Market Statistics

| Study Period | 2019 - 2030 |

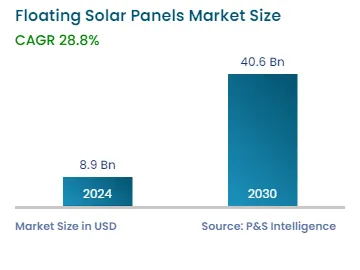

| 2024 Market Size | USD 8.9 Billion |

| 2030 Forecast | USD 40.6 Billion |

| Growth Rate(CAGR) | 28.8% |

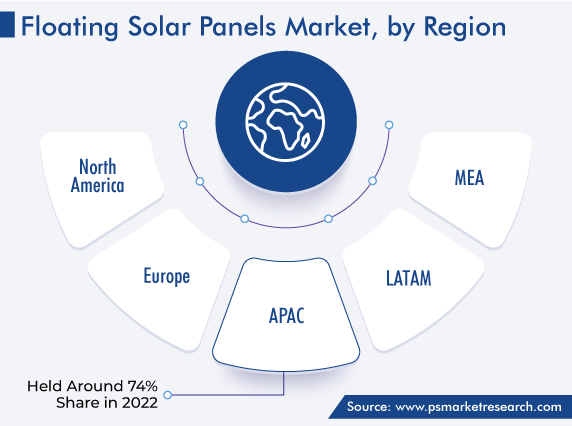

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 10142

Get a Comprehensive Overview of the Floating Solar Panels Market Report Prepared by P&S Intelligence, Segmented by Based on Type (Stationary, Solar Tracking), Location (Onshore, Offshore), Technology (PV, CSP), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 8.9 Billion |

| 2030 Forecast | USD 40.6 Billion |

| Growth Rate(CAGR) | 28.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global floating solar panels market is estimated to be USD 8.9 billion in 2024, and the market size is predicted to reach USD 40.6 billion by 2030, advancing at a CAGR of 28.8% during 2024–2030. The market is driven by the increasing count of government initiatives for the utilization of renewable resources, stringent environmental regulations, and the elimination of the need for the acquisition of large terrestrial areas with the installation of PV plants on waterbodies.

The rapid depletion of fossil fuel resources and the global warming caused by their usage have shifted the world’s interest from conventional energy to green energy. In order to curb the usage of conventional resources and promote green energy, several governments across the globe have initiated projects and schemes, along with implementing several environmental regulations.

Solar energy is one of the major strategies for combating climate change. A significant spike in the number of distributed PV solar systems on rooftops and solar farms, to improve clean energy generation, has been observed throughout the years. Moreover, as research and development in this field has progressed, floating solar panels have emerged.

Additionally, investments in projects related to this are in trend, as this technology does not require any land. For instance, in India, Satluj Jal Vidyut Nigam (SJVN) will work with Assam Power Distribution Company (APDCL) to create floating solar power plants with a combined generation capacity of 1,000 MW. The project will produce 2.1 billion units of energy in the first year after commissioning and about 50 billion units over 25 years.

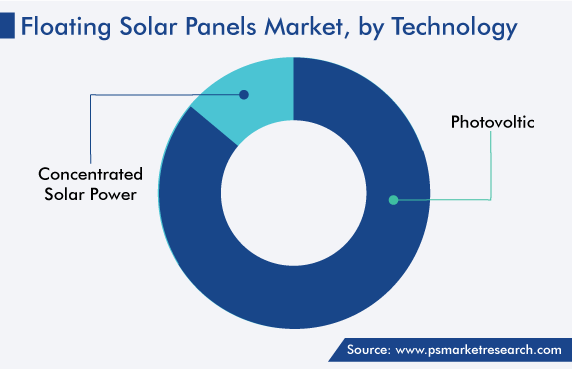

Floating PV systems held the larger revenue share, of 93%, in 2022, as installing PV plants in waterbodies helps overcome the limitations of traditional PV sites. It allows for the most-efficient land use, tidal management, creation of an aesthetically pleasing environment, and increase in power generation. They are also cost-effective in comparison to traditional mounting-based PV systems, and they make maximum use of water’s cooling effect to generate higher energy.

There is an enormous potential for expansion in these photovoltaic power generation. Hydropower reservoirs alone encompass more than 250 thousand square kilometers throughout the world, enabling 2.5 times as much floating solar capacity as the entire underlying hydropower capacity. Combining hydropower generation with floating solar panels has the potential to produce remarkable outcomes.

Stationary panels held the larger share, of 82%, in 2022. On a lake, dam reservoir, or another waterbody, it is relatively easy to install these panels. Moreover, serving as a shade above the body of water, these panels slow down the evaporation of the water. Additionally, installing a stationary floating PV plant is more economical than a solar-tracking floating plant, since the former type of panels are made of low-cost, high-strength plastic. Due to the rising expenses on the solar tracking technology's upkeep, the spending on the production and installation of stationary variants in emerging economies is set to boost the demand for them in the coming years.

Still, the solar-tracking category is expected to grow at the higher CAGR during the forecast period. Due to the longer direct exposure to the sun's rays, these variants produce more electricity than their stationary counterparts. Depending on where the tracking system is located, this increase could range from 10 to 25%. Solar trackers come in a variety of forms, including single-axis and dual-axis, both of which can be the ideal fit for a particular jobsite.

The size of the installation, local weather, latitude, and electricity needs are all significant factors that decide what kind of solar tracker is appropriate for a particular installation. Solar trackers are the ideal option for maximizing land use as they produce more electricity from about the same space as fixed-tilt systems.

Drive strategic growth with comprehensive market analysis

The APAC region is the largest across the globe in 2022. The market is expected to witness rapid growth primarily on account of the government initiatives promoting the usage of floating solar panels in the region.

Additionally, the stringent environmental regulations, along with the rising low-cost energy demand, are promoting the growth of the market. The installation of ground-based PV systems requires large landmasses; hence, land acquisition increases the cost of power. The available land in most Asian countries is quite less, owing to their high population densities. For instance, India, South Korea, the Philippines, and Japan have a population density of 464 per square km, 527 per square km, 368 per square km, and 347 per square km, respectively.

Hence, in order to reduce the dependence on land acquisition for ground-based solar systems, many Asian countries have already started adopting the floating PV technology. Additionally, several countries have announced projects to increase their floating solar capacity, which are likely to begin operations in the coming years. Furthermore, the rapid popularity of the technology and abundance of waterbodies (ponds, lakes, rivers, waste waterbodies, and industrial effluent ponds) are supporting the region’s plans to increase the floating PV capacity. In turn, this will help overcome the hurdles in reaching the set targets of the overall solar capacity during the forecast period.

Moreover, Europe held the second-largest share in 2022. The European region is projected to showcase strong growth in the future on account of the increasing investments by the major players for the development of these plants in the region. The majority of the European nations lack easily available land to build massive solar farms. Furthermore, the price of constructing such plants is significantly higher, particularly in the Netherlands, where land is expensive. Due to its easy access to existing electrical infrastructure, floating solar also entails lower grid connection costs.

Moreover, the stringent environmental regulations, increasing compliance for clean electricity, and technological advancements in the floating solar power niche are fueling the growth of the market in Europe.

The largest floating solar park in Europe, with a capacity of 27.4 MW, started operating on a quarry lake in the Netherlands last spring. A number of additional plants in the double-MW range have been built in the region lately, especially in France and the U.K.

Floating PV projects with a combined capacity of about 100 MW have been put into place in Europe by BayWa r.e. alone. Further, in the coming years, there are plans to commission such projects with a combined capacity of more over 800 MW in Greece, on artificial waterbodies, such as reservoirs, Similarly, in Germany, where floating PV is in trend, solar project of 1.5 MW is currently undergoing its initial phase of construction on a quarry lake in Rhineland–Palatinate.

Based on Type

Based on Location

Based on Technology

Geographical Analysis

The market for floating solar panels valued 8.9 billion in 2024.

The government initiatives for renewable energy and restrictions with conventional PV technologies drive the floating solar panels industry.

Stationary variants dominate the market for floating solar panels.

APAC houses the largest floating solar panels industry.

Most end users in the market for floating solar panels prefer onshore installation.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages