Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 798.1 Million |

| 2030 Forecast | USD 2,098.9 Million |

| Growth Rate(CAGR) | 17.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12642

Get a Comprehensive Overview of the ESG Reporting Software Market Report Prepared by P&S Intelligence, Segmented by Component (Solutions, Services), Deployment Type (On-Premises, Cloud), Organization Size (SMEs, Large Enterprises), Vertical (BFSI, IT and ITeS, Government and Public Sector, Manufacturing, Retail and Consumer Goods, Healthcare and Life Sciences, Energy and Utilities), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 798.1 Million |

| 2030 Forecast | USD 2,098.9 Million |

| Growth Rate(CAGR) | 17.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global ESG reporting software market revenue was valued at USD 798.1 million in 2024, and it is expected to reach USD 2,098.9 million by 2030, advancing at a CAGR of 17.5% during the forecast period. This is ascribed to the rising industrialization coupled with urbanization; the rising number of startups requiring investment or funding; the mounting need of several companies to attain higher responsibility and sustainability; and the growing trend to become green companies.

ESG reporting software helps businesses to measure and report their performance such as environmental, social, and governance (ESG). Such reporting is becoming extremely essential in recent years as investors concerning more about sustainable investments. Moreover, several companies have started to adopt such reporting to meet legislation. Also, as ESG investigation and reporting is complex and needs efficiency in a process, such software is playing a vital role for investors as well as organizations.

In addition, it helps businesses track their performance over a period of time, compare their performance to peers, and distinguish the set of opportunities for enhancement. Such reporting software also automates the ESG reporting procedure, which makes it simpler as well as faster for organizations to fulfill the set of reporting requirements. The reporting software for ESG can also offer a sort of insight into organizations that manage ESG risks efficiently, which further helps investors to make their decision while investing in the firms.

In past, ESG reporting was used as a voluntary option, but recently, it has become compulsory for organizations. In context to the same, the EU has adopted new regulations, which lead all EU stock exchange-listed organizations to disclose their ESG data at the beginning of 2023. Similarly, in May 2022, the U.S. Securities and Exchange Commission (SEC) proposed new legislation, which compels all organizations to disclose their sustainability information.

Moreover, in 2007, the Non-Financial Reporting Directive (NFRD) was implemented in the EU, which states that all public-listed companies standing with above 500 employees should report non-financial information (The European Commission, 2022). This requirement from the NFRD affected more than 11,000 companies in the region. Additionally, in April 2021, the Commission implemented the Corporate Sustainability Reporting Directive (CSRD), which builds upon the NFRD and takes over the role of non-financial sustainability reporting. It expands its scope to cover all large, listed firms with comprehensive reporting requirements and standards.

Moreover, according to the Commission, an audit is required for the information reporting by companies. The CSRD is tailor-made to the EU guidelines, and the drafts are established by the European Financial Reporting Advisory Group (EFRAG). As a result, businesses need to report their sustainable performance to authorities, which, in turn, will further drive the overall ESG reporting software market.

The trend of greenwashing is observed in the market. It refers to the promotion of a product, service, or entire business to become environment-friendly. Some companies are misleading or embellished claims in their marketing proposals or sustainability reports about this. These unsubstantiated claims can be made intentionally or unintentionally. Thus, it becomes critical to differentiate between retailers that are truly adopting ESG culture and those that are seemed camouflaged as green.

Moreover, regulatory authorities are increasingly examining businesses’ sustainability claims and inspecting allegations of greenwashing. This risk of greenwashing can be avoided by adopting ESG assurance, which refers to the authentication of the data to be included in ESG-related disclosures and reports. The whole procedure can be done internally or via an external auditor.

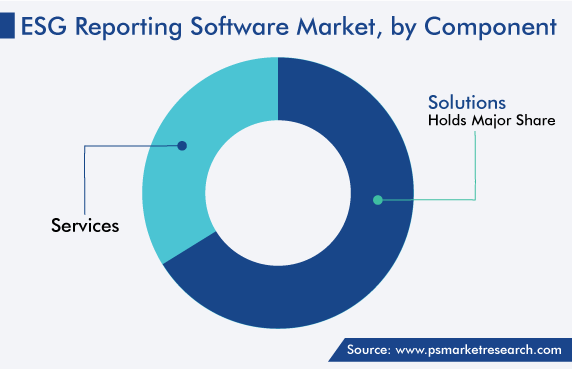

The solutions category contributed the majority of revenue share, around 70%, in 2022, and it is expected to maintain its position during the forecast period as well. This is due to the surging need for ESG reporting across industrial verticals, the increasing need of investors to see actual financials and operational processes data while investing, and the rising focus of companies to report crucial information with less complexity.

Digitalization is growing rapidly due to its advantages, including effective resource planning, which has upsurged the acceptance of digital technologies in businesses. They need to store their data in a secure and cost-efficient manner, and to enhance overall efficiency. In order to attain effectiveness, cloud-based data management solutions provide a feasible choice, as it is easy to use cloud-based data throughout the firms and requires minimum IT infrastructure support. Therefore, the high generation of corporate data is the prime factor contributing to the market growth.

The BFSI category will witness the highest growth rate in the coming years, advancing at a CAGR of over 13%. Countries and organizations are facing sustainability issues, including social outbreaks, corporate governance, climate change, and health crises. Moreover, the acceptance of such software in the sector is due to the increasing focus of businesses on operational and process efficiencies, risk and compliance, and product innovation.

The SMEs category, based on organization size, will register faster growth during the forecast period. This can be attributed to the growing SME sector due to the rising number of SMEs and related investments; the surging need for enhanced overall firm efficiency; and the increasing work effectiveness of employees.

Drive strategic growth with comprehensive market analysis

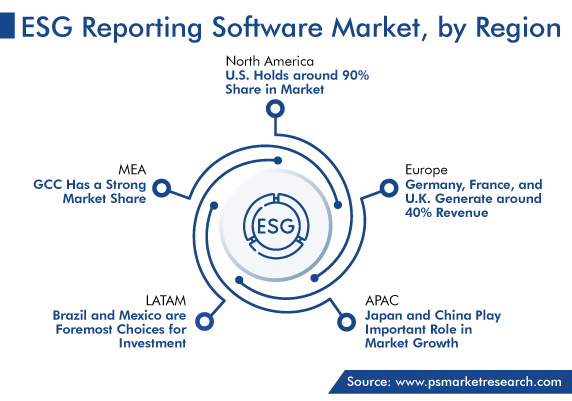

North America accounted for the largest revenue share, around 40%, in 2022, and it is further expected to maintain its dominance during the forecast period. This is due to the presence of major industry titans, well-established IT companies, and a high adoption rate of advanced technologies in the region.

Additionally, the well-developed healthcare infrastructure, the surge in shifting of the focus of BFSI firms from CSR to ESG, and government-supporting regulations for public companies are driving the regional market.

Whereas the APAC market will witness the fastest growth in the coming years. This can be due to the rapid digitalization associated with urbanization; upsurge in per capita income; high growth in the telecom and IT, manufacturing, retail, and consumer goods industries; and technological advancements. Additionally, the growing funding and investment activities by industry giants to setting their production facilities in the region, owing to several benefits; and the surging need to maintain transparency in terms of financials of companies are some other reasons responsible for the regional market growth.

Furthermore, Europe held a significant revenue share in 2022, and it is expected to maintain its position in the coming years as well. This is due to the significant number of players and several corporate environments, sustainability, and governance legislations.

Based on Component

Based on Deployment Type

Based on Organization Size

Based on Vertical

Geographical Analysis

The ESG reporting software market size stood at USD 798.1 million in 2024.

During 2024–2030, the growth rate of the ESG reporting software market will be 17.5%.

North America is the largest region in the ESG reporting software market.

The major drivers of the ESG reporting software market include the growing digitalization, the mounting need to collect and organize ESG data that assists businesses in meeting numerous disclosure requirements, and the increasing government initiatives across the globe governing ESG investments.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages