Ethylene Vinyl Acetate Market Future Prospects

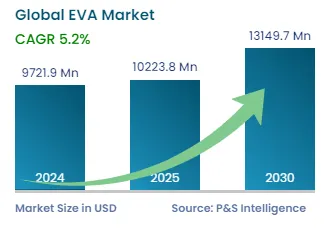

The global ethylene vinyl acetate market is estimated to have generated USD 9,721.9 million in 2024, and it is expected to grow at a CAGR of 5.2% during 2024–2030, to reach USD 13,149.7 million by 2030.

The key factors responsible for the growth of the industry include increasing solar photovoltaic (PV) installation, surging demand in various industries, and rising agricultural activities.

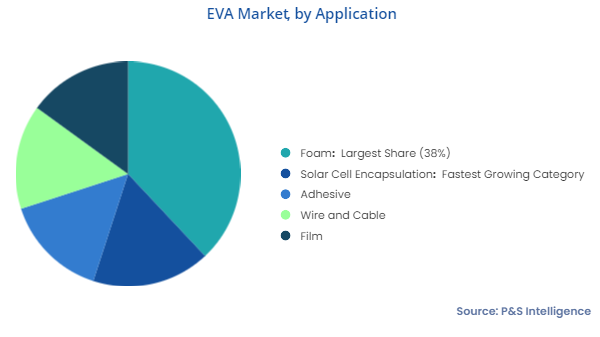

Furthermore, the demand for EVA for the production of adhesives is rising due to the growing demand for adhesives in the textile, packaging, bookbinding films, and coated paper industries. Since ethylene provides high mechanical strength, block resistance, and paraffin solubility, and VA provides flexibility, adhesion, and better low-temperature performance, EVA adhesives are formulated to adhere to waxes, paper, paper stocks, and various aqueous coatings.

Additionally, EVA is heavily used in solar modules as an encapsulating agent. The solar cells encapsulating the films form a sealing and insulating film that prevents the entry of air and the formation of moisture, which allows the sun’s energy to pass through it while being resistant to sunlight degradation over time.