Report Code: 12069 | Available Format: PDF

- Home

- ICT and Media

- Extended Reality Market

Extended Reality Market Research Report: By Component (Hardware, Software, Services), Device Type (Mobile, Personal Computer, Headset), User (Single-User, Multi-User), Delivery Model (Consumer Engagement, Business Engagement), Application (VR, AR, Mixed Reality), Industry (Retail, Education, Industrial & Manufacturing, Healthcare, Media & Entertainment, Gaming, Aerospace & Defense – Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12069

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global extended reality market was valued at $38.3 billion in 2022, and it is predicted to reach $394.8 billion by 2030, advancing at a 38.5% CAGR during 2022–2030. The industry is driven by the growing use of connected devices and smartphones, increasing collaborations among market players, and rising adoption of AR and VR.

In India, the growing internet penetration and the increased government initiatives toward digitization are the key factors driving the market. Besides, the rising adoption of AR/VR in numerous industries, including construction, entertainment, automotive, and retail, is propelling the growth of the industry. Also, the growing deployment of 5G and rising investments in AR/VR startups are boosting the market.

The increasing focus on gesture-based computing is a key trend being observed in the XR market. Gesture-based computing can be defined as an interface where humans interact with digital resources without the use of common input devices, including a keyboard, game controller, mouse, and voice-entry mechanism, and instead employ body movements and gestures for the purpose. An increasing use of gesture-based computing with AR/VR can be seen across industries, including healthcare, manufacturing, and oil & gas. With the integration of these technologies, medical students are now performing medical procedures on virtual patients on simulation models.

Similarly, in manufacturing, product development engineers are developing the design and look of the product with the help of gesture-based computing and AR/VR, which can be altered as per the requirement.

In medical settings, XR platform allows patients to observe surgical operations before they actually undergo one, as well as provide appropriate training and guidance for surgeons, enhancing trust and comfort level and reducing the cost of care. It can be used to overlay real- time data into live procedures, cure some mental conditions and to minimize dependency on pain medication.

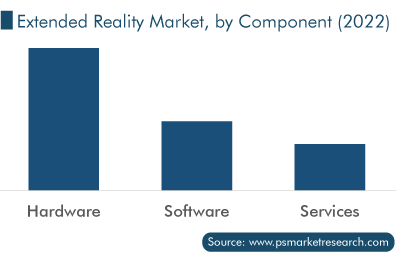

Hardware is Widely Adopted by People

The hardware category held the largest share, around 55%, in the market in 2022. This is because of the increasing penetration of smart devices and the reduced cost of components, including sensors, displays, cameras, and position trackers.

On the other hand, service category will grow the fastest in the years to come. The rising adoption of XR devices has further increased the need for services, such as integration & maintenance, training, and repair, owing to which the demand in this category will grow at a rapid pace.

Majorly Used by Single-User

The single-user category held the major share of revenue in 2022. This can be attributed to the fact that the currently most organizations are offering platforms that support a single-user interface with virtual environment. However, in terms of growth, the multi-user category is projected to witness the higher CAGR, over 35%, in the coming years. This can be because of the rising adoption of multi-user AR and VR devices in industries, including retail, manufacturing, aerospace & defense, entertainment, and education, for training and education purposes.

AR Holds Significant Market Share

AR held significant share in the market in 2022. This was because of the high demand for AR devices and applications in the healthcare, retail, and e-commerce industries. In addition, rising investments in AR worldwide, along with the growing demand for technology among individuals, are further driving the category growth.

Besides, the MR category is expected to grow the fastest in the years to come. This is mainly due to the growing demand for MR in aerospace & defense for training and simulation purposes and the huge funding in the technology by organizations for product planning to enhance consumer experience. For instance, in May 2020, Apple Inc. acquired NextVR Inc. to launch a new product line supported by VR and AR technologies.

Business Engagement was Most Preferred

Business engagement held the largest share in 2022. This can be attributed to the increased adoption of immersive technologies in organizations for employee training and development purposes. Moreover, the increasing use of XR technologies to solve business issues and create innovative solutions to meet client needs will also to drive the growth of the category in the years to come.

On the other hand, the consumer engagement category is projected to witness faster growth, throughout the forecast period. This can be mainly ascribed to the increasing demand for VR and AR technologies among consumers, primarily for gaming and entertainment purposes. The development of AR/VR apps for travel & tourism is further supporting the growth in this category.

Rising Adoption of AR and VR

The rising adoption of AR and VR by businesses and general public is another key driver which is expected to support the growth of the XR market during the forecast period. In recent years, augmented reality (AR) and virtual reality (VR) have witnessed tremendous popularity, including applications driven by the epidemic due to social distancing constraints. AR/VR, which was once considered a niche product in the entertainment and gaming industries, is now being used in numerous areas, including education, health care, and marketing.

Businesses are increasingly using AR/VR solutions to provide a more interactive and engaging customer experience in order to increase brand awareness and provide product demos and product information. Consumers, on the other hand, are adopting AR/VR devices for knowledge and entertainment purposes through immersive experience. Thus, the increasing penetration of HMDs is expected to drive the market growth in the coming years.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$38.3 Billion |

Revenue Forecast in 2030 |

$394.8 Billion |

Growth Rate |

38.5% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By Device Type; By User; By Delivery Mode; By Application; By Industry; By Region |

Explore more about this report - Request free sample

Major Opportunities

- The growing AR/VR market in China, India, and Brazil, is expected to boost the prospects in the near future. The increased spending on AR and VR technologies in these countries is the major factor for the market growth.

- Also, the growing focus of AR/VR startups in developing countries on enhancing customer experience has further increased the scope for technology development and adoption.

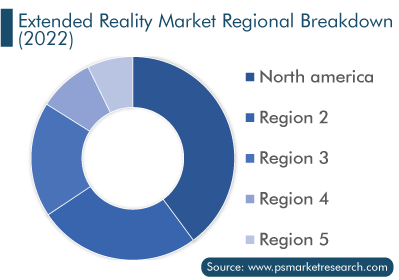

North America Held Largest Share

The North American extended reality market held the largest share, of over 40%, in 2022. The key factor contributing toward the market growth is the high adoption of immersive technologies for training purposes in industries, including oil & gas, mining, and construction. Moreover, the presence of a large number of companies that are investing heavily in such technologies to introduce advanced solutions is another important factor for the growth of the industry. The surge in demand for AR/VR in organizations for training & development purposes along with the growing investment in immersive technologies across industries, including education, e-commerce, and retail, is projected to further drive the market growth in the near future.

Since around 2012, the U.S. military started using VR technology for training. Many military trainings in the U.S. are already conducted using simulations rather than real exercises, with a concentration on flying, battlefield, and medical training. This is the most practical application of the technology because simulations are considerably cost effective than actual fighter jet training, which is why the military was an early consumer of the platform. Combat training, mission rehearsal, concept creation, material design and testing, medical training, and personnel selection are all examples of XR military applications.

Moreover, Europe held the second largest share in 2022. The market was mainly driven by the growing technology adoption in the region. The increasing use of AR and VR for training and simulation in automobile manufacturing and the growing penetration of immersive technologies among youngsters for gaming and entertainment purposes are the key reasons for the regional market growth.

The European Commission is funding research and innovation in order to create a European XR ecosystem. The advancement of technology, such as 5G/6G, data, artificial intelligence, edge, and cloud computing provides advanced and powerful XR capabilities. The European Commission is also supporting cross-pollination between disciplines and domains, with a particular emphasis on industry and SMEs, to help Europe become a mainstay in XR.

Moreover, in LATAM, the industry is boosting due to the rising deployment of immersive technologies in industries for training purposes and among consumers for entertainment purposes. The increasing government as well as private investment in immersive technologies, along with the rising focus of key market players in the region.

Top Extended Reality Provider Are:

- Microsoft Corporation

- Sony Corporation

- Meta Platforms Inc.

- HTC Corporation

- Google LLC

- Samsung Electronics Co. Ltd.

- PTC Inc.

- Seiko Epson Corporation

- Apple Inc.

- Qualcomm Incorporated

Extended Reality Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the market, to offer accurate market estimations for 2017–2030.

Based on Component

- Hardware

- Software

- Services

Based on Device Type

- Mobile

- Personal Computer

- Headset

Based on User

- Single-User

- Multi-User

Based on Delivery Model

- Consumer Engagement

- Business Engagement

Based on Application

- Virtual Reality

- Augmented Reality

- Mixed Reality

Based on Industry

- Retail

- Education

- Industrial & Manufacturing

- Healthcare

- Media & Entertainment

- Gaming

- Aerospace & Defense

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The extended reality market had a value of $38.3 billion in 2022.

North America dominated the extended reality industry.

AR was the most used technology in the extended reality market.

Industrial and manufacturing sector was the largest user of the extended reality industry.

Single-user dominated the extended reality market.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws