Market Statistics

| Study Period | 2019 - 2030 |

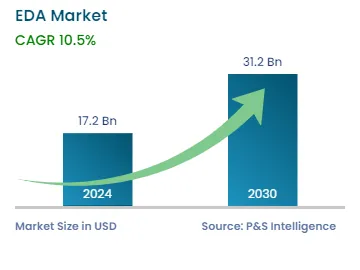

| 2024 Market Size | USD 17.2 Billion |

| 2030 Forecast | USD 31.2 Billion |

| Growth Rate(CAGR) | 10.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12670

Get a Comprehensive Overview of the Electronic Design Automation Market Report Prepared by P&S Intelligence, Segmented by Type (CAE, IC Physical Design and Verification, PCB and MCM, Semiconductor IP), Application (Communication, Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 17.2 Billion |

| 2030 Forecast | USD 31.2 Billion |

| Growth Rate(CAGR) | 10.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The electronic design automation market generated revenue of USD 17.2 billion in 2024, which will reach USD 31.2 billion by 2030, advancing at 10.5% CAGR between 2024 and 2030. This is due to the increasing complexity of electronic systems and the need for efficient design tools.

Additionally, a number of sectors have contributed to the market expansion by establishing unique design specifications, such as telecommunications, automotive, consumer electronics, and healthcare. This creates the demand for customized design solutions.

Furthermore, the consumer electronics industry has experienced significant growth and innovation in recent years, primarily due to technological breakthroughs to cater to the rising demand for cutting-edge equipment. In this sector, EDA is important for the development of sophisticated design tools, as it allows manufacturers to create complex electronic systems. This technology essentially expedites and lowers the cost of designing electronic circuits.

Moreover, EDA’s usage is driven by the rising demand for sophisticated integrated circuits (ICs). Electronic devices, such as smartphones, tablets, wristbands, smartwatches, and laptops, are already ubiquitous in daily life. Additionally, they continue to become smaller yet laden with more features, because of technological innovations. In addition, as broadband networks have become more widely available and accessible at high speeds and more-reasonable prices, many novel services, such as social networking and streaming platforms, have been developed.

Further, every industry, such as healthcare, electronics, automotive, and aerospace & defense, is incorporating ML and AI. These trends are opening up more opportunities for EDA solution providers as software testers look to switch from manual testing to automated process testing.

The semiconductor industry has gained momentous headway in contracting process nodes, thus empowering the development of more-modest and power-proficient ICs. The need to reduce power consumption and heat dissipation and, yet, maintain signal integrity creates design issues, as a result of this miniaturization. EDA apparatus gives the important capacities to address these difficulties and improve the IC design for smaller interaction nodes.

Moreover, companies in a variety of industries, including consumer electronics, healthcare, aerospace & defense, and automotive, have been able to produce compact electronic equipment, leveraging the trend of miniaturization. Small semiconductor components are integrated into a variety of products, including smart luggage tags, fitness trackers, automotive subsystems, blood glucose monitors, and connected surgical devices.

Additionally, miniaturization makes room for more features and more-powerful batteries. Customers' increasing fitness awareness is driving the demand for small fitness devices, such as smartwatches and fitness trackers. This has driven businesses to offer new products with improved features, with the academia innovating advanced electronic design tools to enable reliable and affordable products.

Furthermore, the use of portable devices has increased among media professionals due to the growing demand for live coverage of a variety of events, including riots, accidents, sports, and political events. Due to the impracticality of using large TV production trucks to cover these events, there has been a rise in the demand for portable, handheld equipment. These devices can easily be carried to the setting in a knapsack. The semiconductor industry's ability to produce miniaturized components in response to the demand for tiny devices across a variety of industries has benefited the market for electronic design automation solutions.

The increasing complexity of EDA requires specialized knowledge to create and optimize these systems. Engineers and designers with the expertise and ability to handle complicated designs are in high demand among the businesses in the market. As a result, there is a need for trained professionals, which can increase the competition for talent.

Moreover, as the complexity of electronic designing rises, there will be a corresponding increase in the need for tools that can handle these complexities. Industries require electronic design automation tools that can precisely handle large-scale designs and offer effective optimization strategies that are necessary for business.

Furthermore, due to the greater functionality of systems-on-chip (SoCs), EDA tools can handle chips with increased complexities. These technologies aid in raising power, performance, and area (PPA). In addition, every phase of the semiconductor design process, such as simulation, design verification, prototype emulation, and chip rollout, is aided by EDA tools with AI and ML integration.

Additionally, by utilizing ML, manufacturers can improve the IC design, production quality, and speed, leading to impressive, rapid outcomes and satisfied clients. Therefore, AI-integrated EDA enables the production of the devices required to meet evolving consumer requirements.

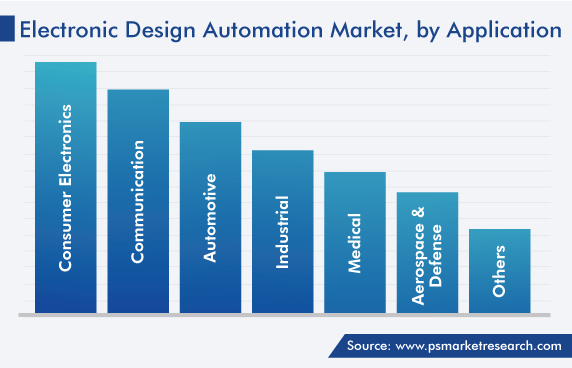

Based on application, the consumer electronics category held the largest share, of 30%, in the electronic design automation market in 2022, and it will continue this way in the future. This is because of the emergence of more-sophisticated electronics, due to the rising demand for cutting-edge smartwatches, smart TVs, and smartphones. Thus, the increasing disposable income around the world is projected to fuel the category’s expansion at a strong rate over the forecast period.

The communications category is expected to witness notable growth over this decade too. This is due to the extensive use of EDA software and services for designing and optimizing a range of electronic systems and components and enabling the development of high-performance and highly reliable communication devices and networks faster.

In addition, programming for FPGAs utilizing a high-speed broadband network is effective, suitable, and adaptive for complex communication protocols. EDA tools play an important role in FPGA designing. They are used to design the digital circuit for the desired functionality, using hardware description languages (HDLs). The design is then unified, maximized, and mapped onto the resources available on the FPGA. Moreover, the development of FPGAs is growing to meet the needs of the communications sector for high-speed and good performance. EDA tools also make it easier to develop 5G mobile phones. Many industries offer a portfolio of IPs and security modules for 5G smartphones.

Drive strategic growth with comprehensive market analysis

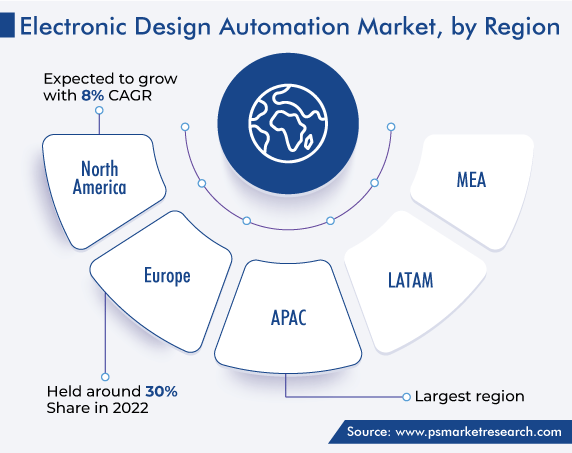

Based on region, Asia-Pacific held the largest share, of 40%, in the market in 2022, and it is expected to continue its dominance in the future. This is due to the rising demand for electronic devices, increasing adoption of emerging technologies, such as AI, IoT, and 5G; and the strong attention being paid to innovation and research and development (R&D). The region is a key user of EDA solutions as complex semiconductor chips require sophisticated EDA tools for design and development.

APAC, especially China, Taiwan, South Korea, and Japan, has long served as significant centers for the production of electronics. Consumer electronics businesses, semiconductor foundries, and producers of electronic components for other larger systems are all well-represented in the region. The demand for EDA solutions to enable the design and production of electronic systems is driven by this manufacturing strength.

Moreover, the technology is cost-efficient for the communications sector, which is the most-significant factor driving it to adopt it. This is also driven by the increase in the demand for consumer electronics, especially smartphones, in regional economies. Governments that aim to promote the manufacturing sector are also expected to support the expansion of the market in the region, including Japan, India, China, and South Korea.

Additionally, the Asia-Pacific region has a sizable consumer base, an expanding middle class, and rising income. smartphones, tablets, wearables, and smart home appliances are widely manufactured and bought in the region. As a result, advanced EDA tools are being adopted for the design and development of these products, in order to guarantee performance, power efficiency, and time-to-market advantages.

North America is also expected to grow significantly in the market due to the early adoption of technologies such as 5G, artificial intelligence (AI), and machine learning (ML). Additionally, the rising usage of these solutions in various industries, such as automotive and consumer electronics, helps the regional market grow.

This report offers deep insights into the EDA industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Application

Geographical Analysis

The market for electronic design automation solutions valued USD 17.2 billion in 2024.

The electronic design automation industry CAGR during 2024–2030 will be 10.5%.

Consumer electronics is the leading application in the market for electronic design automation solutions.

The electronic design automation industry is driven by the advancing semiconductor industry and growing consumer electronics demand.

APAC is the largest and North America the fastest-growing market for electronic design automation solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages