Epigenetics Market Future Prospects

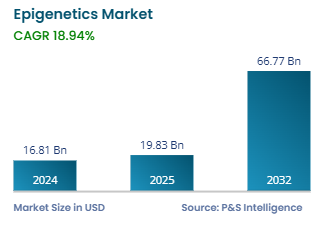

The global epigenetics market size in 2024 was USD 16.81 billion, and it is expected to advance at a CAGR of 18.94% during 2025–2032, to reach USD 66.77 billion by 2032. This is due to the rising incidence of chronic illnesses including cancer, diabetes, and neurological disorders. Epigenetics is the study of how behavior and the environment influence genes’ functioning.

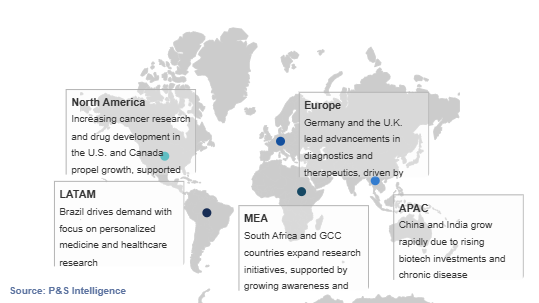

The rapid technological developments and their simultaneous adoption by end users have created lucrative opportunities for the major companies within the entire molecular diagnostics biosphere. The diagnostics and biotech industries are rapidly evolving to regularize epigenetics in clinical settings, with both market giants and emerging, disruptive companies playing a significant role.

Thus, investments and the focus on developing novel strategies to reverse epigenetic and transcriptional abnormalities and on epigenetic drug discovery and development have recently gained traction. These research targets have implications for metabolic, oncologic, neurological, inflammatory, and cardiovascular disorders.

The global COVID-19 pandemic has had a beneficial impact on the business outlook, as several research institutes are investigating epigenetic variables that may interfere with viral infection and replication and, thus, increase the likelihood of COVID-19 infection. Such research efforts, as well as the prospective use of the findings in the development of effective coronavirus treatments, will continue to have a favorable impact on the industry in the coming years.