use). Owing to its beneficial properties such as high corrosion resistance, durability, and strength at extreme temperatures, graphite is consumed in huge quantities during steel manufacturing.

The utilization of graphite in batteries, especially Li-ion batteries, is expanding substantially around the world. Each Li-ion battery requires 10–20 times more graphite than lithium, as more the graphite, more is the capacity to intercalate lithium. A significant amount of graphite is used in Li-ion batteries as an anode. Natural graphite is less expensive than lithium titanate and synthetic graphite; hence, the growing demand for Li-ion batteries is boosting the graphite market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$19,092.9 Million |

Forecast Period CAGR |

7.4% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategic Developments, Competitive Benchmarking, Company Profiling |

Market Size by Segments |

By Type, By Application, By End-Use Industry, By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Russia, Turkey, Japan, China, India, South Korea, Brazil, Mexico, Saudi Arabia, Egypt |

Secondary Sources and References (Partial List) |

All India Lubricant Association, Alliance of Automobile Manufacturers, Automotive Component Manufacturers Association of India, China Carbon Industry Association, European Automobile Manufacturers' Association, European Carbon and Graphite Association, International Monetary Fund, Indian Steel Association, National Electrical Manufacturers Association, Organisation Internationale des Constructeurs d'Automobiles |

Explore more about this report - Request free sample

Players Focusing on Mergers & Acquisitions as Key Strategy

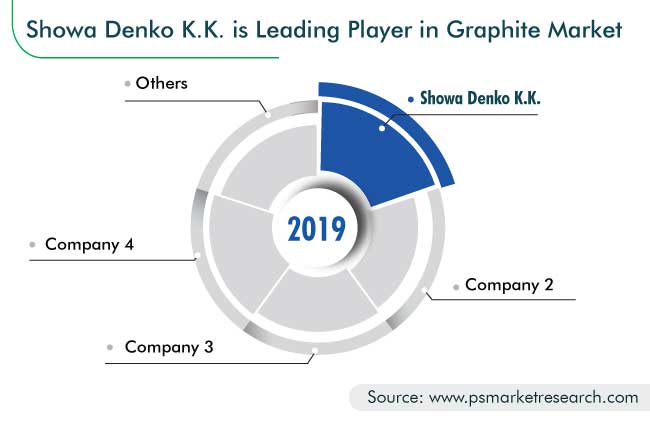

The graphite industry is fragmented in nature, with the presence of market players such as Showa Denko K.K., SGL Carbon SE, Graphite India Ltd., Graftech International Ltd., Tokai Carbon Co. Ltd., Syrah Resources Limited, Hitachi Chemicals Company Ltd., Qingdao Guangxing Electronic Materials Co. Ltd., and HEG Ltd.

In recent years, players in the industry have merged with and acquired other players in order to stay ahead of their competitors. For instance:

- In April 2020, Tokai Carbon Co. Ltd. announced the acquisition of a France-based carbon and graphite manufacturer, Carbon Savoie SAS (now TokaiCarbon Savoie SAS), for $183.0 million. The acquisition will diversify the portfolio of Tokai Carbon Co. Ltd. with Carbone Savoie’s product base and strengthen its position in the European market.

- In December 2019, Showa Denko K.K. announced the acquisition of Hitachi Chemical Ltd. for $8.8 billion. The acquisition was aimed at strengthening the position of Showa Denko K.K. as a leading supplier of graphite to Li-ion battery manufacturers.

Some Key players in Graphite Market Are:

-

SGL Carbon SE

-

HEG Ltd.

-

GrafTech International Ltd.

-

Showa Denko K.K.

-

Graphite India Ltd.

-

Syrah Resources Ltd.

-

Shanshan Corporation

-

Tokai Carbon Co. Ltd.

-

Fangda Carbon New Material Technology Co. Ltd.

-

Qingdao Guangxing Electronic Materials Co. Ltd.

Global Graphite Market Size Breakdown by Segment

The global graphite market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Natural

- Synthetic

- Graphite electrode

- Carbon fiber

Based on Application

- Electrodes

- Refractories

- Lubricants

- Foundries

- Graphite Shapes

- Batteries

- Friction Products

Based on End-Use Industry

- Metallurgy

- Automotive

- Electronics

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- U.K.

- France

- Spain

- Russia

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Rest of the World (RoW)

- Brazil

- Mexico

- Saudi Arabia

- Egypt

- Turkey

The graphite market is predicted to reach $36,889.1 million in 2030 from $19,092.9 million in 2019.

Synthetic is the larger category within the type segment of the graphite industry.

Graphite market players receive the highest revenue from APAC.

Pebble-bed nuclear reactors could be a potentially lucrative application in the graphite industry.

Showa Denko K.K. is the largest player in the graphite market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws