Autorefractors and phoropters witness the highest sales in the market for eye testing equipment.

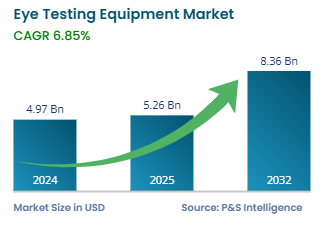

In 2032, the eye testing equipment industry will value USD 8.36 billion.

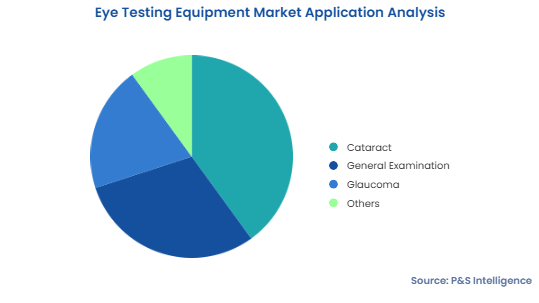

Which will be the fastest-growing application in the eye testing equipment market?+

Glaucoma will lead the market for eye testing equipment, by application, in terms of growth.

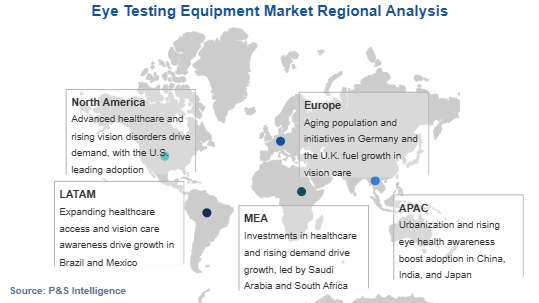

North America and APAC offer the best opportunities in the eye testing equipment industry.

Players in the market for eye testing equipment are engaging in acquisitions and product launches.