Market Statistics

| Study Period | 2019 - 2030 |

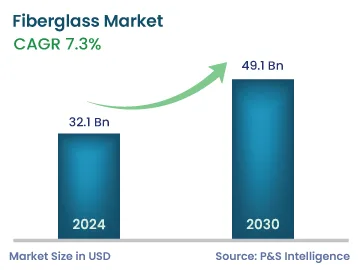

| 2024 Market Size | 32.1 Billion |

| 2030 Forecast | 49.1 Billion |

| Growth Rate(CAGR) | 7.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Report Code: 12810

Get a Comprehensive Overview of the Fiberglass Market Report Prepared by P&S Intelligence, Segmented by Type (E Glass, ECR Glass, H Glass, AR Glass, S Glass), Product (Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strands), Application (Composites, Insulation), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 32.1 Billion |

| 2030 Forecast | 49.1 Billion |

| Growth Rate(CAGR) | 7.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global fiberglass market is valued at an estimated USD 32.1 billion in 2024, which is expected to reach USD 49.1 billion by 2030, progressing with a CAGR of 7.3% during 2024–2030. This is because of the unique properties of fiberglass, such as high resistance to chemicals, high tensile strength, non-flammable nature, and relatively low density. Thus, it has applications in several industries, such as construction & infrastructure, aerospace, wind energy, automobile, boats, septic tanks, and water tanks.

The increasing application of fiberglass in construction & infrastructure is a major driver for this market. The material is widely used for surface coating, insulation, and roofing purposes in construction and related sectors. Moreover, it offers similar benefits as aluminum, concrete, timber, and iron, with fewer drawbacks and higher cost-effectiveness. In addition, the waterproof feature of this material makes it popular in exterior and roofing panel applications. This is also why it is utilized in indoor installations and areas where water exposure is a constant phenomenon.

Moreover, the automobile industry uses various materials to manufacture automobiles, including aluminum, iron, plastic, steel, and glass. Fiberglass has also started becoming popular as it is lighter in weight, chemically resistant, and more corrosion-retardant than steel. It is also gaining preference with the growing demand for higher vehicle speeds, as iron and steel make the vehicle heavy and slow. As a result, fiberglass is increasingly being incorporated into the bumpers, doors, and casings of automobiles.

By glass type, the E category dominate the market, with a share of 25%, in 2023. This is because of the special properties of E glass, such as resistance to abrasion and vibrations, good flexibility, and higher specific resistance than steel. Therefore, E glass fibers are used on a large scale as an insulator for electrical conductors, in the textile industry, and for making advanced composites.

The S category also holds a considerable share in the market because this variant is made from oxides of silicon, magnesium, and alumina. Moreover, it has higher tensile strength as compared to other kinds of fiberglass; hence, it finds usage where durability and strength are important. Therefore, the key applications of this material are electrical goods, automobiles, storage tanks, and pipes.

Further, E-CR glass is highly chemically and thermally resistant and has higher dielectric strength. Because of this, it is preferred for laminates that will come into contact with bases and acids, such as the machines, containers, and pipelines utilized by the chemical industry.

Glass wool accounts for the largest share in the fiberglass market, and it is expected to grow at a CAGR of 7.5% during the forecast period. This will be because of the increasing usage of glass wool in the construction industry because of its fire resistance, good tensile strength, and insulative property. It is primarily used for roof and ceiling insulation in halls and other large areas as it blocks the loss and gain of heat. This is also why HVAC ducting systems are an important application for this material.

Chopped strands are expected to be the fastest-growing category during the forecast period owing to its burgeoning usage for the manufacturing of vehicles and in a booming construction sector. Moreover, the increasing consumption of fiberglass composites in different industries, such as aerospace, wind energy, and consumer durables will drive the market in the coming years.

Fiberglass yarn also holds a significant share in the market, attributed to its rising usage in the construction, aerospace, textile, and electronics industries. It is used in electronic products because of its high mechanical strength, low elongation, thermal resistance, and excellent dielectric properties.

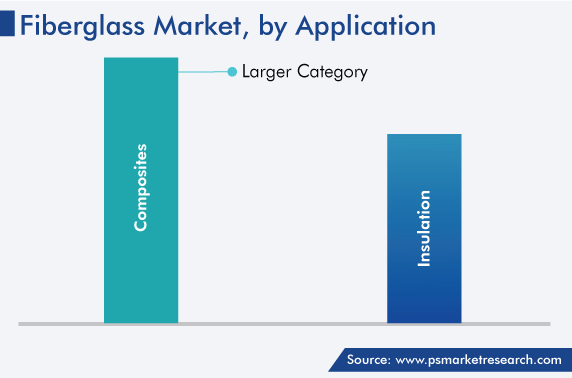

By application, composites hold the largest share in 2023 because of the various benefits of fiberglass composites over traditional materials, such as wood and steel. The key advantages associated with it are cost-effectiveness, corrosion resistance, good structural strength, and low maintenance requirement. Hence, the increasing use of fiberglass composites in the automotive, aerospace, and construction industries is expected to drive the market during the forecast period.

Fiberglass is widely used in residential construction. Fiberglass materials are extensively used in residential spaces as insulation, due to their durability and fire resistance. Thus, as governments continue to work to offer housing for everyone, the market will have numerous opportunities, especially in highly populated countries, including India and China.

Drive strategic growth with comprehensive market analysis

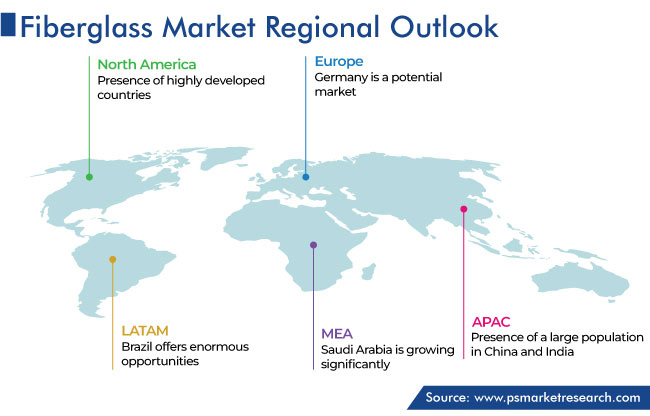

APAC dominates the market, with a share of 50%, in 2023. This is due to the high-volume utilization of fiberglass in various industries, increase in the level of industrialization, and presence of a large population in China and India. Moreover, the increasing disposable income and the presence of big players are likely to drive the market in the APAC region during the forecast period.

In APAC, India and China both have more than 1.4 billion people, which continues to increase the demand for fiberglass materials in numerous industries. Further, the easy availability of raw materials and low-cost labor drive the market growth in the region.

Moreover, companies are engaging in mergers & acquisitions to expand their presence in APAC. For instance, in February 2023, U.P. Twiga Fiberglass Ltd., a provider of glass wool insulation in India, was acquired by Saint-Gobain. The main objective of this acquisition is to accelerate its business growth and expand its range of solutions for light and residential construction.

North America is the significant-growing market because of the extensive use of fiberglass insulation in construction and the growing automotive industry. In addition, to cement their positions and gain a larger customer base, companies are launching new fiberglass products. For instance, in January 2023, Therma-Tru Corp. announced its steel and fiberglass lineup featuring an entry door system, paint and stain color options, and decorative glass designs.

Based on Type

Based on Product

Based on Application

Geographical Analysis

Companies are focusing on mergers and acquisitions for expanding their market share. For instance, in June 2022, Owens Corning and Pultron Composites announced a joint venture to manufacture fiberglass rebars, to provide more-advanced and higher-performance concrete reinforcement products. The companies also aim to augment the usage of fiberglass rebar in construction and heavy-load structural applications.

Moreover, in May 2022, SEI Group LLC announced the acquisition of Energy Conservation Insulation Company, based in Oregon, U.S. ECI is a provider of residential insulation services in the central and eastern Oregon regions, with key offerings including fiberglass, cellulose products, and spray foam.

The market for fiberglass is witnessing a CAGR of 7.3%.

The fiberglass industry 2030 value will be USD 49.1 billion.

Glass wool generates the highest revenue in the market for fiberglass.

The key players in the market for fiberglass are engaging in acquisitions, establishing joint ventures, and launching new products.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages