Report Code: 12338 | Available Format: PDF | Pages: 137

Fruit and Vegetable Processing Equipment Market Revenue Outlook by Equipment Type (Pre-processing, Peeling/Inspection/slicing, Washing & dewatering, Fillers, Packaging & handling, Seasoning systems), Mode of Operation (Semi-Automatic, Automatic), Processing System (Small Scale, Intermediate Scale, Large Scale), End Product (Fresh-Cut, Canned, Frozen, Dried & dehydrated) - Forecast to 2030

- Report Code: 12338

- Available Format: PDF

- Pages: 137

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

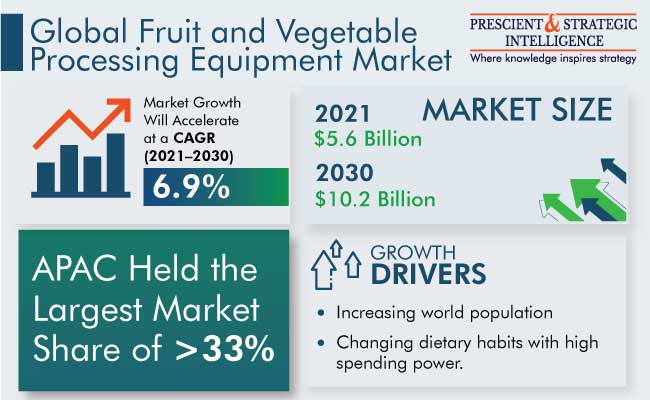

The fruit and vegetable processing equipment market size was valued at $5.6 billion in 2021, and it will grow at a CAGR of 6.9% during 2021–2030. The sector is growing with the increasing world population, and changing dietary habits due to the surging spending power of people toward higher-value items. As a result, the demand for food processing, storage, packaging, and preparation equipment has increased.

During the COVID-19 pandemic, food security, food safety, and food sustainability were all rigorously impacted. The food consumption behavior of consumers has shifted dramatically, with preponderant accentuation on safety and quality. Manufacturers have been compelled to analyze the safety standards of consumable goods in order to maintain their products’ values in the market.

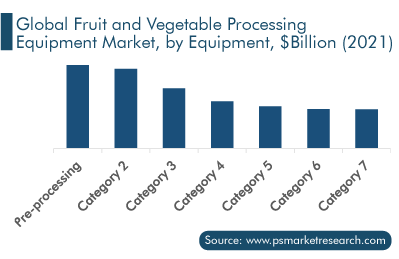

Pre-Processing Equipment Holds Maximum Share in the Market

The demand for pre-processing equipment held the largest market share, of around 20%, in 2021, and the category is expected to grow at a CAGR of around 7.0% during 2021–2030. This is because after being collected from farms, fruits and vegetables are prone to contain dirt, soil, bacteria, and foreign materials, rendering them unsafe for direct consumption. To make them consumable, pre-processing intervention is required to maintain hygiene.

Pre-processing equipment does the entire process of cleaning in very less time without hindering the hygiene and quality of the products. Also, it cleans off pesticides and other crop protection substances effectively, which are used by farmers. Moreover, new equipment is being introduced in the market with more automation, which reduces the output cost and time.

However, the packaging and handling equipment category is projected to witness the fastest growth during the forecast period in the fruit and vegetable processing equipment market. This is ascribed to the surging demand for packaging and handling equipment to increase the shelf life of products. Moreover, most of the industry players focus on good packaging, which helps in boosting the sales of their products. Also, packaging prevents the products from getting contaminated, and it becomes easy to identify a product of a specific brand.

Major Opportunity Areas

The rising popularity of vegan food has caused a positive shift in the plant-based food industry. According to the data released by Plant Proteins.com, the U.S. retail sales of plant-based food items increased by 11.0% from 2018 to 2019. This leads food processing companies to increase their production capacity to cater to the high demand for plant-based products. Thus, they are looking to expand their facilities, which require more equipment to process fruits and vegetables, so that there must not be a gap between the demand and supply of the products.

Moreover, manufacturers of plant-based meals are focusing on fruits and vegetables, legumes, pulses, and fruit-based goods, due to their high nutritional contents and functionality, which can improve the texture and flavor of meals. This offers several opportunities in the market.

Paradigm Shift Toward Automatic Equipment

Over the year, most industries have been moving toward automation. Similarly, fruit and vegetable processing companies are incorporating automatic equipment in their processing plants, as it helps in improving productivity and operational efficiency. Nevertheless, fully automated processing equipment contributes to effective processing, fast and non-dependable production processes, efficient time management, lowering labor costs, and well-controlled operations in fruits processing equipment as well as vegetable processing equipment. Thus, most equipment manufacturers have begun to provide fully automated solutions that can do pre-processing, processing, and packaging of food items.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$5.6 Billion |

Revenue Forecast in 2030 |

$10.2 Billion |

Growth Rate |

6.9% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Equipment Type; By Mode of Operation; By Processing System; By End Product |

Explore more about this report - Request free sample

Surge in Demand for Convenience Food Will Drive the Market

According to the data released by the World Bank, it is expected that by the next 10 years, two-thirds of the world’s population will start living in urban areas. Due to the rapid urbanization and hectic lifestyles, the young generation and working professionals are trying to keep up with their busy schedules, and thus, they are preferring ready-to-eat products and frozen foods, as these take less time to prepare. This trend will continue pushing the sales of convenience food products. Also, the increased demand for convenient ready-to-eat food presents a growth opportunity for the food service sector, particularly in emerging markets, and is driving the innovation in flexible packaging products.

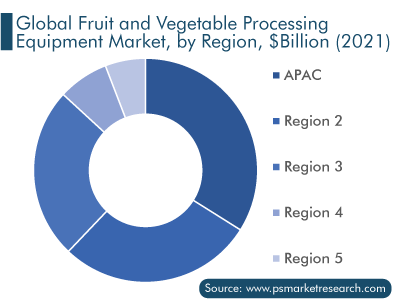

APAC Is the Fastest-Growing Market for Fruits and Vegetable Equipment

The APAC fruit and vegetable processing equipment market is growing at the highest pace, owing to factors like growing population, increasing foreign direct investment, surging disposable income, and changing food preferences. Also, the increasing consumption of ready-to-eat food is attracting new venture capitalists to invest in the food equipment business. For instance, it is expected that by 2035, the demand for processed food will increase by 60% in APAC. To fulfill the surging demand, key players in the region are expanding exponentially, which is boosting the demand for new equipment.

The U.S. is a larger market for the equipment in North America, as it holds the third position in the world in eating ready-to-eat and packaged food. Also, the safety measures adopted by agencies like Food and Drugs Association helped the country to offer more trust to the people.

To Increase Market Share, Companies Involved in Various Strategic Developments

Key players in the fruit and vegetable processing equipment market have adopted various strategies such as launching new and advanced equipment and making innovations in the existing equipment. In addition, they have emphasized on facility expansions, partnerships, marketing schemes, and information sharing programs to raise awareness and improve the applications of fruit and vegetable processing systems. For instance:

- In May 2022, GEA Group AG launched food processing, freezing, and packaging product, which focused on sustainability, digitalization, product quality, and productivity.

- In January 2021, Bühler and DIL Deutsches Institut für Lebensmitteltechnik e. V, a research institute, teamed up to develop new production technologies for healthy and sustainable food products.

- In October 2020, Krones Inc. introduced the Krones Process Group North America to provide a more cohesive offering to companies of beverage, dairy, and food in North America, Central America, and the Caribbean.

Key Players in the Market Are:

- Alfa Laval

- ANKO FOOD MACHINE CO. LTD.

- Bigtem Makine A.S.

- Bühler AG

- FENCO Food Machinery S.R.L.

- GEA Group AG

- Heat and Control Inc.

- JBT Corporation

- Krones AG

- Marel

- Syntegon Technology GmbH

- Turatti Group

Segmentation Analysis

The research offers market size of the fruit and vegetable Processing Equipment Market for the period 2017–2030.

Based on Equipment Type

- Pre-processing

- Peeling/Inspection/slicing

- Washing & dewatering

- Fillers

- Packaging & handling

- Seasoning systems

Based on Mode of Operation

- Semi-Automatic

- Automatic

Based on Processing System

- Small Scale

- Intermediate Scale

- Large Scale

Based on End Product

- Fresh-cut

- Canned

- Frozen

- Dried & dehydrated

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

During 2021–2030, the growth rate of the fruit and vegetable processing equipment market will be around XX%.

In 2021, the size of the fruit and vegetable processing equipment market stood at $XX million.

Pre-processing equipment is the largest equipment type in the market.

APAC is the largest market for fruit and vegetable processing equipment, globally.

Top players in the fruit and vegetable processing equipment market include Alfa Laval, ANKO FOOD MACHINE CO. LTD., Bigtem Makine A.S., GEA Group AG, Bühler AG, FENCO Food Machinery S.R.L., JBT Corporation, Krones AG, Heat and Control Inc., Marel, Syntegon Technology GmbH, and Turatti Group.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws