Report Code: 10426 | Available Format: PDF | Pages: 280

Food Coating Ingredients Market Size Analysis Report by Product Type (Cocoa & Chocolate, Fats & Oils, Flours, Breaders, Batter & Crumbs, Sugars & Syrups, Spices & Seasonings, Starches, Hydrocolloids), Form (Dry, Liquid), Application (Meat & Poultry Products, Confectionery Products, Bakery Products, Ready to Eat Cereals, Fruits & vegetables, Snacks) - Industry Analysis Forecast to 2030

- Report Code: 10426

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

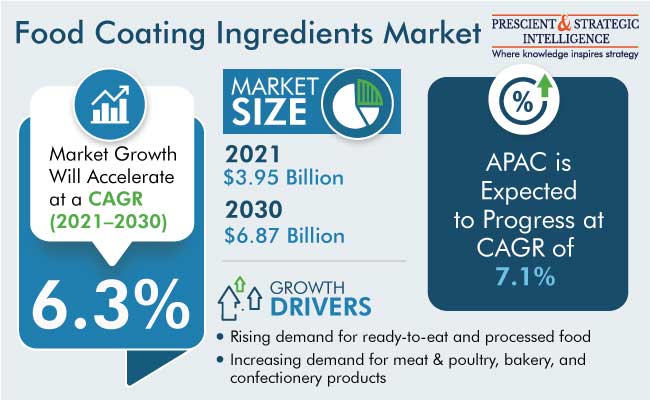

The global food coating ingredients market size was $3.95 billion in 2021, and it is expected to reach $6.87 billion by 2030, advancing at a CAGR of 6.35% during 2021–2030.

This growth is primarily attributed to the rising demand for ready-to-eat and processed food across the world. Furthermore, the increasing demand for meat & poultry products, bakery products, and confectionery products is predicted to drive the market growth in the coming years. In addition, the shifting consumer preference toward healthy eating is expected to support the demand for nutritious and antimicrobial ingredients for food coatings, which will contribute to the overall growth of the food coating ingredients market during the forecast period.

Furthermore, the shifting consumer preference toward protein-based meals, growing popularity of frozen foods, and increasing consumption of snacks are set to boost the growth of the food coating ingredient market till 2030.

Sugars & Syrups Hold Largest Market Share

The sugars & syrups category, based on product type, is dominating the market in 2021, and it is expected to grow at a significant CAGR over the forecast period. Sugars and syrups have long been utilized as coating agents in the food processing industry as they induce qualities such as a rich color, flavor, and sweetness, into the materials being coated.

In addition to this, the flours category will hold the second-largest revenue share during the forecast period as flours are used as the major ingredient in bakery & confectionery products.

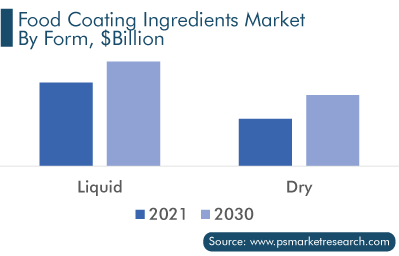

Liquid Form Category Holds Largest Share by Revenue

The liquid form category accounted for the largest revenue share in 2021, and it is set to grow at a substantial CAGR during the forecast period. Liquid coatings are used in bakery products, ice creams, flavored nuts, confectioneries, such as candy bars, and granola bars. Such coatings include fat-based formulations, which are melted before being applied to nuts, donuts, cookies, cakes, sugar wafers, fruit pieces, ice cream bars, and a range of other solid food products, for adding flavors. For instance, batter is used to cover chicken wings and nuggets, as well as fritters, to enhance their flavor, color, and texture and extend their shelf life.

Confectionery Products To Be Dominant in Market

The confectionery products category, based on application, dominated the market, with more than 25% share, in 2021, and it is set to grow at the highest CAGR during the forecast period. This will be due to the widespread acceptance of confectionary products, along with the increasing popularity of branded outlets selling such products in emerging economies. The demand for these products is supported by the increasing per capita income and customer willingness to spend more for healthier items.

The consumption of confectioneries, such as wafer bars, pastries, and candies, has expanded dramatically in recent years due to their growing popularity among the millennials, particularly chocolate-coated items. These coatings help in enhancing the products’ shelf life. Additionally, the process of enrobing was sluggish and required manually dipping the product in the coating; however, the rising demand for these items has encouraged the adoption of numerous advanced production technologies, such as electrostatic coating, which increase the rate of production and help F&B companies in satisfying the demands of customers.

Meat & Poultry Products To Witness Fastest Growth

The meat & poultry products category is expected to grow at a CAGR of more than 7.5% during the forecast period. The market growth is primarily attributed to the rising usage of meat & poultry products in North America. Food coatings allow for the addition of savory tastes as well as crispy texture to such products. In this regard, the rising consumption of crispy & fried chicken covered with batter and crumbs is propelling the market in this region.

Increasing Demand for Processed and Ready-To-Eat Food

The changing lifestyles of consumers and rapid urbanization have increased the demand for ready-to-eat foods, as they need less cooking time, but still provide nutrition and durability. Moreover, the growing demand for processed food is expected to contribute to the growth of the food coating ingredients market.

The rising disposable income of consumers and increasing working population have led to a surge in the demand for processed foods as well as ready-to-eat food products, which, in turn, will drive the growth of the market. Additionally, manufacturers of ready-to-eat products are launching new products regularly, to attract customers, thus resulting in a growth in their sales.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$3.95 Billion |

Revenue Forecast in 2030 |

$6.87 Billion |

Growth Rate |

6.35% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Segmentation Analysis of Countries; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product Type; By Form; By Application; By Region |

Explore more about this report - Request free sample

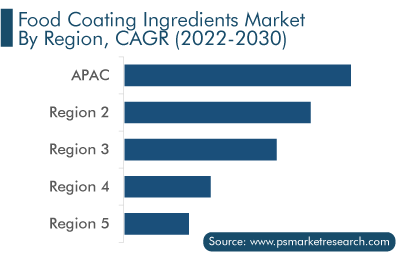

North America Dominates Market

North America had the largest share in the food coating ingredients market in 2021. Advanced food coating technologies, such as mechanized equipment, are available in the region to coat food products. The people of the U.S. and Canada like salty foods, such as potato and corn chips, which are coated with dry ingredients. These countries also witness a high-volume consumption of frozen food, which need to remain fresh for a longer period. Moreover, people in the continent like cereals in breakfast, which need to be kept safe from pathogenic contamination; hence, the increasing antimicrobial coating demand will drive food coating ingredient sales.

The U.S. is regarded as one of the most-important markets for food coating ingredients. The overall sales are likely to rise due to the increasing demand for processed foods, particularly bakery items, across the country.

Furthermore, the demand for antimicrobial coatings is expected to spur innovation in the food coating ingredients market, in part, due to the favorable regulations. Because of the growing emphasis on the safety of processed foods, the government of the U.S. has implemented laws on the usage of antimicrobial food coatings.

Asia-Pacific To Witness Highest Growth Rate

Asia-Pacific is expected to grow at a CAGR of around 7.1% in the food coating ingredients market over this decade. The rising demand for such additives from diverse industries, rapid industrialization, and the increasing government investment to allow food processing companies to modernize their technologies are driving the demand for such additives. Moreover, manufacturers are expanding their footprint by establishing distribution centers, manufacturing plants, and R&D facilities.

Because of the government’s support and cheap labor, India is predicted to grow the fastest in the market of the region, with many international firms making investments in this country.

Furthermore, the growing number of supermarkets and shopping marts, as well as India's booming retail sector, are expected to boost the ready-to-eat business, since such outlets account for around 70.0% of the RTE product sales. Moreover, China is predicted to be a leading market for food coating ingredients owing to the rising consumption and production of ready-to-eat food products in the country.

Top Players in Food Coating Ingredients Market Are:

- Cargill Inc.

- Kerry Group

- Buhler AG

- Archer Daniels Midland Company

- Ingredion

- Bowman Ingredients

- JBT Corporation

- Tate & Lyle PLC

- PGP International

- Marel

Global Food Coating Ingredients Market Size Breakdown by Segment

The study offers a comprehensive market segmentation analysis along with market estimation for the period 2017-2030.

Based on Product Type

- Cocoa & Chocolate

- Fats & Oils

- Flours

- Breaders

- Batter & Crumbs

- Sugars & Syrups

- Spices & Seasonings

- Starches

- Hydrocolloids

Based on Form

- Dry

- Liquid

Based on Application

- Meat & Poultry Products

- Confectionery Products

- Bakery Products

- Ready to Eat Cereals

- Fruits & vegetables

- Snacks

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

In 2030, the market for food coating ingredients will generate $6.87 billion.

The food coating ingredients industry is driven by the rising demand for ready-to-eat foods.

Sugars and syrups dominate the market for food coating ingredients.

The APAC food coating ingredients industry will have a CAGR of 7.1%.

Antimicrobial coatings are trending in the market for food coating ingredients.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws