EV Charging as a Service Industry Insights

Type Insights

- The level 2 category will hold the largest market share, of 55%, in 2024.

- These chargers can fully charge an electric vehicle in 4–8 hours.

- Level 2 chargers are compatible with every electric vehicle, unlike levels 1 and 3, making them popular among consumers.

- Moreover, these chargers are widely installed in public as well as residential spaces, making them accessible to the majority of electric vehicle users.

- Their cost effectiveness is another reason for their widespread use, as level 2 chargers are cheaper to install compared to level 3, because the latter require high-power connections, making them expensive.

The types included in this report are:

- Level 1

- Level 2 (Largest Category)

- Level 3 (Fastest-Growing Category)

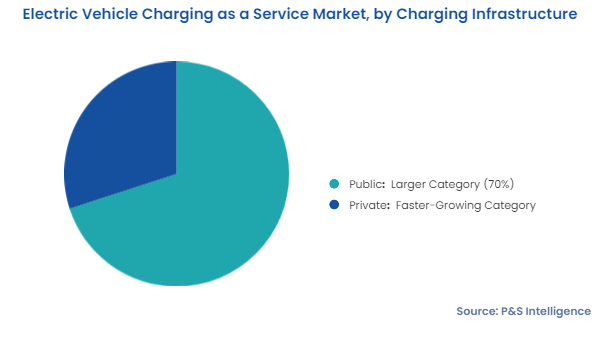

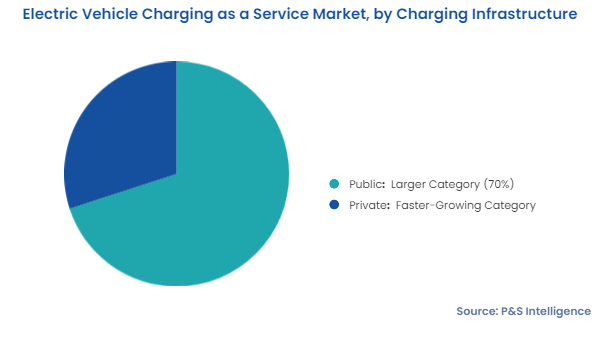

Charging Infrastructure Insights

- Public charging infrastructure will hold the larger market share, of 70%, in 2024, and it is expected to do the same in the coming few years.

- As per an article in the Economic Times, the U.S. now has more than 9,000 public fast-charging stations.

- This infrastructure is available at a lot of places; so, electric vehicle users do not have to fear running out of battery power.

- Moreover, governments are heavily investing in public charging infrastructure.

The charging infrastructures included in this report are:

- Public (Larger Category)

- Private (Faster-Growing Category)

Current Type Insights

- Direct current will hold the larger market share, in 2024, and it is expected to grow at a higher CAGR of 18.6% in the forecast period.

- DC offers a high-power output in comparison to AC, of around 50 kW to 350 kW.

- DC chargers can charge up to 80% in 20−30 minutes, which saves time and is useful for long-distance traveling.

- Moreover, several public transportation systems heavily rely on direct charging to maintain operational efficiency.

The current type analyzed in this report are:

- Direct Current (DC) (Larger and Faster-Growing Category)

- Alternating Current (AC)

Vehicle Type Insights

- BEVs will hold the largest market share, in 2024.

- BEVs contain much larger battery packs compared to others, due to which they need frequent and high-capacity charging, thus driving the need for electric vehicle charging services.

- Moreover, governments are focusing on promoting the adoption of battery electric vehicles through stronger incentives and strict emission regulations.

- Battery electric vehicles emit zero tailpipe emissions, offering sustainable transport solutions.

- Additionally, BEVs need the longest to charge because of their higher-capacity batteries, which supports direct charging infrastructure.

The vehicle types included in this report are:

- Battery Electric Vehicles (BEVs) (Largest Category)

- Plug-In Hybrid Electric Vehicles (PHEVs) (Fastest-Growing Category)

- Hybrid Electric Vehicles (HEVs)

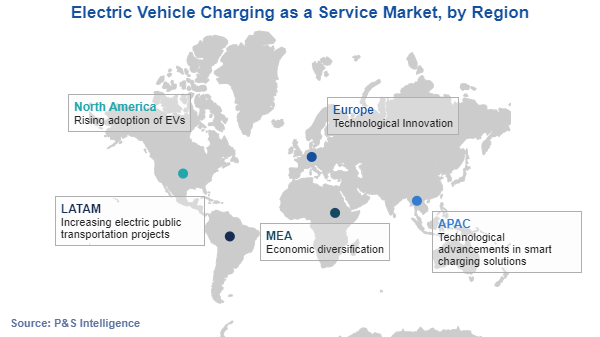

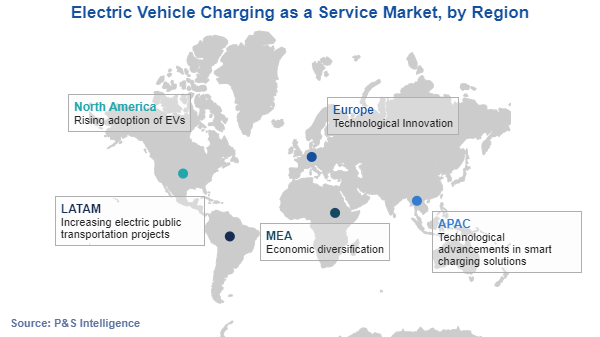

Geographical Analysis

- The APAC region will hold the largest market share, of 45%, in 2024 due to the high electric vehicle ownership rate.

- As per a report, Asia-Pacific sold 2.96 million electric vehicles in 2023.

- In China, electric vehicle sales went up to 141% higher than in in 2021, with over 100,000 electric cars sold.

- With government support in the APAC region encouraging citizens to shift to EVs, the market is experiencing accelerated growth.

- The support is being offered in the form of various incentives and policies.

- Moreover, the technological advancements in smart charging solutions, including faster charging and wireless charging, are key drivers contributing to the high adoption of electric vehicle charging services.

- North America is expected to grow at the highest CAGR in the forecast period.

- President Biden has vowed to build 500,000 EV charging stations in the U.S. by 2030.

- Furthermore, the rising adoption of EVs in the North American region due to their sustainability and low operating costs is increasing the market growth potential.

The regions and countries analyzed in this report are:

North America (Fastest-Growing Regional Market)

- U.S. (Larger and Faster-Growing Country Market)

- Canada

Europe

- U.K. (Largest Country Market)

- Germany (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific (APAC) (Largest Regional Market)

- China (Largest Country Market)

- India (Fastest-Growing Country Market)

- Japan

- South Korea

- Australia

- Rest of APAC

Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa (Fastest-Growing Country Market)

- U.A.E.

- Rest of MEA