Published: September 2021 | Report Code: 11739 | Available Format: PDF | Pages: 370

- Home

- Life Sciences

- Embolotherapy Market

Embolotherapy Market Research Report: By Product (Embolic Agents, Support Devices), Procedure (Transcatheter Arterial Embolization, Transarterial Radioembolization/Selective Internal Radiation Therapy, Transarterial Chemoembolization), Indication (Cancer, Peripheral Vascular Diseases, Neurological Diseases, Urological and Nephrological Disorders, Gastrointestinal Disorders), End-User (Hospitals and Clinics, Ambulatory Surgical Centers) - Global Industry Analysis and Demand Forecast to 2030

- Published: September 2021

- Report Code: 11739

- Available Format: PDF

- Pages: 370

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

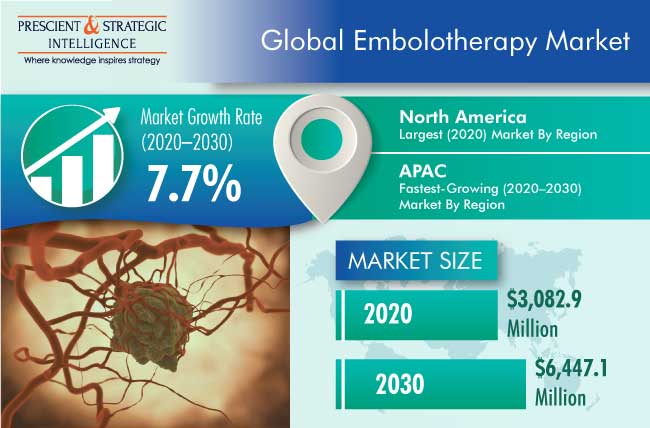

The global embolotherapy market stood at $3,082.9 million in 2020, and it is expected to grow at a 7.7% CAGR during 2020–2030. The growing patient pool, escalating prevalence of chronic and lifestyle-associated diseases, increasing healthcare expenditure, and improving healthcare infrastructure are some of the major factors driving the growth of the market.

COVID-19 has spread to almost every country, due to which the number of infected patients is rising, which is straining the countries’ healthcare ecosystem and resources. This is mainly on account of the intensifying demand for healthcare facilities, workers, and, most importantly, medical equipment, devices, drugs, and research studies. To deal with the pandemic, significant changes were made to surgical practice around the world. Furthermore, many general guidelines were released to establish case classification criteria in order to differentiate between elective surgeries that can be postponed and urgent procedures that require immediate intervention. This led to the shutting down of most of the surgical departments in hospitals, which led to a reduced use of products associated with embolotherapy. This posed negative impact on the embolotherapy industry.

Embolic Agents Lead Market due to Their Higher Adoption in Interventional Radiology Procedures

Embolic agents dominated the embolotherapy market in 2020, based on product. The increasing use of embolic agents in various interventional radiology procedures is the primary reason for this product category's dominance on the market. Furthermore, due to the advancements in such agents, such as calibrated microspheres for bland embolization, drug-eluting microspheres, and radioactive yttrium-90 (Y-90) microspheres, for treating primary or secondary liver disease, the category is expected to grow at the higher rate over the forecast period (2021–2030).

TAE To Witness Fastest Growth due to Its Higher Adoption over other Procedures

In the embolotherapy market, transcatheter arterial embolization (TAE) is expected to be the fastest-growing category during the forecast period, based on procedure. This is attributed to the proliferating demand for minimally invasive procedures and rapidly growing geriatric population. Moreover, TAE is effective and well-tolerated in patients with ruptured hepatocellular carcinoma (HCC), and it is preferred over transarterial chemoembolization (TACE) and transarterial radioembolization (TARE)/ selective internal radiation therapy (SIRT).

North America Dominated Market due to Its Strong Healthcare Ecosystem

North America dominated the market for embolotherapy in 2020, and it is expected to hold the largest market share during the forecast period as well. The increasing prevalence of indications that require embolization procedures, established healthcare ecosystem, and development of advanced embolic agents by the players operating in the region are some of the major reasons for the growth of the North American market.

Product Approvals and Launches Key Market Trends

Over the past few years, key players in the embolotherapy market have been focusing on the commercialization of new products for embolization. For instance, in December 2020, Terumo Medical Corporation introduced the first intrasaccular flow disruptor device in the Japanese market, under the brand name Woven EndoBridge (WEB) Embolization System, for the treatment of brain aneurysms. Moreover, in September 2019, Merit Medical Systems Inc. launched Torpedo, a proprietary gelatin foam loaded into a cartridge with an optional blunt stylet, for the smooth delivery of Torpedo to the target vasculature via a syringe.

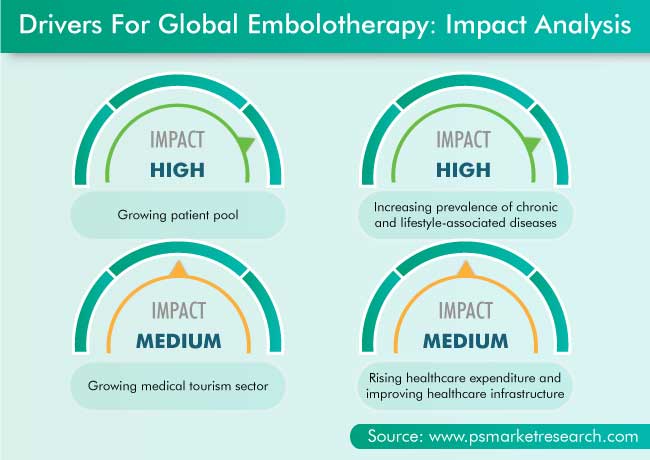

Growing Patient Pool Key Driver for Market

The embolotherapy market is witnessing growth on account of the increase in the number of patients seeking embolization for the treatment of HCC, renal cell carcinoma (RCC), varicose veins, and aneurysms. According to the Centers for Disease Control and Prevention (CDC), in 2018, aortic aneurysms were responsible for 9,923 deaths in the U.S., which shows the unmet medical need for such procedures. Hence, the increasing patient pool strengthens the demand for embolization procedures.

Increasing Prevalence of Chronic and Lifestyle-Associated Diseases also Helping Market Advance

The prolonged exposure to four modifiable lifestyle behaviors, namely smoking, unhealthy diet, alcohol consumption, and physical inactivity, often results in chronic diseases, including stroke, diabetes, obesity, metabolic syndrome, chronic obstructive pulmonary disease, and various types of cancer. Chronic diseases are a major healthcare burden affecting high-income as well as low- and middle-income countries (LMICs). Cancer, hepatitis, and central nervous system disorders are some of the chronic diseases that require advanced treatment. Thus, the increase in the prevalence of chronic and lifestyle-associated diseases is driving the embolotherapy market globally.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$3,082.9 Million |

Market Size Forecast in 2030 |

$6,447.1 Million |

Forecast Period CAGR |

7.7% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional and Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis; Company Profiling |

Market Size by Segments |

By Product; By Procedure; By Indication; By End User; By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India, Australia, South Korea, Singapore, Brazil, Mexico, Saudi Arabia, South Africa |

Secondary Sources and References (Partial List) |

American Institute for Cancer Research, Canadian Cancer Statistics, Centers for Disease Control and Prevention, Centers for Medicare & Medicaid Services, Economic and Social Research Council, German Medical Association, Government of Canada, University of Ottawa Heart Institute, World Bank Group, World Cancer Research Fund |

Explore more about this report - Request free sample

Market Players Involved in Product Launches and Technological Advancements to Gain Significant Position

The players in the embolotherapy industry have been involved in product launches and regulatory approvals in order to attain a significant position. For instance:

- In August 2019, Cook Medical LLC launched the 2.6 Fr CXI support catheter for small-vessel anatomy or super-selective anatomy, for diagnostic and interventional procedures.

- In January 2019, Terumo Europe announced that its product QuiremScout has received the CE mark, which led to the availability of the product across Europe. QuiremScout is designed to advance the SIRT workup procedure by improving the accuracy of predicting lung shunting and intrahepatic distribution, to optimize SIRT patient selection and treatment planning. This product has been developed by Quirem Medical, but it will be exclusively distributed by Terumo.

Key Players in Global Embolotherapy Market Are:

-

Stryker Corporation

-

Terumo Corporation

-

Sirtex Medical Limited

-

Merit Medical Systems Inc.

-

Meril Life Sciences Pvt. Ltd.

-

Medtronic Plc

-

Kaneka Corporation

-

Johnson & Johnson

-

Boston Scientific Corporation

-

BALT EXTRUSION SAS

-

Guerbet

-

Abbott Laboratories

Market Size Breakdown by Segment

The global embolotherapy market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Product

- Embolic Agents

- Microspheres

- Embolic coils

- Liquid embolic agents

- Embolic plug systems

- Detachable balloons

- Support Devices

- Microcatheters

- Guidewires

Based on Procedure

- Transcatheter Arterial Embolization (TAE)

- Transarterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

- Transarterial Chemoembolization (TACE)

Based on Indication

- Cancer

- Kidney

- Liver

- Others

- Peripheral Vascular Diseases

- Neurological Diseases

- Cerebral aneurysms

- Arteriovenous malformations & fistulas

- Urological & Nephrological Disorders

- Gastrointestinal Disorders

Based on End User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Singapore

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

The market for embolotherapy products valued $3,082.9 million in 2020.

TAE is preferred the most in the embolotherapy industry.

North America is the largest market for embolotherapy.

The embolotherapy industry has a fragmented nature.

The market for embolotherapy is witnessing a lot of product launches.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws