Report Code: 12083 | Available Format: PDF | Pages: 122

Germany Automotive Telematics Market Research Report: By Product Type (Embedded, Tethered, Integrated), Service (Safety and Security, Infotainment and Navigation, Remote Diagnostics, Fleet/Asset Management, Insurance Telematics, V2X), Channel (OEMs, Aftermarket), Vehicle Type (Two-Wheeler, Passenger Car, Commercial Vehicle, Construction Machines), Verticals (Transportation and Logistics, Government and Utilities, Travel and Tourism, Construction, Education, Healthcare, Media and Entertainment), Offerings (Hardware, Software, Services) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12083

- Available Format: PDF

- Pages: 122

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Germany Automotive Telematics Market Overview

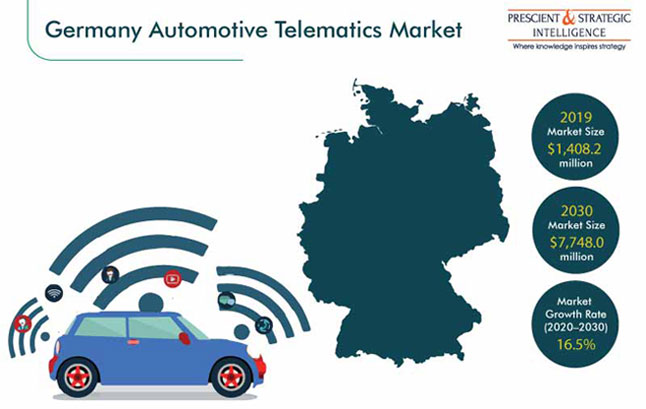

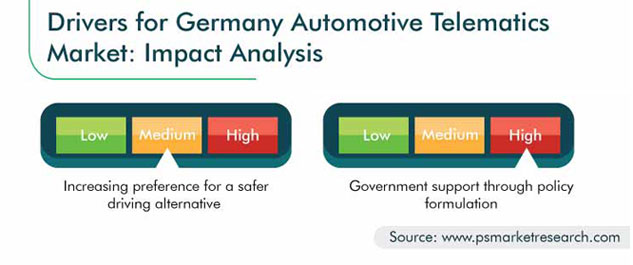

The German automotive telematics market was valued at $1,408.2 million in 2019, and it is projected to advance with a CAGR of 16.5% during the forecast period (2020–2030). The major factors driving the growth of the German automotive telematics industry is the increasing preference for a safer driving alternative, along with the extensive government support, in terms of policy and regulation formulation, for the integration of such systems in automobiles.

However, the ongoing COVID-19 pandemic across the world is expected to have a tremendous adverse impact on different spectra of the society, including the automobile sector. The pandemic has led to a decline in the overall vehicle sales in Germany. For instance, passenger car sales in Germany are expected to witness a decline from 3.6 million units in 2019 to around 3.1 million units in 2020, which is equivalent to a decline of 13.7%. However, with the mandatory rule of installing eCall systems in vehicles, the German automotive telematics market is expected to recover in the near future.

Integrated Product Type To Exhibit Fastest Growth in Market in Forecast Period

The integrated category is projected to exhibit the highest growth rate in the German automotive telematics market, when segmented on the basis of product type. This is attributed to the growing demand for internet-connected infotainment units in mid-range and premium passenger vehicles. Additionally, the growing sales of electric vehicles in the country would support the growth of the category during the forecast period.

Safety and Security Is Expected To Advance with Highest Rate in Forecast Period

Safety and security is expected to be the fastest-growing category during the forecast period, when the German automotive telematics market is segmented on the basis of service. The development of intelligent transportation systems and automated driving technologies will increase the demand for passenger safety in vehicles. Furthermore, government mandates for increasing the number of passenger safety features in cars are expected to drive the market for this category during the forecast period.

Original Equipment Manufacturers (OEMs) Were Dominant Channel till 2019

OEMs dominated the German automotive telematics market during the historical period (2014–2019), when segmented on the basis of channel. Furthermore, the category is set to retain its market domination during the forecast period. The mandatory rules and regulations to incorporate the necessary safety features in vehicles, coupled with the growing consumer preference for connected vehicles, are driving the growth of this category.

Construction Machines Category Is Projected To Witness Fastest Growth in Market

Construction machines are expected to exhibit the fastest growth in the German automotive telematics market during the forecast period, under segmentation by vehicle type. Safety and security have been two of the initial requirements associated with construction machines. Safety and compliance solutions include accident communication and theft protection features, which are vital for construction machines. Owing to the lower revenue in 2019, the market for this category is expected to grow at a CAGR of 23.3%, in terms of value.

Adoption of Telematics Solutions in Off-Highway Vehicles Is Chief Market Trend

The increasing application of telematics solutions in off-highway vehicles is the key trend being witnessed in the German automotive telematics market. The improved productivity and efficiency of these vehicles and growing demand for off-highway vehicle data analysis, along with the need to reduce the operational costs associated with their repair and maintenance, are the major reasons for the growing adoption of telematics solutions in these vehicles. Further, different automotive associations in the country have standardized the major versions of the telematics solutions available for off-highway vehicles, which further encourages their adoption in these vehicles.

Increasing Preference for Safer Driving Alternatives

The growing preference for safer driving alternatives and smoother road traffic is the key driver for the growth of the German automotive telematics market. Road traffic, serious injuries, and death are a few undesirable outcomes of road transportation, and the main cause of road crashes and accidents is usually human error. Numerous aspects associated with human drivers, such as speeding, failure to pay attention, and risky distance from the vehicle in front, are majorly responsible for road accidents.

According to the provisional results of the Federal Statistical Office (Destatis), in the initial six months of 2020, over 1,281 people lost their lives in road accidents in Germany. This can be reduced with the support offered by different telematics solutions, which provide a safer driving alternative to drivers, thereby aiding in the growth of the German automotive telematics market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$1,408.2 Million |

Forecast Period CAGR |

16.5% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Impact of COVID-19, Market Indicators, Regulatory landscape, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Product Type, By Service, By Channel, By Vehicle Type, By Vertical, By Offering |

Secondary Sources and References (Partial List) |

Connected Vehicle Trade Association (CVTA), Danish Artificial Intelligence Society (DAIS), European Automobile Manufacturers’ Association (ACEA), European Union eSafety Forum, Organisation Internationale des Constructeurs d'Automobiles (OICA), Permanent International Association of Road Congresses (PIARC), Telecommunications Industry Association (TIA) |

Explore more about this report - Request free sample

Government Support through Policy Formulation

The German government is actively implementing regulations supporting the use of telematics solutions in vehicles, which is a major driver for the growth of the German automotive telematics market. For instance, in January 2016, the Conference of the German Federal and State Data Protection Authorities and the German Association of the Automotive Industry (Verband der Automobilindustrie [VDA]) introduced a joint declaration policy on the principles of data protection revolving around the use of telematics in connected and not-connected vehicles.

The policy mandates complete data transparency, proper consent from the customer on the collection and usage of their data, as well as absolute security of the data acquired from customers. Such regulatory government policies toward the adoption of telematics solutions are expected to propel the growth of the German automotive telematics market.

Partnerships and Collaborations Are Strongest Strategic Developments Undertaken by Key Players in Market

The German automotive telematics market is fragmented in nature, with the presence of market players such as Valeo S.A., Robert Bosch GmbH, MiX Telematics Ltd., Continental AG, and Verizon Communication Inc.

In recent years, players in the industry have entered into various collaborations and partnerships in order to gain a competitive edge. For instance:

- In October 2019, HARMAN International Industries Inc. announced that it has entered into a partnership with Volkswagen AG in order to provide its audio solutions for Volkswagen AG’s vehicles across the world. The partnership was debuted with the global launch of Volkswagen AG’s Golf 8 at an event at Hafen 1 in Wolfsburg, Germany.

- In October 2019, Geotab Inc. entered into a partnership with Volvo AB to offer the connected vehicle technology to the latter. Under this strategic development, Volvo AB would use Geotab’s technology tointroduce a fully integrated electronic logging device (ELD) for its trucks.

Some of the Key Players in the Germany Automotive Telematics Market Include

-

Robert Bosch GmbH

-

Valeo S.A.

-

Continental AG

-

MiX Telematics Ltd.

-

Verizon Communication Inc.

-

AREALCONTROL GmbH

-

FleetGO Group Ltd.

-

MAC & NIL srl

-

frameLOGIC PL

-

Emixis SA

-

CVS Mobile Inc.

-

Mireo d.d.

-

Axtech AB

-

Transpoco

-

Loqus Holdings p.l.c.

Germany Automotive Telematics Market Size Breakdown by Segment

The Germany automotive telematics market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Product Type

- Embedded

- Tethered

- Integrated

Based on Service

- Safety and Security

- Infotainment and Navigation

- Remote Diagnostics

- Fleet/Asset Management

- Insurance Telematics

- Vehicle to Everything (V2X)

Based on Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Based on Vehicle Type

- Two-Wheeler

- Passenger Car

- Commercial Vehicle

- Construction Machines

Based on Verticals

- Transportation and Logistics

- Government and Utilities

- Travel and Tourism

- Construction

- Education

- Healthcare

- Media and Entertainment

Based on Offerings

- Hardware

- Software

- Services

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws