Report Code: 12044 | Available Format: PDF | Pages: 236

Field Force Automation Market Research Report: By Offering (Solutions, Services), Enterprise (Large Enterprises, SMEs), Deployment (Cloud ,On-Premises), Pricing Model (Subscription-Based, Free, Quote-Based), Application (Sales Order Management, Customer Service, Lead Management), Vertical (IT & Telecom, Manufacturing, Logistics & Transportation, Healthcare, Retail & E-Commerce, BFSI) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12044

- Available Format: PDF

- Pages: 236

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

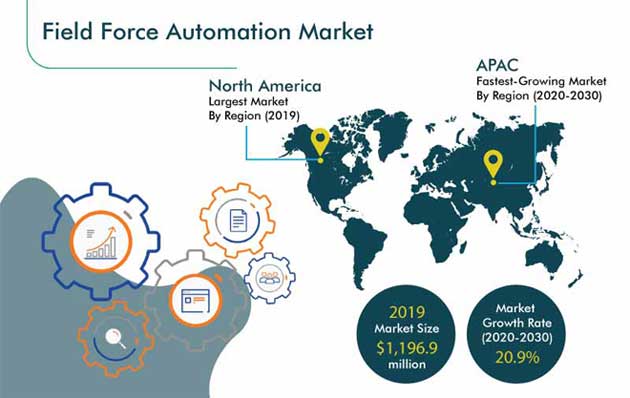

The field force automation market size was $1,196.9 million in 2019, and it is projected to record a CAGR of 20.9% during 2020–2030. The strongest growth drivers for this market include the increasing smartphone and mobile internet penetration, surging focus on leveraging advanced technologies, such as cloud computing, the internet of things (IoT), and artificial intelligence (AI), in field force automation solutions, and soaring requirement for automating repetitive activities.

COVID-19 Impact Analysis

The field force automation industry is expected to witness growth due to the ongoing COVID-19 pandemic. This will be because of the imposition of lockdowns in numerous countries, which are projected to create a high demand for automated field operations for collecting real-time insights. Additionally, the high adoption rate of digital initiatives and rapid pace of production in the post-lockdown era would encourage industries to adopt automated solutions in the coming years.

Services To Grow Faster

The service category, under the offering segment, is expected to demonstrate the faster growth in the coming years. This can be owed to the burgeoning demand for services such as system integration, installation, and maintenance and support, to continuously update the software to the latest version, enhance resource productivity, and streamline the project lifecycle.

Furthermore, the professional classification of the service category held the larger share in the field force automation market in 2019, and it will also record the faster growth between 2020 and 2030. This can be ascribed to the large-scale adoption of professional services, including education, consulting and support, and training, for the deployment of field force automation solutions. Businesses are incorporating such solutions to gather real-time data and analyze it to procure meaningful information, to support quick decision making through the integration of next-generation technologies.

Large Enterprises Generated Higher Revenue

In 2019, the large enterprises category was the major contributor to the market for field force automation solutions. Large enterprises are increasingly procuring field force automation solutions to improve business productivity, simplify complex work operations, support data-driven decision making, and map the performance of field agents.

The small and medium enterprises (SMEs) category is projected to showcase the faster growth in the coming years due to the rapid digitization of SMEs and the adoption of cloud computing technologies and mobile-based solutions by such firms.

Subscription-Based Model Observes Highest Demand

The subscription-based category generated the highest revenue in 2019, based on pricing model, owing to the easy availability of monthly and yearly subscription plans for such solutions with field force automation market players. The subscriptions are designed based on the requirements of customers and the number of individuals utilizing the service. Further, market players offer a free trial for a limited number of days, which helps users in choosing from the plans available the one that caters to their requirements the best.

Sales Order Management Is Largest Application of Such Solutions

The sales order management category held the major share in 2019, under the application segment, due to the robust demand for automating field sales activities, such as inventory management, data analysis, work shift scheduling based on area and locality, and gathering real-time insights into product inquiries and lead lifecycle.

Retail & E-Commerce Sector Generates Highest Revenue

The retail and e-commerce category generated the highest revenue in 2019, on the basis of vertical. This can be ascribed to the surging usage of such solutions in this industry for filtering information based on potential leads, collecting real-time feedback from clients and analyzing it for future purposes, understanding the requirements of customers in detail, and automating marketing and sales activities. Owing to this reason, players in the field force automation market are introducing task-based solutions to meet the amplifying need for automated sales operations and attain a larger share in the market.

North America Recorded Highest Field Force Automation Solution Usage

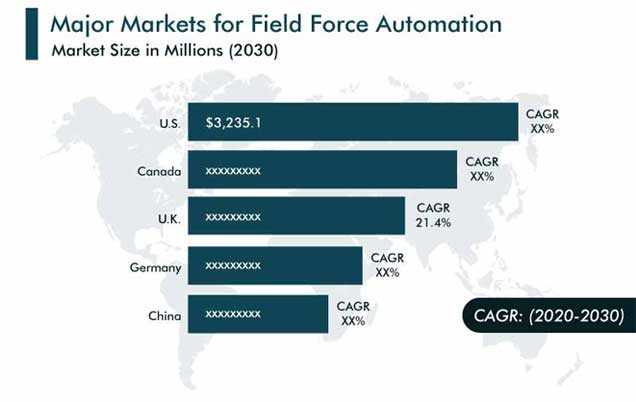

North America was the largest user of field force automation solutions during 2014–2019. The prime factors behind this include the huge investments in the IT infrastructure, vast adoption of mobile applications to gather real-time field information, high demand for industrial automation, rapid shift toward cloud computing, swift integration of advanced technologies, such as machine learning (ML), IoT, and facial recognition, in business activities, and presence of leading market players in the region.

Asia-Pacific (APAC) To Exhibit Fastest Growth

APAC is expected to demonstrate the fastest growth in the usage of such solutions during 2020–2030 on account of the accelerating industrialization rate, escalating awareness regarding computerized operations of field sales teams, burgeoning utilization of real-time data for sales forecasting, and booming need for the identification and analysis of the buying patterns of consumers. Additionally, the deployment of the cloud technology, presence of a large number of field force automation startups in India, Singapore, China, and Australia, and increasing need of businesses to improve the productivity and reduce the operational costs are boosting the field force automation market growth in the region.

Usage of Cloud-Supported Field Force Mobile Application Is Key Trend

The rising preference for cloud-based field force mobile applications can be owed to the several benefits offered by them to enterprises. These include data back-up, a high storage capacity, flexibility to share and retrieve data from multiple sources, and multiple platform support.

Cloud-based field force mobile applications help in assigning work orders, transferring important information from general packet radio services (GPRS) to cloud serves, and working with real-time status updates. Thus, players in the market for field force automation solutions are focusing on combining the benefits of cloud storage with field force mobile applications to offer user-friendly interfaces and ease of access.

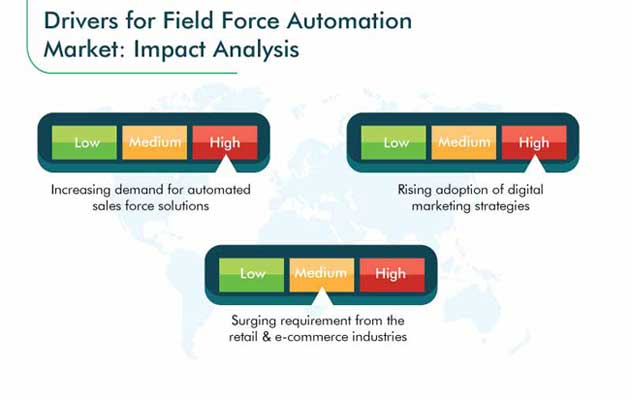

Spurring Demand for Automated Salesforce Solutions Facilitating Market Growth

Enterprises require automated salesforce solutions for a better control of sales operations. These solutions offer support to field representatives in several processes, such as marketing automation, lead tracking, automated assessment of the marketing needs of clients, automatic approval of orders, and assembly of all sales tasks on a single dashboard.

In addition, these solutions provide an improved customer experience, streamlined sales operations, and enhanced efficiency of field agents. To offer the aforementioned benefits to enterprises, field force automation market players are concentrating on the introduction of automated sales force solutions worldwide.

Surging Adoption of Digital Marketing Strategies Pivotal in Market Advance

Another key factor supporting the market growth is the increasing adoption of digital marketing among business organizations to expand their customer base, achieve a competitive edge, and fulfill the customized needs of businesses. Besides, the swift deployment of next-generation technologies, such as ML, cloud computing, robotics, and computer vision, has led to the digital transformation of business entities.

Rising Solution Need in Retail & E-Commerce Industry Boosting Market Size

The retail & e-commerce sector has been using field force automation solutions on a substantial rate to mitigate the burgeoning number of challenges, such as the changing customer demands, high labor costs, raw material cost inflation, and complex process of supply chain management (SCM). Moreover, the deployment of such solutions helps retail & e-commerce companies gain a competitive edge in the market.

Additionally, the increasing revenue encourages retailers to make huge investments in sales automation solutions, as they offer a detailed analysis of customer requirements, automated control over sales operations, scheduled delivery of goods, and improved customer loyalty.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$1,196.9 million |

Forecast Period CAGR |

20.9% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Offering, Enterprise, Deployment, Pricing Model, Application, Vertical, Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Japan, China, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E., Turkey |

Secondary Sources and References (Partial List) |

Association for Advancing Automation (A3), Association for Manufacturing Technology (AMT), Association for the Advancement of Artificial Intelligence (AAAI), Canadian Professional Sales Association (CPSA), International Society of Automation (ISA), National Association for Sales Professionals (NASP), Sales Management Association |

Explore more about this report - Request free sample

Market Players Acquiring Others to Gain Competitive Edge in Industry

The global field force automation market is witnessing high competition, owing to the increasing need for automated field operations, demand for effective lead generation tools, tracking of all the customer insights, and gathering real-time field data, for providing a personalized experience to customers, among enterprises. Major industry players, such as Salesforce.com Inc., IFS AB, and ServiceMax Inc., have acquired small players to capture a larger share, strengthen business, and improve brand positioning. For instance:

- In December 2019, IFS AB announced the acquisition of U.S.-based field service management (FSM) solutions provider Astea International Inc. for an undisclosed amount. This acquisition strengthens the expansion plans of the former company in the global market, by helping it offer enhanced FSM offerings to an increasing number of customers.

- In October 2019, Salesforce.com Inc. acquired MEA-based FSM company ClickSoftware Technologies Ltd. for $1.35 billion. With this acquisition, the former company aimed to combine the capabilities of Salesforce Field Service Lightning, an FSM solution, and ClickSoftware, in order to offer innovative and end-to-end field service solutions to field agents.

Some of the Key Players in the Field Force Automation Market Report include:

-

Oracle Corporation

-

SAP SE

-

Salesforce.com Inc.

-

Microsoft Corporation

-

Trimble Inc.

-

ServiceMax Inc.

-

Channelplay Limited

-

BeatRoute Innovations Pvt. Ltd.

-

MarketXpander Services Private Limited (Leadsquared)

-

IFS AB

-

Kloudq Technologies Limited

-

FieldEZ Technologies Inc.

-

Acumatica Inc.

-

Infosys Limited

Field Force Automation Market Size Breakdown by Segment

The field force automation market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Offering

- Solutions

- Mobile

- Web-based

- Services

- Professional

- Managed

Based on Enterprise

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Based on Deployment

- Cloud

- On-Premises

Based on Pricing Model

- Subscription-Based

- Free

- Quote-Based

Based on Application

- Sales Order Management

- Customer Service

- Lead Management

Based on Vertical

- Information Technology (IT) & Telecom

- Manufacturing

- Logistics & Transportation

- Healthcare

- Retail & E-Commerce

- Banking, Financial Services, and Insurance (BFSI)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Asia-Pacific (APAC)

- Japan

- China

- India

- South Korea

- Australia

- Middle East and Africa (MEA)

- Saudi Arabia

- U.A.E.

- Turkey

- South Africa

- Latin America (LATAM)

- Brazil

- Mexico

In 2030, the field force automation market will reach $9,033.0 million.

The impact of COVID-19 on the field force automation industry has been positive, as the demand for automatic collection of field data has risen during the lockdown

The subscription-based pricing model generates the highest revenue in the field force automation market.

Cloud-enabled FFA mobile applications are the field force automation industry trend due to their multi-platform support, data back-up, data access and sharing flexibility, and high storage capacity.

Acquisition is the strongest strategic measure in the field force automation market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

.jpg)