ENT Devices Market Future Prospects

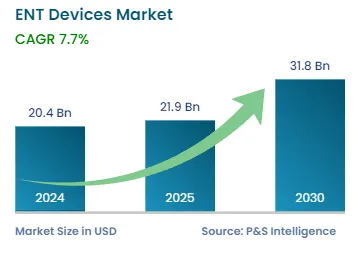

The global ENT devices market will account for a revenue of USD 20.4 billion in 2024 and reach USD 31.8 billion by 2030, advancing at a CAGR of 7.7% during 2024–2030. The proliferating incidence of hearing disorders and sinusitis, growing preference for minimally invasive procedures in ENT specialty, and increasing healthcare expenditure are boosting the market growth. The growing aging population also supports the demand for ENT devices, as the geriatric population is more prone to hearing loss and disorders associated with throat and nose. As per the WHO statistics, the number of geriatric people is set to grow by over 15% by 2050.

Some of the other factors driving the market for ENT devices include the technological advancements leading to their advanced applications, surging cases of chronic ear infection, growing life expectancy, and increasing noise pollution. Hearing impairment is one of the most common factors in patients, especially in industrialized countries. Infections such as middle ear infection, measles, and meningitis are also some common factors causing hearing loss in developing economies. In addition, chronic inflammation, vascular disorders, noise exposure, genetic susceptibility, and physiological aging of the ear may cause hearing impairment.

Furthermore, as many medical insurance players do not cover cosmetic ENT procedures, the need for cosmetic ENT procedures, including otoplasty (ear reshaping) and rhinoplasty (nose reshaping), is surging. Less invasive procedures; increased safety, popularity, and accessibility of cosmetic ENT procedures; and rise in disposable income of people are other key factors inspiring people to spend more on these procedures.

Moreover, the healthcare system has witnessed a paradigm shift from conventional surgeries to minimally invasive procedures over the past few years. The minimally invasive procedures have become popular in a variety of specialties, including oncology, gastroenterology, and urology. Similarly, in the ENT specialty, the preference for minimally invasive procedures has been steadily increasing.