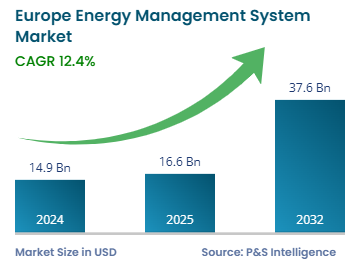

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 14.9 billion |

| 2025 Market Size | USD 16.6 billion |

| 2032 Forecast | USD 37.6 billion |

| Growth Rate(CAGR) | 12.4% |

| Largest Country | Germany |

| Fastest Growing Country | UK |

| Nature of the Market | Fragmented |

Report Code: 12530

This Report Provides In-Depth Analysis of the Europe Energy Management System Market Report Prepared by P&S Intelligence, Segmented by Offering (System, Service), Component (Control systems, Communication systems, Software, Field equipment, Sensors, Other Hardware), Device (In-House Displays, Thermostats, Smart Plugs, Load Control Switches), Solution (Carbon Energy Management, Demand Response Management, Utility Billing and Customer Information System), Vertical (Power and energy, Telecom & IT, Manufacturing, Office and commercial buildings, Education, Retail, Healthcare, Residential), Application (IEM, BEM, HEM), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 14.9 billion |

| 2025 Market Size | USD 16.6 billion |

| 2032 Forecast | USD 37.6 billion |

| Growth Rate(CAGR) | 12.4% |

| Largest Country | Germany |

| Fastest Growing Country | UK |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The European energy management system market size was USD 14.9 billion in 2024, and the market size is predicted to reach USD 37.6 billion by 2032, advancing at a CAGR of 12.4% during 2025–2032.

The market expands at a fast pace because of mounting energy efficiency rules together with increasing power costs and escalating sustainability demands. Organizations together with government institutions choose EMS as a tool for better energy usage alongside decreased greenhouse gas production while integrating clean power solutions. The market grows because of smart grids AI-driven analytics and IoT-based automation which enhance precision and reduce costs in energy management. The market is increasingly shifting towards cloud-based EMS platforms and decentralized power generation systems, integrated with real-time monitoring capabilities. The European nations Germany along with France and UK serve as market leaders for EMS adoption because of their comprehensive policy backing and industrial business needs.

The energy management system market demonstrates positive industry prospects because of the European Green Deal together with net-zero goals and advanced AI/machine learning technology for predictive energy optimization. The EMS market will experience additional growth because of fluctuating energy prices and rising sustainability demands thereby providing advanced solutions that optimize efficiency and resilience for industrial, commercial, and residential clients.

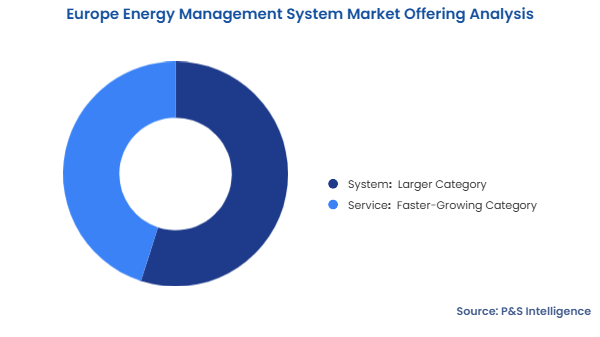

The system category held the larger market share, of 55%, in 2024. This is because it contains essential EMS platforms together with hardware that enables energy monitoring along with automation and optimization capabilities. Industrial facilities together with utility companies and commercial operations implement EMS systems for gathering real-time power usage information and operating power networks along with achieving cost-efficiency benefits. Large organizations give preference to complete EMS solutions before acquiring supplementary services because of their need to meet rising regulations and build smart energy systems.

The service category will grow at a higher CAGR, of 14%, during the forecast period, because organizations increasingly adopt AI-driven and cloud-based, and IoT-enabled EMS solutions. The growing need for businesses to track energy usage in real time predict outcomes and automate control systems leads to improved energy efficiency while lowering operational expenses. Remote energy management initiatives together with decentralized energy grids create rising requirements for continuous monitoring and control services.

The offerings analyzed here are:

The software category held the largest market share, of 50%, in 2024, because utilities and grid operators need sophisticated platforms to control extensive energy distribution networks maintain power grid stability and, integrate renewable power sources. The utility EMS software proves essential for European power management because it regulates flows and predicts customer needs while enhancing grid functionality. Regulations aimed at achieving carbon neutrality alongside energy efficiency requirements accelerate organizations toward implementing advanced energy management systems.

The sensor category will grow at a highest CAGR, of 14.8%, during the forecast period. This is because customers need IoT-based intelligent energy management solutions. Real-time data collection alongside automation requires sensors to monitor energy consumption together with equipment performance and environmental conditions in EMS platforms. Smart meters and industrial automation together with AI-driven monitoring systems are quickly driving up the market demand for precise energy sensors within residential commercial and industrial sectors.

The components analyzed are:

The thermostats category held the largest market share, of 30%, in 2024, becoming the standard choice for residential and commercial HVAC system optimization in buildings. European energy efficiency regulations together with expensive energy costs and smart building requirements have made thermostats essential for reducing energy waste and environmental emissions. The combination of AI, IoT, and cloud-based EMS platforms with these solutions makes them the optimal choice for domestic and commercial settings.

The smart plugs category will grow at a highest CAGR, of 12.8%, during the forecast period.

This is because they remain affordable and easy to install while people want real-time energy monitoring capabilities. The rising commitment to cut standby energy waste and remotely control energy usage prompts businesses and customers to adopt smart plugs because they provide affordable scalability. The integration between smart plugs and both home automation systems and voice assistants and mobile applications has accelerated their market adoption.

The devices analyzed here are:

The carbon energy management category held the largest market share, of 45%, in 2024. This is because European sustainability rules and corporate carbon reduction requirements along with EU net-zero targets drive its dominance. Businesses alongside industries use carbon tracking along with reporting and energy optimization solutions to meet requirements from the EU green deal and the corporate sustainability reporting directive (CSRD). Organizations depend on this segment to track their emissions enhance their energy efficiency and succeed at their environmental objectives.

The demand response management category will grow at a highest CAGR, of 13.5%, during the forecast period. This is the most rapidly expanding solution because of growing system instability rising renewable energy penetration and immediate load distribution requirements. The implementation of demand response programs across Europe aids decentralized energy systems with renewable power (wind and solar among others) to optimize energy consumption and protect against grid failures while easing peak demand on the distribution network. The growing acceptance of AI-controlled demand response systems among businesses and utilities drives quick market expansion in this area.

The solutions analyzed here are:

The power and energy category held the largest market share, of 20%, in 2024. This is because utilities and grid operators along with energy providers depend on EMS solutions for maintaining grid stability and integrating renewable energy while preserving real-time energy monitoring capabilities. Energy suppliers direct their investments toward AI-powered EMS and demand response management systems and carbon tracking platforms because Europe demands decarbonization and efficient smart grid operations.

The residential category will grow at a highest CAGR, of 13.8%, during the forecast period, because homeowners face cost increases and embrace smart home technology as the government supports energy-efficient measures. Shared home automation systems smart thermostats and smart meters appeal to homeowners who seek simultaneous energy cost reduction with reduced power usage. The expansion of solar panels alongside battery storage systems and EVs generates a rising need for house energy control solutions that apply AI and IoT technologies.

The verticals analyzed here are:

The IEM category held the largest market share, of 65%, in 2024, because manufacturing plants and heavy industries together with utilities consume abundant quantities of energy. Industries are turning to EMS solutions because EU energy efficiency regulations together with carbon reduction requirements and increasing electricity costs drive them to boost energy utilization efficiency while cutting operating expenses and building sustainability. Smart energy management systems experience enhanced demand because industrial facilities integrate AI with IoT and automation technology.

The HEM category will grow at a highest CAGR, of 15%, during the forecast period. This is because residential power costs increase while smart homes gain popularity and technical advancements in DERs happen through solar panels and battery storage. Customers spend their money on smart thermostats combined with energy monitoring systems and AI-based automation technology to both track their energy usage and reduce their utility bills. The development of EV charging systems alongside government programs for energy-efficient residences drives additional adoption of Home Energy Management solutions.

The applications analyzed here are:

Drive strategic growth with comprehensive market analysis

The Germany held the largest market share, of 30%, in 2024, because of the country's strong industrial foundation together with modernized energy infrastructure and its strict energy efficiency standards. Germany leads the way in renewable energy deployment while operating sophisticated EMS solutions to ensure power grid stability along with energy optimization across its power systems.

The UK will grow at a higher CAGR, of 14.1% during the forecast period. This is because the nation sets strict carbon neutrality goals while investing in smart grids and implementing Artificial Intelligence for energy solution management systems. The sustained growth of smart-meter technology alongside digitalization efforts and rising corporate sustainability movements speeds up the deployment of EMS systems. Real-time energy monitoring and optimization technologies have become essential for businesses because rising electricity costs and energy cost reduction priorities compel them to take such steps.

The regions analyzed in this report are:

The European energy management system market is fragmented because it includes big multinational firms together with regional companies and specialized technology providers. The market is fragmented due to varying energy regulations, diverse industry needs, and rapid technological advancements. The EMS market consists of several segments, including industrial automation, smart grids, AI-based analytics, and residential energy management, fostering a decentralized competitive landscape. Schneider Electric is a key market leader, offering comprehensive EMS solutions with a global presence and established business segments in three major sectors. This market spans manufacturing, utilities, commercial buildings, and smart cities, continually expanding as customers increasingly seek decentralized energy systems, AI-driven solutions, and real-time energy monitoring.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages