Report Code: 10275 | Available Format: PDF

Enterprise Video Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10275

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

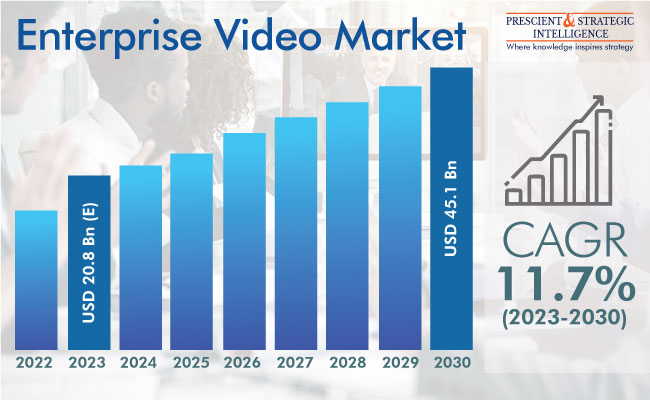

The global enterprise video market is expected to reach USD 45.1 billion by 2030 from USD 20.8 billion in 2023, witnessing 11.7% CAGR during 2023–2030.

This can be primarily credited to the augmenting application of enterprise video solutions by firms to enhance employee collaboration. Moreover, video solutions have become a vital part of the content promotion plans of numerous businesses. As a result, they are now concentrating on content delivery networks (CDNs), which accelerate the transfer of multimedia internet content and offer improved video streaming abilities to companies.

For example, in 2022, Google launched its new CDN software, known as Media CDN, which allows companies to leverage Google’s YouTube network, insert custom ads and business ecosystems, and extend platforms. The solution also offers automation tools, a variety of APIs, playback tracing, and pre-aggregated metrics.

The growth of the industry is being further accelerated by the increasing need for on-demand video streaming for employee training and skill enhancement purposes. On-demand content aids team members to gain comprehensive information from videos pre-recorded by executives, trainers, and colleagues. Additionally, numerous businesses are utilizing enterprise video channels for external activities, including training, sales and marketing, and public event broadcasting.

Video Conferencing Category Holds Significant Market Share

The video conferencing category holds the largest market share under the solution segment. This can be credited to the growing need for video communication, propelled by the presence of geographically distributed workforces and the acceptance of WFH models since the pandemic. The arrival of the pandemic has directed an extreme surge in the count of online conferences, workshops, and seminars, thus driving the need for video conferencing solutions.

The growth of the telemedicine sector and the augmenting usage of online teaching modes throughout the world have further generated new opportunities for the market players in this category.

Professional Service Demand Driven by Growing Need for Experts to Address Security Issues

The professional services category is experiencing growth because of the continuous requirement for professionals to integrate, troubleshoot, and handle enterprise video solutions. Furthermore, professional services permit users to confront security problems and advance the security measures for best leveraging their digital marketing software. The main benefits of such services comprise negligible administrative costs, optimum utilization of resources, and augmented effectiveness. Professional services also enable better resource handling via integrated knowledge management, collaboration, and better planning.

Cloud Category Is Projected To Experience Higher CAGR

The cloud category is projected to advance at a significant CAGR during the projection period, as this deployment model provides users scalability for video distribution, creation, and management via pay-as-you-go tools. Furthermore, the increasing acceptance of cloud-based solutions by SMEs in emerging economies, such as Brazil, India, and Egypt, is projected to enhance the category’s outlook. Cloud-based solutions provide convenient access to enterprise video platforms via laptops and mobiles, allow for on-demand scalability, and reduce operational costs.

Corporate Communications Category Is Gaining Momentum

The corporate communications category holds a sizeable industry share, on the basis of application. This can be ascribed to the increasing need for such solutions in sales kick-offs, board meetings, and executive briefings. The category’s development is further propelled by the growing acceptance of enterprise video solutions in telecom and IT businesses for corporate branding, corporate reputation, corporate responsibility, crisis communications, investor, media, and public relations; company profiling, and problem management.

Adaptive Streaming Category Is Projected To Grow Significantly

In the forecast period, the adaptive streaming category, based on delivery technique, will witness quick progress. This is because this technique permits users to see content at a quality their network connection can best accommodate, thus offer quick startup and negligible buffering during playback. Furthermore, the growing utilization of video streaming channels, particularly during the COVID-19 epidemic, has vigorously augmented the acceptance of adaptive streaming in the media & entertainment sector.

Large Enterprises Category Is Dominating Industry

The large enterprises category is dominating the industry, ascribed to the augmenting expenditure on video conferencing solutions by multinational IT & telecom establishments. This is because these companies have geographically dispersed workforces, which need to communicate and collaborate efficiently for the best business outcomes. Additionally, these companies have more money to spend on comprehensive connected enterprise solutions, which include video conferencing, webcasting, and video content management capabilities as integrated or add-on solutions.

The small and medium enterprises category is projected to advance at a substantial CAGR during the projection period, mainly because of the government steps targeted at encouraging the acceptance of cloud-based solutions throughout these enterprises. According to a study done by NASSCOM, around 60% of the SMEs in India have adopted cloud solutions, and the count is projected to surge to 75% in the years to come.

Furthermore, the lucrative nature of cloud-based solutions is projected to surge their usage among SMEs. For example, in July 2021, Tata Teleservices joined Zoom Video Communications Inc. to provide comprehensive communication solutions to companies and people. This corporation will aid Tata Teleservices reach companies, especially SMEs, in approximately 60 cities in India where it operates.

BFSI Category Is Growing at Considerable Pace

The BFSI category is growing at a considerable pace, credited to the surging need for video-based sales and marketing solutions to advance customer reach and engagement. Enterprise video solutions essentially aid banks in communicating with their clientele via audio, video, and digital content, as well as guarantee improved risk management, accountability, operational management, and end-to-end safety governance.

| Report Attribute | Details |

Market Size in 2023 |

USD 20.8 Billion (E) |

Revenue Forecast in 2030 |

USD 45.1 Billion |

Growth Rate |

11.7% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Dominating Market

The North American region is dominating the market, mainly because of the existence of key market players, easy access to high-speed internet, and growing need for video-based meetings. Furthermore, the surging demand for virtual private networks across numerous industries and educational establishments is projected to propel the regional industry.

The market growth in the forecast period will be the fastest in the Asia-Pacific region. The key drivers of this development are the rising usage of the internet and smartphones, growing focus of companies on establishing a digital presence among consumers, advancing telecommunications infrastructure with the rollout of 5G networks, increasing need of companies to improve customer engagement, and burgeoning popularity of online classes.

Key Companies in Enterprise Video Market Are:

- Adobe Inc.

- Brightcove Inc.

- Avaya Inc.

- IBM Corporation

- Kaltura Inc.

- Cisco Systems Inc.

- Microsoft Corporation

- Polycom Inc.

- Zoom Video Communications

- Google LLC

- Vidyo Inc.

- Vbrick Systems Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws