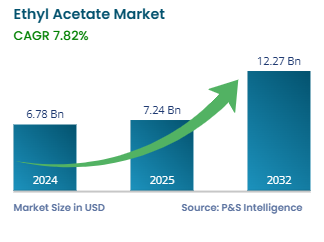

The ethyl acetate market size stood at USD 6.78 billion in 2024.

What will be the growth rate of the ethyl acetate market during the forecast period?+

During 2025-2032, the growth rate of the ethyl acetate market will be around 7.82%.

Food & Beverage is the largest end-use industry in the ethyl acetate market.

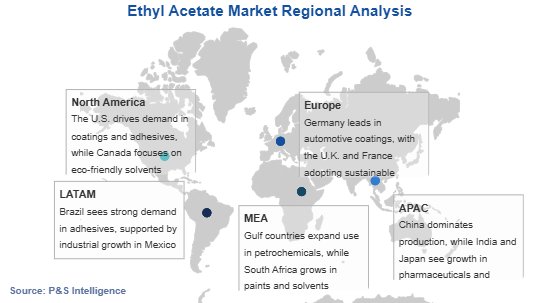

The major drivers of the ethyl acetate market include the growing end-use industries such as construction, automotive, and pharmaceutical; the rising need for this chemical in the flexible packaging sector; and the increasing demand for artificial leather.

Ethyl acetate market is fragmented in nature.