Europe E-Signature Market Analysis

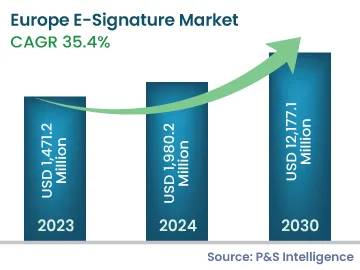

The European e-signature market generated revenue of USD 1,471.2 million in 2023, which is expected to witness a CAGR of 35.4% during 2024–2030, to reach USD 12,177.1 million by 2030. This is primarily due to the rise in the prevalence of remote working models, favorable government laws, increase in the volume of online documentation processes, and cost-effectiveness of e-signatures.

The growth in the e-commerce industry has triggered the boom of several related sectors. In this sector, e-signatures provide efficiency, strong partner/customer relationships, and deep integration of supply chains. Thus, the growing e-commerce sector is expected to provide growth opportunities to players in the European e-signature market. As more businesses move online, more legally binding documents would be required for governing and accommodating this transition. Additionally, this would lead to a significant requirement for solutions that offer security to sensitive documents online.

Moreover, the rising internet penetration, along with the surging number of connected devices, would drive e-businesses’ prosperity in Europe. As a result of the growing e-commerce market, the demand for secure transactions is increasing, which would drive the demand for e-signature solutions in the coming years.